The ongoing energy emergency and net zero demands are necessitating a shift in the UK’s approach to energy. But what needs to be done? Jordan Marshall explores

The UK is in the grip of an energy crisis. As prices soar due to an unhappy mix of global economic and political factors, the government has introduced a range of measures to support businesses and households alike.

But despite these measures, it is undeniable that the country needs to look for new energy sources, in order not only to ensure security of supply but also to enable the UK to meet its net zero commitments. In this context, Gleeds’ energy market report 2022 could not have come at a more appropriate moment. In this snapshot of opinion from across the industry, the report has sought to examine exactly what the state of play is in the energy sector.

Why is energy dominating the headlines?

Global energy prices sharply rose when covid-19 lockdown restrictions lifted and economies started returning to normal, and prices have risen further since Russia invaded Ukraine.

While Europe has looked for alternative energy sources to reduce imports from Russia, this has only increased market competition and prices. Russia has also constrained natural gas supply, causing price spikes.

The simple fact is that high energy prices are affecting daily life, contributing to spiralling costs for both individual households and businesses. Approximately 13% of companies surveyed by Make UK were cutting hours of operation or avoiding production during peak energy price periods, with 7% stopping output for more extended periods. It also found that 12% of firms surveyed had already cut jobs.

Added to this is the extreme weather that occurred in the UK over the summer, further highlighting the need to transition to net zero carbon as soon as possible to avoid further catastrophic climate change. In fact, just last year the International Energy Agency said: “Nothing short of a total transformation of our energy infrastructure is required [as the] energy that powers our daily lives produces three-quarters of global emissions.”

What is the right energy mix?

It is clear to everyone that the UK’s energy supply must come from a mix of sources, but what does that look like? More than half of respondents to Gleeds’ energy survey said, unsurprisingly, that clean and sustainable energy was the most important priority for the energy sector – but what does that mean in practical terms?

Replies to the survey were that renewables such as wind, solar and hydropower would all play a key role in the energy mix. In fact, the trio were deemed likely to play the most significant role, with 89% of respondents saying they would be integral to getting the right energy mix. Next came nuclear, with 71% citing that as a key energy source, followed by alternative energies such as biofuels, hydrogen, and carbon capture, usage and storage (CCUS) at 68%.

But while there is no doubting the role these sources will need to play, it is not as simple as building the infrastructure to garner energy via these routes. As Andy Ellis, managing director of Gleeds Energy, points out: “The intermittent nature of renewables means that energy storage is needed to manage electricity generation variations and increase resilience.”

What’s the cost?

There is no doubt the energy sector needs serious investment if it is to deliver the energy supply the UK needs. Launched in April, key parts of the British Energy Security Strategy include the acceleration of new nuclear power to install up to 24GW of total capacity by 2050, along with increasing offshore wind power to 50GW by 2030, of which 5GW will be floating offshore wind.

There is also some support for solar, hydrogen and heat pumps. So, it is clear that a huge financial commitment is needed to meet these targets.

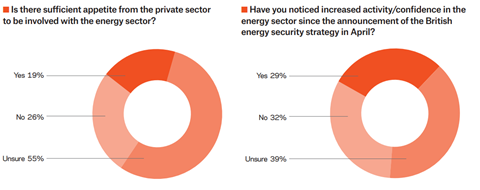

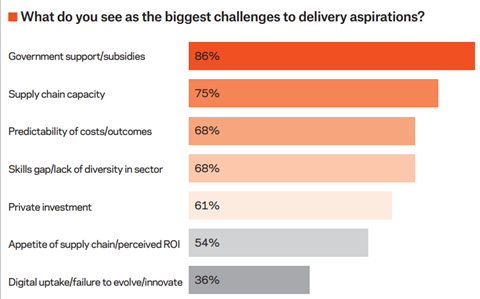

Despite this, only 30% of respondents to the Gleeds survey had noticed increased activity and confidence in the energy sector since the strategy’s launch, while only one in 10 thought there was sufficient government support to achieve the objectives set. And perhaps that is no surprise.

The energy price guarantee support from the government is expected to lead to significant borrowing, on top of what it owes as a result of the pandemic, while funding is also required for defence and to adjust to the needs of an ageing population.

With this in mind it’s clear that to deliver the pipeline of energy projects needed, private project financing will be required — and 54% of survey respondents considered this “very important” for delivery. But only one in five felt there was sufficient appetite from the private sector to be involved with the funding of energy projects. So, how can that be addressed?

Gleeds’ Ellis says: “To encourage private investment in the energy sector, there will need to be confidence in the return on investment. Attractive return on investment encourages competition, creates a thriving market and will increase supply.”

Unlocking delivery

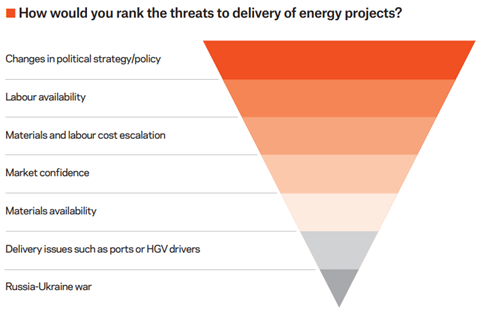

Funding is not the only issue facing the sector, as there are many threats to delivery of the much-needed energy projects in the current climate. Results of the survey ranked the top threat as changes in political strategy and policy, while labour availability and material and labour cost escalation were also considered key risks.

Despite this, the benefits of energy investment are well understood, and steps have been taken to speed up developments. In July, the government approved six fixed offshore wind projects to generate electricity for more than seven million homes.

Essentially, for priority cases where quality standards are met, examination timescales for project approval by the relevant secretary of state could be set shorter due to an amendment to the Planning Act 2008. The government hopes this measure will reduce the time taken to get planning consent down to just one year, as it can currently take up to four years.

Robust procurement principles that encourage collaboration, digital transformation of construction and increased use of data analytics are also seen as key levers to help speed up delivery of energy projects while ensuring quality is not compromised.

Experience is growing in the project delivery of renewables; an expertise that can be shared to help other countries meet their aspirations. In fact, Gleeds has been working alongside parent body organisations, site licence companies and suppliers across all parts of the energy sector — renewables, nuclear, oil and gas, as well as hydrogen and CCUS.

The consultant’s team have accumulated and assembled their knowledge to compile a comprehensive data warehouse and technology library to inform more accurate budgets. Gleeds advises throughout the lifecycle of projects and helps to embed collaborative behaviours. At such a key time for the sector, now is the moment for clients and teams around the globe to come together in powering up.

Gleeds Energy is an industry recognised specialist arm of Gleeds, with a proven track record of delivery within renewables, nuclear, oil and gas, as well as hydrogen and CCUS.