The top end of the capital’s residential market is booming. Joseph Blythe of Davis Langdon, an Aecom company, with contributions from CBRE and Darling Associates, looks at the factors that are driving the market and the key financial considerations for future developments

01 / INTRODUCTION

Over the last four years the residential market in London has been a tale of two cities, with the “prime” end of the market resisting the volatility in demand and price stagnation that is evident elsewhere in Greater London and the rest of the UK. Based on recent reports, the prime residential market in central London has outperformed the sales price increases achieved elsewhere in the city by 30%.

But what, and where, is prime? Traditionally, prime residential is considered to be those schemes that achieve in excess of £1,000 per ft² in sales - about £750,000 to £1m-plus on an apartment or house. For the purposes of this article, we have classified prime residential as between £1,400-1,800 per ft², with “super prime” being £2,500-5,000 per ft² or more. Later on, we discuss the emerging or “sub-prime” market, where values start at £800-1,000 per ft².

Over the past decade, the area that could be classified as prime residential within London has steadily expanded. The traditional districts of Knightsbridge, Mayfair and Belgravia have maintained their place at the centre, and have been elevated in many cases to super prime. The most notable example of this has been Candy & Candy’s One Hyde Park development, which had sales last year topping the £7,000 per ft² mark.

By the middle of the last decade, the prime residential boundary had expanded to include St John’s Wood to the north and Holland Park to the west. In 2009, the City of London and the South Bank had breached the £1,000 per ft² barrier. As long as key criteria in design and specifications are met, many inner London schemes today are now achieving in excess of £1,000 per ft², (see Figure 2, page 54).

The next area to enter the prime arena is likely to be the Vauxhall Nine Elms Battersea zone. Already schemes such as The Tower at St George Wharf, Riverlight and Embassy Gardens have broken through this target.

A strong pipeline of prime residential is also popping up along the South Bank such as the Berkeley Group’s One Blackfriars and Carlyle Group’s Bankside. Other areas considered to be on the brink of prime status include Putney, Aldgate, City Road and Canary Wharf. With the acquisition of News International’s former headquarters site in Wapping by Berkeley Group, it is expected that this too will join the list.

However, plans to expand the super prime zone much beyond the exclusive Knightsbridge addresses of SW7 are severely limited due to the lack of suitable sites and the conservative nature of the super prime purchasers, whose preferences lean them towards the recognised postcodes.

02 / MARKET CONDITIONS

Prime central London house prices have increased 6% since last year and by 49% since the first quarter of 2009. They now stand at 14% higher than the market peak back in 2008. Today, the average cost of prime residential in London is reputedly six times the national average, with the overall stock within these areas estimated at £130bn.

The rental market for prime properties has also performed well during the same period. Rents have recovered since the downturn and are now more than 20% higher than 2009. However, in the last year rents have dipped, partly due to the local economy but also concerns over the eurozone crisis. The volume of lettings continues to be bolstered by the lack of mortgage funding, along with prime purchasers biding their time and renting until attractive schemes come on line.

Who’s buying?

The forces that have been fuelling these price rises during the economic downturn are: demand from overseas buyers; limited supply; and the perception that prime areas of London are a “safe haven” for investment. Some 87% of residential purchases in London during the third quarter of this year were in cash, 61% of which was for investment.

A recent Office for National Statistics study found that 53% of the population living in the boroughs of Westminster and Kensington and Chelsea originate from outside the UK. London-wide, that figure is 35%. Within the last three years, just over 40% of the buyers of £1m-plus houses and apartments in the capital were from overseas, and closer to 50% for purchases between £2m and £5m. In the case of “super” prime buyers, the percentage from overseas rises to above 60%, with most emanating from Russia, the Middle East and the Far East. This trend is mirrored in the rental market where 59% of prime rents in London are going to international tenants.

So much foreign investment raises concerns in some quarters that the London market is at risk of becoming dysfunctional as the number of indigenous residents in prime areas diminishes. However, London has always lured foreign residential investment. In 1985, 53% of residential buyers in the prime London areas were from overseas, although most purchases were for investment rather than for primary or secondary homes. It does seem the current trend is likely to continue.

Will it last?

Early reports for this year suggest that prime central London prices may have flatlined, with some predicting a drop, albeit a small one, in the months ahead. This has been laid at the doorstep of the recent changes in stamp duty land tax and capital gains tax. This has had an impact mainly on properties with a price tag in excess of £2m, as these are also subject to an annual charge.

Demand has also been affected by the downturn in the financial services sector in the City, which has curtailed remuneration packages. Part of the resulting availability has been absorbed by overseas purchasers.

Further changes in tax or charges levied against prime properties may cause uncertainty and undermine demand. Political intervention in recent months has done little to ease any concerns on this front.

However it is expected that the super prime market will be impervious to all of this, as central London continues to be seen as a safe haven compared to other more volatile markets around the globe. Looking forward, CBRE forecasts prices to grow next year by 5% with this trend to continue in 2014.

The outcome of the euro crisis could have an impact on the long-term stability of the prime market. There is now a significant diversion of investment from Europe to London. If the euro was to actually disappear, there would likely be a surge in the exchange rates in favour of sterling. This would benefit prime residential in London in the short term, but there could be a drop in prices in the years ahead as investors diversify their assets across Europe.

Clearly, any forecasts come with hefty caveats. As long as certainty is established within the short term around the taxation of the prime residential sector, then growth will continue but possibly not at the same pace as in the last four years. London is one of only a handful of global cities that are attractive to foreign investors. As with any other global city, demand and the size of the market can fluctuate in the short term, but as long as London is perceived as a safe haven, regardless of changes in global equities, exchange rates or commodities prices, then stability and potentially growth will continue.

03 / DESIGN CONSIDERATIONS

In order to achieve prime residential sales values, location is often cited as the key factor. But in a market where there is a limited supply of suitable sites, developers can drive a premium above the local embedded value (LEV) through good design and specification. For example, the proposed 10 Trinity Square development, next to the Tower of London, will have high-end finishes incorporated into historic architecture. This one-off scheme is expected to achieve super prime sales of £3,000 or more per ft2, a first for that part of the City.

Of course, this process is helped if the site has natural attributes that can be leveraged - for example, views of the Thames, which have helped developments such as Neo Bankside achieve sales in excess of the LEV. Panoramic views looking north of the Thames can add a 20% premium compared with those that look inland. However, attractive aspects can also be created with the use of well-designed internal courtyards such as the Berkeley Group’s Chelsea Bridge Wharf scheme. Here, the premiums achieved on the riverside-facing apartments were not diluted by those that faced onto the internal piazza.

The use of balconies or winter gardens can help to enhance views and help nudge the sales premium upwards. As well as adding costs to the envelope and apartment fit-out, if the winter garden space is serviced - that is, heated and cooled so it can be used all year round - it can be classified within the net internal area (NIA).

The only way is up

Building tall is another way of improving aspects as well as privacy. The increased costs of building tall can be recouped in sales premiums above the LEV, provided that planning hurdles can be overcome. Sales prices can rise by 1.3-2.2% per floor, depending on view and location, as you go up the building. Evidence shows that on average a 36% premium can be achieved, with the Pan Peninsula in Docklands hitting 57% above the LEV.

Floor plate size and cladding need careful consideration. A minimum floor plate of 800m2 helps to optimise development ratios of net:gross and wall:floor. Optimising the horizontal structural and services zones has been used to facilitate an additional floor. Alternatively the extra height can be transferred into the clear floor-to-ceiling dimensions, which can result in higher sales premiums.

Delivery timescales for tall buildings are longer than for comparable low-rise schemes, and most have single core layouts, which hamper phased handovers. All of these impact on finance charges. As such, selling the apartments off-plan plays an essential part in funding a scheme, and many lenders will require that a minimum of 30% or more of units are pre-sold.

There is a growing appetite for off-plan selling due to the lack of available high-quality housing. However, anecdotal evidence suggests that anything more than a 30-month wait between placing a deposit and completion would be unpalatable to most purchasers.

Target market

Marketing needs to be carefully targeted. For example, purchasers from South-east Asia are usually familiar, and therefore very comfortable, with high-rise living. However, some European purchasers may feel unconnected from the local environment if the apartment they are viewing is too high up, and might be dissuaded from buying, no matter how stunning the views. Cultural considerations should be factored into both design and marketing, such as the use of feng shui when trying to attract Chinese buyers.

Good architecture and clever layouts that provide flexible living are sought after by many ultra high net worth individuals (UHNWIs). Generous space and volume - with a minimum 2.6m clear floor-to-ceiling height - are key factors, as are high level of specifications and good detailing. Innovative features, such as the “sky gardens” proposed in Manhattan Loft’s Stratford scheme, will help to push price levels.

As you move up the price scale, facilities such as walk-in wardrobes, studies and media rooms become requisite. If the fit-out is aimed at the prime rental market, then it would need to be a robust product for daily use but still maintaining the high-quality appearance and feel.

Establishing a marketing suite at the earliest opportunity provides an excellent forum to test and hone layouts and specifications, and catch the latest trends ahead of finalising the fit-out.

In terms of audiovisual design and specification, how far do you go with technology that advances so quickly from year to year? The level of home automation required differs from one purchaser to the next. There is definitely a push to have fibre optics throughout to improve broadband performance, and this is a key consideration for many purchasers.

The design of the heating and cooling systems needs to take into account overseas purchasers’ lifestyles. These properties may be left vacant for a number of months in a year and therefore boost functions should be designed into services for when the occupier returns.

In sustainability terms, there has been a drive to place monitoring points on each of the services to measure consumption. Where the services are centralised, this is linked back to the service charge. However, where the services are not centralised, there does not appear to be a need by many UHNWIs to monitor consumption beyond payment of the bill. Installing these monitoring points adds to fit-out costs but is not reflected in any enhancement to the sales premium. Sustainability measures are not high on the list of requirements with many prime purchasers, with the exception of those from US.

Pavement to apartment door

The journey from pavement to apartment door, via landscaped gardens, main entrance, lift lobbies and corridors, should mirror the opulence of the apartment itself and can contribute to achieving the sales premium. Prime residential developments are expected to provide exclusive facilities such as 24-hour concierge, gyms, spas, swimming pools and business lounges.

However, there is a tipping point with how far this can be pushed, as recent evidence suggests that many purchasers do not wish to pay a premium for this and are fully aware of its impact on service charges.

At the super prime end of the market, purchasers expect a luxury hotel experience as standard. Many highly regarded hotel chains provide this service and become affiliated with residential developments.

Branding

Sales prices can increase through association with brands, or through the use of partners such as signature architects, interior designers, and fashion houses, such as Armani, Bvlgari, Ralph Lauren and Versace. Even celebrities such as Jade Jagger and Elle Macpherson are dipping their finely pedicured toes into this field and collaborating with developers in establishing brands for prime residential schemes.

A prime residential scheme that has a recognised brand can provide confidence to the purchaser - especially those from overseas - in respect of the quality and design. A branded development can achieve sales premiums of between 10-20% and sell 20-30% faster.

04 / PRIVATE RESIDENTIAL FIT-OUT COST MODEL

We have taken residential fit-out to encompass all works (with the exception of loose fittings and furniture) within the apartment from the entrance threshold onwards. On the basis that the preceding contract would provide structural frame and floors, envelope, communal lifts, and mechanical, water and electrical services connection points at the entrance, the fit-out works would complete all other remaining services, finishes and fittings within the apartment. The benchmark data and cost models below exclude communal finishes and apartment entrance doors, which are assumed to form part of the shell-and-core works.

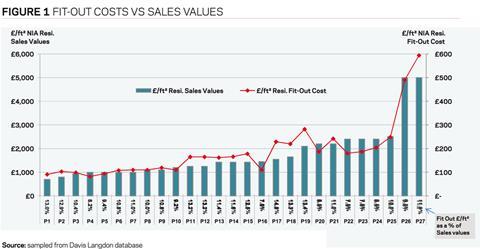

Figure 1 charts benchmark fit-out costs in relation to sales values - which range from £800 to £5,000 per ft2 of NIA. There is a clear correlation between sales values and fit-out costs, which range between 8% and 15% (average 10.6%) of the £/ft2 sales price for the scheme (see graph, page 51). When establishing a budget for the fit-out works of prime residential in advance of designs and specifications, an understanding of the target sales price for the scheme is advisory.

In addition to specification and design, the other factors that influence costs are proposed unit mix and the overall unit density. For example, a scheme that has a high density of one and two-bedroom apartments will have a significantly higher fit-out rate than an alternative scheme that favours large apartments with three or more bedrooms. Based on comparable specifications and maintaining the overall NIA, these variances in unit mix will affect the fit-out cost rate by as much as +/- £10 per ft² or more.

The cost model is based on generic fit-out specifications prepared by Darling Associates. All costs are at fourth quarter 2012 prices.The costs for bespoke enhancements to suit purchasers’ specific requirements are excluded.

Emerging prime, typically outer zone 1 or Docklands Sales value @ £800-1,000 per ft2 Average-sized two-bedroom unit @ 850ft2 (79m2)

| Total (£) | £/ft2 | |

| Internal partitions, doors | 8,100 | 9.53 |

| Stud partitions | ||

| Doors - full height, dark oak veneered doors with brushed chrome ironmongery | ||

| Plain MDF skirtings (no cornices) | ||

|

Wall finishes Pain finish generally Porcelain ceramic tiles to bathrooms |

4,000 | 4.71 |

| Floor finishes | 8,700 | 10.24 |

| Laminated timber-effect flooring to living areas, entrance hall and corridors | ||

| Porcelain ceramic tiles to bathrooms | ||

| Carpet to all bedrooms | ||

| Ceiling finishes | 3,700 | 4.35 |

| Suspended ceiling and paint finish | ||

| FF&E | 19,100 | 22.47 |

| Contemporary Italian high gloss, handleless kitchen with soft closing mechanisms to drawers and doors, eg Polyform, Modulnova, and so on | ||

| Composite stone worktops to island and wall units | ||

| LED feature lighting | ||

| Undermounted sink and chrome mixer tap | ||

| Siemens appliances including washer / dryer | ||

| Dark oak veneered bathroom cabinet with mirrored front | ||

| Full height fitted wardrobes, matt lacquered doors | ||

| Sanitaryware | 6,300 | 7.41 |

| Contemporary white sanitaryware by Villeroy & Boch | ||

| Hansgrohe brassware | ||

| Wall-mounted WC | ||

| Bath with porcelain front panel and wall-mounted chrome mixer tap | ||

| Walk-in shower with glass shower screen, wall and ceiling mounted chrome showerhead and hand shower | ||

| MEP services | 26,400 | 31.06 |

| Energy-efficient heating and hot water system with underfloor heating throughout, controlled by zoned thermostats; | ||

| Heat recovery ventilation and cooling in living and master bedroom | ||

| Low-energy recessed downlighting to all areas | ||

| Video entry system | ||

| Generous supply of electrical sockets, plain finish | ||

| Hidden wiring and recessed wall supports installed to supply signal and support flatscreen TV, DAB radio, satellite x 2 and telephone sockets to living room | ||

| Telephone, data and loopthrough TV point to master bedroom | ||

| Wiring for flush-mounted ceiling speakers to living areas | ||

| BWIC | 1,600 | 1.88 |

| Sub total | 77,900 | 91.65 |

| Preliminaries, OHP and contingency | 15,600 | 18.35 |

| Total | 94,000 | 110.59 |

Prime central London, typically West End, Chelsea or South Bank Sales value @ £1,400-1,800 per ft2 Average-sized two-bedroom unit @ 1,200ft2 (111m2)

| Total (£) | £/ft2 | |

|---|---|---|

| Internal partitions, doors | 17,200 | 14.33 |

| Stud partitions | ||

| Doors: full-height, dark oak veneered doors with high-quality black nickel Joseph Giles ironmongery | ||

| Sliding obscured glazed doors to bathrooms | ||

| Flash gap skirting detail with doubled plasterboard linings | ||

| Wall finishes | 17,300 | 14.42 |

| Paint finish generally | ||

| Stone finish to bathrooms | ||

| Floor finishes | 20,000 | 16.67 |

| High-quality wide-board (200mm) engineered-wood flooring to living areas | ||

| 900mm x 900mm Italian marble to entrance halls and kitchens | ||

| Stone finish to bathroom | ||

| Ceiling finishes | 5,500 | 4.58 |

| Suspended ceiling and paint finish | ||

| Coffered ceilings to living and master bedroom | ||

| FF&E | 57,700 | 48.08 |

| Contemporary Italian high gloss, handleless kitchen with soft closing mechanisms to drawers and doors - for example, Modulnova (SP29) or Bulthaup | ||

| Stone worktops to island and wall units | ||

| LED feature lighting | ||

| Franke undermounted sink and Dornbracht chrome mixer tap | ||

| Miele appliances; Quooker boiling hot water tap | ||

| Dark oak veneered bathroom cabinet with mirrored front | ||

| Full-height fitted wardrobes, matt lacquered doors | ||

| Sanitaryware | 11,600 | 9.67 |

| Contemporary white sanitaryware by Villeroy & Boch | ||

| Dornbracht brassware | ||

| Wall mounted WC | ||

| Stone vanity basin | ||

| Built-in bath with stone front and surround, and wall mounted chrome mixer tap | ||

| Walk-in shower with glass shower screen, wall and ceiling mounted chrome showerhead and hand shower | ||

| MEP services | 57,700 | 48.08 |

| Energy efficient heating and hot water system with underfloor heating throughout, controlled by zoned thermostats linked back to apartment BMS control system | ||

| Fully air conditioned with heat recovery and cooling. All controls linked back to the apartment BMS control system | ||

| Ventilation | ||

| Electrical installations | ||

| Low-energy recessed downlighting to all areas | ||

| Feature concealed lighting in coffer ceilings to living and master bedroom | ||

| All lighting controllable from central touch-screen control panel and at entry point to each room with mood settings using Dali system | ||

| Video entry system | ||

| Generous supply of electrical sockets | ||

| Audiovisual wired network to living and master bedroom wired back to central hub | ||

| BMS Crestron system controlling heating, ventilation, lighting and AV | ||

| High speed internet, Digital aerials, Hotbird satellite system, BT line and 3G/4G boosted reception connections provided | ||

| BWIC | 3.500 | 2.92 |

| Sub total | 190,500 | 158.75 |

| Preliminaries, OHP and contingency | 38,100 | 31.75 |

| Total | 229,000 | 190.83 |

Super prime central London, Knightsbridge or MayfairSales value @ £2,500-plus per ft2 Average-sized two-bedroom unit @ 1,600 ft2 ( 149m2)

| Total (£) | £/ft2 | |

|---|---|---|

| Internal partitions, doors | 38,700 | 24.19 |

| Stud partitions | ||

| Doors: full-height, dark oak solid doors with bespoke ironmongery | ||

| Sliding obscured glazed doors to bathrooms | ||

| Solid hardwood skirtings to bedrooms | ||

| Stone skirtings to entrance halls, reception rooms and kitchens | ||

| Wall finishes | 25,200 | 15.75 |

| Paint finish generally | ||

| Stone slab finish to bathrooms | ||

| Timber wall cladding to hallways | ||

| Floor finishes | 34,600 | 21.63 |

| Herringbone engineered-timber flooring to reception rooms | ||

| Italian stone slab flooring in complex patterns to entrance halls and kitchens with stone skirtings | ||

| Stone slab finish to bathrooms | ||

| Wide board flooring with silk carpet to all bedrooms | ||

| Ceiling finishes | 24,800 | 15.50 |

| Suspended ceiling and paint finish | ||

| Coffered ceilings to entrance hall, living, master bedroom and bathroom | ||

| FF&E | 97,600 | 61.00 |

| Bespoke kitchen units at top end range, for example, Minotti | ||

| Rare granite worktops cantilevered with steel internal frames | ||

| LED feature lighting | ||

| Franke taps | ||

| Gaggenau / Miele / Wolf appliances; Qooker boiling hot water tap | ||

| Dark oak veneered bathroom cabinet with mirrored front, incorporating TV | ||

| Full-height fully fitted dressing rooms with solid timber / glazed / obscured glass | ||

| Sanitaryware | 29,900 | 18.69 |

| Contemporary white sanitaryware by Villeroy & Boch | ||

| Dornbracht brassware | ||

| Wall-mounted WC in separate area | ||

| Stone vanity basin | ||

| Freestanding or built-in Quarrycast high-gloss bath with stone front and surround, and floor or wall- mounted chrome mixer tap |

||

| Walk-in shower with glass shower screen, wall and ceiling mounted chrome showerhead and hand shower | ||

| MEP services | 96,600 | 60.38 |

| Energy efficient heating and hot water system with underfloor heating throughout, controlled by zoned thermostats linked back to apartment BMS control system |

||

| Fully air conditioned with heat recovery and cooling. All controls linked back to the apartment BMS control system | ||

| Low-energy recessed downlighting to all areas | ||

| Feature concealed lighting in coffer ceilings to entrance hall, living, master bedroom and bathroom | ||

| All lighting controllable from central touch-screen control panel and at entry point to each room with mood settings using Dali system |

||

| Video entry system | ||

| Generous supply of flush electrical sockets with chrome nickel finish | ||

| Sound system to bathroom | ||

| Full functioning home entertainment system wired network to all main rooms, wired back to central hub | ||

| BMS Crestron system controlling heating, ventilation, lighting, curtains, blinds and AV | ||

| High speed internet, Digital aerials, Hotbird satellite system, BT line and 3G/4G boosted reception connections provided |

||

| BWIC | 6,300 | 3.94 |

|

Sub total Preliminaries, OHP and contingency Total |

353,700 70,700 424,000 |

221.06 44.19 265.00 |

Downloads

Emerging prime cost model

PDF, Size 0 kbPrime cost model

PDF, Size 0 kbSuper prime cost model

PDF, Size 0 kb

Source

Davis Langdon would like to thank Helen Gray of CBRE and Chris Darling of Darling Associates for their contributions to the preparation of this article.

No comments yet