Orders remain low and the bleak employment outlook continues. However, tender enquiries did rise, as did the overall UK index. Experian Marketing Information Services provides the latest figures

1. The state of play

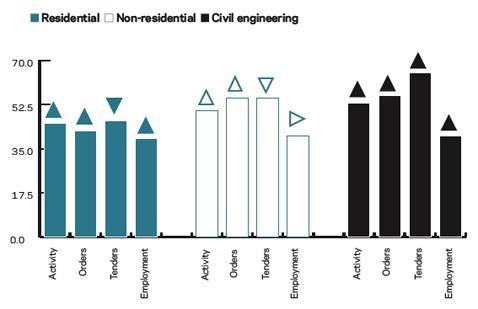

Following a substantial weather-related fall in December, the activity index rose by eight points in January to the no-change mark of 50. The residential activity index was the only one below 50 in January, though it rose by three points to 45. The non-residential activity index rose by one point to 50, indicating that activity levels were unchanged from the previous month, while the civil engineering activity index jumped by 22 points to post 53.

More than half of respondents (55%) indicated that insufficient demand was constraining activity in January, a substantial increase on the proportion in the previous two months. Bad weather became less of an issue, although 10% of firms continued to indicate that it was having a negative impact.

Firms continued to report that orders were below normal for the time of year in January, as the orders index remained below 50 for the 31st successive month. Non-residential and civil engineering firms reported higher than normal orders during the month but residential new orders were below normal.

Tender enquiries continued to rise in January, although the index eased by two points to 51. The recent volatility of the civil engineering tender enquiries index continued, as it jumped by 22 points to a nine-month high of 65. The non-residential index was at 55, but the residential tender enquiries index dropped eight points to 46.

The construction employment index remained below 50 for a 37th successive month. It was unchanged at 39 in January, indicating firms anticipate reducing staffing levels over the coming three months.

2. Leading construction activity indicator

CFR’s Leading Construction Activity Indicator points to a return to falling levels of construction activity in the coming three months, albeit at only a weak pace. The activity index is expected to decline by one point to 49 in February and remain unchanged at that level in both March and April.

The indicator uses a base level of 50: an index above that level indicates an increase in activity, below that level a decrease.

3. Labour costs

Half of civil engineering firms reported that labour costs had fallen in January compared with a year earlier, in contrast to 100% three months ago. About 50% of firms in the sector indicated that annual labour cost inflation was between 2.6% and 5% at the beginning of 2011.

Building firms reported a wider range of changes in labour costs from a year earlier, with about one-third indicating that they had fallen in January. This compared with 36% three months ago. At the other end of the scale, around 12% of building firms reported annual labour cost inflation of more than 7.6%, weaker than the 18% three months ago. Just over 37% indicated that labour costs had risen by between 2.6% and 5% from January 2010.

![]()

4. Regional perspective

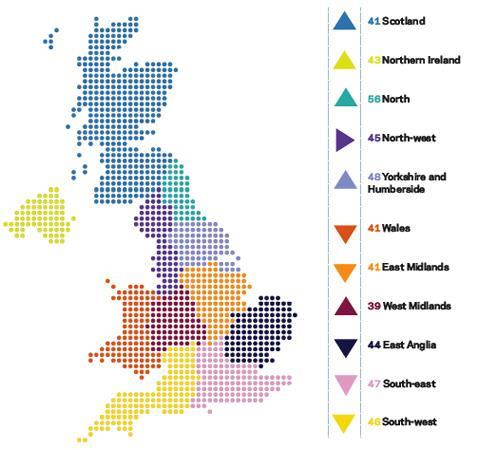

Experian’s regional composite indices incorporate current activity levels, the state of order books and the number of tender enquiries received by contractors to provide a measure of the relative strength of each regional industry.

The North was the only regional index to post a reading above 50 in January. Moreover, the index rose by four points to 56, its highest reading for eight months.

The indices for four other regions and devolved nations also rose during the month. The strongest increase was in Scotland, where the index rose by five points to 41. Yorkshire and Humberside’s index posted 48, four points above the previous month’s reading and a five-month high. The indices for the West Midlands and Northern Ireland both rose by three points to 39 and 43, respectively. However, the West Midlands’ index remained the weakest of all the regions and devolved nations.

The East Midlands saw the strongest decline, as its index fell by six points to 41, its lowest reading for 14 months. East Anglia’s index declined by five points to 44, while the

South-east’s fell below the no-change mark for the first time in six months. The index posted 47, a four-point decline on the previous month.

The South-west and Wales saw declines of three points and two points respectively, while the North-west’s index was unchanged at 45 for the third successive month.

The index for the UK, which includes firms working in five or more regions, rose by six points to 57, a five-month high.

No comments yet