The UK’s energy transmission networks need to attract large volumes of investment to respond to a rapidly changing energy market. David Porter and Simon Rawlinson of EC Harris review progress as new regulatory systems bed down

01 / Introduction

As the UK transitions towards a low-carbon economy, the country’s energy systems face unprecedented levels of change. Energy transmission networks that have been fit for purpose for the past 40+ years need significant reinvestment and reconfiguration to accommodate new energy sources and greater demands for flexibility. In particular, the growing share of the UK’s energy mix provided by renewables will drive big changes in both gas and electricity markets that will drive major changes in the operation of the networks.

The cost of transmission as a share of overall energy bills is low - about 2% of the overall cost of grid supplied electricity, and 4% of the cost of a gas bill. However, with total capital investment in transmission assets alone due to exceed at least £22bn over the current control period to 2021, the regulator Ofgem has an important role in ensuring not only that value for money and service reliability are assured but also in creating a stable environment to attract investment. Ofgem introduced the RIIO framework (Revenues = Incentives, Innovation and Outputs) for regulatory periods commencing from 2013 to ensure that network companies focus on the needs of their stakeholders and continue to invest in their networks. RIIO is also designed to encourage innovation focused on cost reduction and enable a low-carbon economy. By extending the control period to eight years, RIIO provides a longer-term planning and delivery perspective for network operators that for many investments will extend into future control periods. RIIO has now been operational in transmission for nearly two years and the effectiveness of totex-based regulation in encouraging investment and incentivising more efficient network operation is becoming clearer.

The UK’s transmission networks are focused on high voltage electricity supply and high pressure gas transport. National Grid own and manage the mainland gas transmission network and the electricity transmission grid in England and Wales. Scottish Power Transmission and Scottish Hydro Electricity Transmission own and manage separate networks in Scotland and have an increasingly important role in transmitting energy to the rest of the UK as the size of the Scottish renewables industry grows. The system also includes interfaces with other transmission systems through electricity and gas interconnectors to mainland Europe as well as independently owned HV transmission connections from the UK’s growing offshore wind portfolio.

There are two key business activities associated with electricity and gas transmission system operation and development. These different activities are undertaken by a range of transmission owners and the associated system operators for electricity and gas. These roles are explained in further detail below. Compromises are required when balancing the delivery of new investment and the effective operation of the existing network and RIIO’s totex-based regulation seeks to further incentivise the best value outcome.

Transmission owners are responsible for the safe and efficient management of their transmission networks including the planning and development of new infrastructure. The transmission owner role focuses on asset management and maintenance, capital delivery and technical innovation.

System operators are responsible for the day-to-day operation of the gas and electricity transmission systems. System operators are responsible for balancing the transmission systems in real time, procuring balancing services at efficient cost, co-ordinating system outages, managing network constraints and managing the connection application process.

The electricity and gas transmission systems each have a single system operator role performed by National Grid. For electricity, the system operator is responsible for the operation of all transmission networks owned by the various onshore and offshore transmission owners.

Work undertaken to reinforce or maintain the grid will often require parts of the network to be taken out of service, which can have operational costs linked to constraint payments. Planning of work on the grid aims to coordinate long-term bundling of projects and outages so that maximum benefit is gained from the planned works programme. This cross-cutting approach to capital and operational expenditure is supported by totex-based regulation, which seeks to equalise incentives for capex and opex to deliver the best long-term solutions for customers. The projected savings from the operation of the totex approach are estimated by Ofgem to total more than £1bn by 2021.

02 / The changing face of transmission

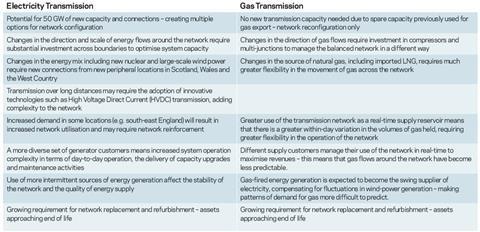

The gas and electricity transmission networks will be subject to very significant change over the next 20-30 years as the UK’s energy mix is transformed and as the behaviour of network users changes. The key changes that are currently anticipated include (click on the table to see it enlarged):

The implications of these changes are very significant and include:

- High levels of uncertainty with respect to future levels of energy demand, mix and supply location. Transmission companies based their investment and operations proposals on a range of outcomes ranging from a slow progression to a low-carbon economy through a “gone-green” scenario based on rapid economic growth and closer integration with a wider European renewables grid to an accelerated growth scenario which envisages very rapid adoption of renewables. This means that many planned investments are at an early stage of development and have not reached Final Investment Decision, and may only be partially completed over the current control period.

- Wide range of options available to meet new reinforcement requirements. There are many ways in which capacity can be increased in an efficient and economical way meeting overall security and quality of supply standards. This complexity affects new connections as well as work on the main interconnected transmission system, making the planning of work more involved.

- Lead-in times for connections exceed lead-in times for generation capacity. The lead-in time for connections is eight to 10 years - much longer than the delivery time for some new energy sources such as onshore and offshore wind farms. To address the risk of transmission constraining some elements of new supply, a ‘connect and manage’ strategy to deliver new connections has been adopted - delivering capacity in advance of need at lower levels of network diversity. This constraint does not apply to the new nuclear programme.

- The need to make best use of existing assets. Some grid components are coming to the end of their useful life so smarter asset management strategies are being developed to maximise residual asset life as far as possible. Examples include the targeted replacement of secondary infrastructure in gas transmission such as valves so that the asset lives of primary assets such as pipes and multi-junctions are extended. In electricity transmission, existing transmission towers are being refurbished and re-rated with higher capacity conductors - increasing the capacity of the existing network without requiring either additional overhead lines or replacement towers.

- The increasing complexity of system operation. Networks have to be managed more intensively because of changed patterns of supply and demand, e.g. variability of wind energy output.

- Risk exposure associated with new capital investment. Transmission companies are adopting new technologies at an increasing rate. The technological innovation associated with HVDC interconnects between England and Scotland is a good example of innovation where Ofgem requires the transmission owner and their supply chain to accept significant technology and delivery risk.

The net impact of these changes is that transmission companies face a far greater challenge in meeting their system operator and transmission owner obligations than in previous control periods. Both gas and electricity networks will be used more flexibly in response to customer needs, and the delivery of large-scale investment and capital maintenance will have to be integrated more closely with day-to-day operation in order to optimise total costs of delivery to customers and the utility itself.

A good example of this is the constraints payments that National Grid pays generators when they are not able to export energy in accordance with their contracted capacity arrangements - these totalled £33m in 2013/14 - equivalent to 5% of the cost of operation. Constraint costs can potentially be reduced further by delivering capital work faster. The optimisation of the delivery of investment to minimise constraint payments demonstrates one way in which totex approach to regulated expenditure encourages the alignment of the network companies and their customers. However, this relies on improved network performance data - an example of a spend-to-save initiative that enables better use of existing capacity.

03 / Defining and delivering outcomes

The regulatory framework under which National Grid, Scottish Power and Scottish Hydro Electric operate under is broadly designed to ensure the continuing operation of a safe and secure network, the delivery of planning and investment for a low-carbon future and the reduction of the environmental footprint associated with the long-term operation of the network. The current control periods will continue to enable large-scale capital investment while ensuring that the operation of the network remains affordable and that investment is aligned with the “willingness to pay” set by stakeholders. Under the settlement outcomes are directly linked to incentive mechanisms, some of which are financial and some reputational.

(click on the table to see it enlarged)

Detailed outcomes for gas and electricity transmission businesses inevitably vary in relation to the characteristics of the networks. However, there is a high degree of commonality in the high level outcomes:

- Safe operation of the networks. Safety comprises a combination of operational health and safety measures and network security measures measured by a suite of network output measures. In addition to short to medium-term performance, safety considerations include work being undertaken to ensure network risk and asset integrity will be maintained in future control periods.

- Reliable operation. Network reliability is measured by energy not supplied and is incentivised using a pain/gain mechanism. Current levels of reliability run at 0.00025% of total annual supply. A cost effective reliability strategy will involve trade-offs between investment and operational expenditure - such as increased spend on condition monitoring and network-wide risk-based maintenance planning. Cost effective delivery of reliable operation benefits from an effectively integrated capital maintenance supply chain. National Grid’s planned expenditure on non-load related expenditure is over £6bn - including over £1bn on operational expenditure.

- Timely delivery of connections. New connections will be a major element of capital expenditure over the current control period. National Grid’s electrical connections programme has a value of over £1bn. A potential penalty of 0.5% of base revenue is at risk related to delivery failure. The connection incentive associated with the gas network is reputational rather than financial.

- Environmental mitigation. In addition to reducing emissions associated with the general operation of the business, both gas and electricity networks have specific mitigation outcomes. Electricity networks use a highly potent greenhouse gas sulphur hexafluoride as an insulator, and some older switchgear needs to be replaced or refurbished to control emissions. On the gas network, EU industrial emissions regulations require a programme to reduce carbon monoxide and nitrous oxide emissions from compressors. For environmental mitigation, the investment is funded through the overall determination and incentives are based on carbon emissions costs.

- Reduction of transmission losses. Monitoring and reporting transmission losses is incentivised, but due to the high efficiency of the network, there is no major investment programme proposed to cut transmission losses further.

- Investment in visual amenity - driven by the planning system and by evidence of customer willingness to pay. The premium costs of undergrounding transmission circuits can be up to 10 times conventional overhead lines, so this is an important aspect of the settlement.

- Customer satisfaction. High scores for customer satisfaction and stakeholder engagement both unlock a small percentage of allowable revenue - 1% for customer satisfaction and 0.5% for engagement.

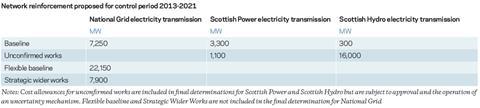

Delivery of network reinforcement is also incentivised for the electricity networks. The Strategic Wider Works programme forms a major part of the electricity investment programme totalling £10bn over the control period. Investment is primarily to increase capacity to accommodate new generating sources and locations. Large-scale projects with a value of more than £500m will require a direct determination by Ofgem. Evidence so far suggests that settlements have been challenging - particularly given the technological and environmental risk associated with these large-scale investments. (click on the table to see it enlarged)

By comparison with the regulatory outcomes that other regulated authorities are required to deliver, many of the targets for the transmission businesses are clear and can be readily evidenced. National Grid, for example, is able to report on network reliability, together with progress on Strategic Wider Works and connections. On non-load related work for example, programme targets were met in 2013/14 with a further £70m of savings being delivered.

For the gas network, investment is initially being ramped up for a long-term programme based on asset health improvement. Efficiency improvements are focused on improved asset data, delivery of more work during supply outages and enhancements to service diversion processes. Volumes of investment are expected to increase to around £350m to £400m per annum from 2014/15 onwards.

Looking forward, the ability for network companies to ensure that expenditure has been focused on key risks affecting safe and reliable operation is a critical aspect of the regulatory settlement. Network companies have the option to balance expenditure between capital and operational work-streams - managing risk by better real-time asset monitoring for example, rather than replacement or refurbishment. The internal tracking of supply-chain performance and network condition is particularly important in demonstrating that investment plans will deliver performance levels required to meet long-term operational standards. The critical risks associated with the control period are, however, mainly focused on network expansion, not only due to the scale of the investment and the level of innovation involved, but also due to the wider impacts of modifications to the network on the ongoing security and cost of network operation.

04 / Incentivising innovation

Innovation is at the heart of the regulatory model for transmission. Both the regulator and the transmission owners recognise that current ways of working will not necessarily deliver required outcomes. The innovation agenda covers almost all aspects of work associated with transmission networks including safe working, system reliability, environmental impacts and improved aspects of customer service including demand management. The regulatory settlement allows for some investment in innovation funding via the Network Innovation Allowance (NIA) as well as setting an annual efficiency improvement target. The value of the NIA is set at 0.7% of allowable revenue for National Grid electricity and gas and Scottish Hydro, and 0.5% for Scottish Power.

Innovations developed in connection with electricity transmission include remote monitoring to enhance asset management and dynamic network management - enabling better use to be made of the existing network. Live line working using remote access techniques improves safety while potentially reducing the duration of outages and the costs of constraints. Large-scale innovations are associated with major capital projects such as the HVDC interconnectors, the development of large-scale offshore wind and the integration of direct current systems within AC networks. The scale and complex nature of the solutions being developed means that future capital investment projects will involve a greater risk profile than has recently been the case - requiring both the transmission owners and Ofgem to adopt a realistic and commercially well-managed approach to the appropriate transfer of technology risk.

Gas transmission investment will be largely focused on the maintenance of the health of the existing network, increasingly the degree to which network performance can be controlled in real time to respond to rapid changes in network flows. Key innovations being developed include remote condition monitoring to enable the safety of the network to be assured at a relatively low cost. Other innovations include work to reduce emissions associated with compressor plant and improvements to demand forecasting - enabling customers to use the network more pro-actively to meet commercial objectives.

05 / Delivery & Procurement

With significant load related network reinforcements planned for the current control period and continued non-load related expenditure for asset renewal transmission, companies need to deliver substantial capital investment. These network investments, combined with the delivery of optimised maintenance schedules, will require companies to compete internationally for scarce resources to deliver complex and technically challenging programmes of work. Consideration of delivery risk will be increasingly important given the focus of regulatory incentives and requirements to balance risk transfers between the supply chain and transmission owners.

Other aspects of the regulatory model which procurement strategies need to address include:

- The ability to access specialist skills to deliver network reinforcement from a global market

- The facilitation of trade-offs between opex and capex to maintain overall asset health, extending the lives of network assets where appropriate.

- The adoption of a risk-based approach to asset management, balancing spend-to-save capex investment with operational expenditure aimed at short-term risk mitigation.

- Managing project scope, cost and timing uncertainties associated with Strategic Wider Works programmes.

- Achieving year-on-year efficiency improvements of 1% within the constraints of an inflation-controlled cost settlement.

These considerations mean that procurement models need to address new skill set requirements and associated logistics, how flexibility in planning and delivery can be accommodated and how global markets can be accessed to implement major projects. A common solution is a portfolio approach, combining competitive procurement for large-scale projects, together with some form of relation-based delivery arrangements for the more predictable capex. These typically involve higher volume projects with lower individual scheme costs which can be let using bundling of projects, long-term frameworks or alliances.

Whatever approach to the procurement of work on the existing network is taken, the relationships developed with the supply chain should be designed to help transmission companies to mitigate the impact of investment programmes on their ongoing operations and customers - reducing the duration of outages, aligning outages with customer shutdowns, as well as delivering better whole life value solutions. How transmission companies organise their supply chains and internal teams to utilise asset management data and existing knowledge of network operation to improve coordination and scheduling of works programmes will be a key aspect of investment delivery. Effective application of a programme management framework, data-driven project and programme controls and KPI-driven pain/gain mechanisms will all have a role.

The duration of the control period and the scale of work to be delivered between now and 2021 are such that transmission companies and their supply chains will be significantly challenged to secure the resources to maintain the performance and reinforce the UK’s key transmission networks. Over the eight years of RIIO-T1, keeping supply chains focused on innovation, higher productivity and delivery certainty will put transmission companies in a strong position to share the benefits of outperformance against their incentives.

We would like to thank Greg Bradley, Stuart Crew and Mark Docherty for their input into this article.

Downloads

Infrastructure - electricity transmission

PDF, Size 0 kbInfrastructure - expenditure settlement

PDF, Size 0 kbInfrastructure - network reinforcement

PDF, Size 0 kb

No comments yet