Costing Steelwork is a series from Aecom, BCSA and Steel for Life that provides guidance on costing structural steelwork. This quarter provides a market update and guidance on embodied carbon targets

Click here to read the full costing report

Private commercial construction new work output fell by 6.5% from November 2023 to February 2024. Private commercial was the only sector of significant size to have increased in the year to November 2023, which makes the slippage more significant. The demand for grade A office space in London is driving a strong recovery in the commercial office sector. Q1 24 has had significantly more construction starts on London projects, than the average for this period over the last decade. This has been on the back of a strong end to 2023, with London showing robust signs of recovery. This recovery is currently very London-centric, with close to 80% of the UK construction starts occurring in London.

UK construction new work output fell by 9.1% on a yearly basis in Q4 2023. The Office of National Statistics has indicated a 7% reduction to January 2024 against the same period last year. Repair and maintenance output rose by 13.4% across the same period. This subsector continues to support the industry’s momentum and keep total output levels respectable, helping to offset the reduced private housebuilding output, which was previously a large contributor to the overall volume of new work. It is worth noting that repair and maintenance activities now account for almost 45% of the overall industry output. Compared with 34% in 2019, it shows a significant shift in workloads.

Construction sentiment indicators steadied over Q4 2023 and Q1 2024. Despite subdued trends through 2023, sentiment has started to rally, albeit below the long-term averages. The industry as a whole is not particularly pessimistic and there are signs of increased activity in sectors with constrained capacity. Q1 2024 brought some optimism and green shoots of economic recovery, with talk of a potential bounce-back in 2024. The Bank of England base rate remaining at 5.25% has been a barrier to investment in new schemes. However, the Bank of England has now indicated that reduction in the base rate is more likely to happen in the summer, now that inflation is expected to be within the set targets. This will go a long way to restore confidence and alleviate the muted outlook.

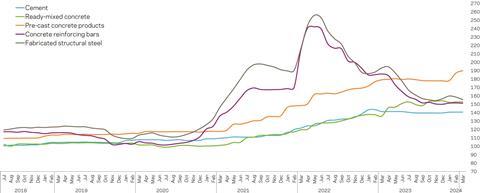

Aecom’s building cost index – a composite measure of materials and labour costs – increased at an annual rate of 2% up to February 2024. This is a slight rise in the rate of cost inflation as recorded in Q4 2023. The increase reflects a wide range of rises in cost again, when measured on a yearly change basis. At the start of 2024, a larger number of materials categories recorded an increase in their yearly rate inflation, although a majority remain below 5%. This is partially accounted for in the scheduled new year price increases. The current shipping disruption in the Middle East is also likely to be a factor. The metals-based materials categories prices have started to level out. Similarly to 2023, many of the categories with the highest current rates of cost inflation are finishes trades.

There is continued pressure in the higher rate of inflation for workforce wages. The aggregate measure of construction labour rates remains at broadly 4%-5% yearly change. Wage growth is persistent in being the largest current factor influencing general inflation. This is heightened by the workforce contraction within the industry. Typically wage inflation for construction trades sits higher than material inflation. Therefore, wage inflation is carefully scrutinised as a key indicator when considering future monetary policy decisions. The trend on wage inflation does set a threshold on the lowering of inflation projections and the adjustment of tender prices, ultimately maintaining a level of upward pressure on costs.

Overall tender price inflation trends continued to slow over Q4 2023. Aecom’s baseline forecast for tender prices has been downgraded from a 2% to a 0.8% increase from Q4 2023 to Q4 2024, and from a 3% to a 1.5% increase from Q4 2024 to Q4 2025. Despite continued pressure from workforce wage inflation, tender prices have remained largely static for the first half of 2024. A composite measure of building input costs rose by 2% in the year to February 2024. The consumer prices index fell to 3.4% in the 12 months to February 2024. A broader range of categories are all contributing to the slower rate of consumer price inflation.

The construction industry is continuing to see increased levels of insolvencies – this has been a hallmark of the industry for the last two years. There is an element of contraction and reduced competition within the industry, although this has greater impact on specific trades. One of the underlying impacts of insolvencies is that it acts as a cautionary tale for other contractors and can make contractors risk-averse when tendering works.

Other market considerations

There are a number of current topics within the steel industry that are impacting design and have the potential to influence costs.

The emphasis on low embodied carbon buildings has seen a shift towards rolled sections as the primary steel, in lieu of fabricated sections. This has meant the introduction of additional columns within office floorplates. The carbon agenda is pushing towards rolled sections from electric arc furnaces (in lieu of blast furnace production) with optimised design to ensure that efficient rolled beam sections work with the building form. This results in alternative sourcing of steelwork and a conscious move away from what has become common practice on large commercial projects.

The London commercial office sector is showing strong signs of recovery, which will have an impact on steel prices and confidence in the sector – with steelwork being the primary frame option, particularly on major office projects. The increase in construction starts is very London-centric, and this is likely to be a factor if this trends continues.

Figure 1: Material price trends

Price indices of construction materials 2015=100. Source: DBEIS

Figure 2: Tender price inflation, Aecom Tender Price Index, 2015=100

| Forecast* | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

|

1 |

120.4 |

120.0 |

131.2 |

145.4 |

145.6 |

147.2 |

150.1 |

|

2 |

121.0 |

122.6 |

134.5 |

146.6 |

146.0 |

147.8 |

151.1 |

|

3 |

119.1 |

125.3 |

138.1 |

146.8 |

146.4 |

148.5 |

152.0 |

|

4 |

119.1 |

127.5 |

142.3 |

145.6 |

146.8 |

149.1 |

153.0 |

Sourcing cost information

Cost information is generally derived from a variety of sources, including similar projects, market testing and benchmarking. Due to the mix of source information it is important to establish relevance, which is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building, with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 3), highlight the existence of different market conditions in different regions.

To use the tables:

1. Identify which frame type most closely relates to the project under consideration

2. Select and add the floor type under consideration

3. Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£165.00 + £110.00 + £28.00 = £303.00

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

Figure 3: Indicative cost ranges based on gross internal floor area

| TYPE | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

||

|

Steel frame to low-rise building |

149-181 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

251-283 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

283-335 |

Steelwork design based on 110kg/m2 |

|

Floors |

||

|

Composite floors, metal decking and lightweight concrete topping |

86-134 |

Two-way spanning deck, typical 3m span with concrete topping up to 150mm |

|

Precast concrete composite floor with concrete topping |

131-184 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

||

|

Fire protection to steel columns and beams (60 minutes resistance) |

23-33 |

Factory applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes resistance) |

27-45 |

Factory applied intumescent coating |

|

Portal frames |

||

|

Large-span single-storey building with low eaves (6-8m) |

108-142 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

132-169 |

Steelwork design based on 45kg/m2 |

Figure 4: BCIS location factors, as at Q4 2023

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

127 |

Nottingham |

102 |

|

Manchester |

101 |

Glasgow |

93 |

|

Birmingham |

98 |

Newcastle |

90 |

|

Liverpool |

96 |

Cardiff |

93 |

|

Leeds |

92 |

Dublin |

90* |

*Aecom index

Steel For Life sponsors

Embodied carbon targets

When specifying structural steel to meet embodied carbon targets, clients can specify low-carbon steel both in a global context and at the project or building level

The urgency to reduce global greenhouse gas emissions, in order to limit the impacts of climate change, is no longer disputed and attention is now focused on how and how quickly we can decarbonise all aspects of our lives.

Globally, steel production is responsible for some 8%-9% of greenhouse gas (GHG) emissions and, with around 50% of all steel being used in construction, there is a clear need for, and growing pressure on, the steel construction industry to decarbonise.

This article gives recommendations on how to specify low carbon structural steel both in a global context and, where required, at the project or building level.

The global context of steel and carbon emissions

Making primary steel is a carbon-intensive process but that is changing fast, with new low carbon technologies being developed globally.

Steel is the backbone of modern economies and has a vital role to play to deliver both sustainable buildings and the low carbon infrastructure required to decarbonise other sectors of the economy, notably renewable and low carbon energy generation.

Although there are moves in the UK to limit new development and to refurbish and repurpose existing buildings wherever possible, globally it is highly likely that new development requiring steel will continue meaning that global steel demand will continue to grow and therefore the global impacts of steelmaking on climate change should take precedence over local or project level carbon decision-making.

Steelmaking

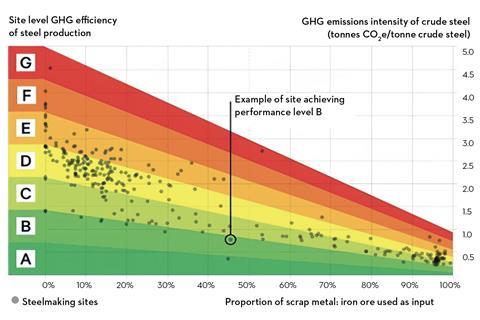

Steelmaking is today dominated (99.5%) by two production processes: Blast furnace basic oxygen furnace (BF-BOF) and electric arc furnace (EAF) mainly using scrap. Globally, BF-BOF currently accounts for 71% of all steelmaking and EAF 29%.

The dominance of BF-BOF production is driven mainly by the finite supply of scrap and the growing global demand for new steel, particularly in developing economies.

Steel construction products

All steel construction products can be produced using either of the two principal steelmaking routes described above. However, for various technical, economic and even historic reasons, long and flat products are currently preferentially produced by one or other of these routes (see figure 5).

Hot-rolled steel sections are the main products used in steel structures. Steel sections of the same size, strength and quality are produced by both the primary, ore-based steelmaking route (BF-BOF) and the 100% scrap-based electric arc furnace (EAF) route. Both variants are widely available in the UK.

Their upfront (module A1) embodied carbon, however, varies markedly with EAF sections typically having only 20% of the embodied carbon of BF-BOF sections.

To meet project or building level embodied carbon targets, therefore, an obvious response is to specify EAF sections for the steel structure. Unfortunately, in a global context, this decision will not reduce carbon emissions from steelmaking.

In fact, additional transport impacts from importing EAF sections can increase overall embodied carbon emissions. There are also wider social and economic ramifications of importing steel in preference to UK-produced steel.

Figure 5: Steelmaking GHG emissions intensity vs scrap input (levels A to G illustrative only)

| Product category | Manufacturing route | Products |

|---|---|---|

| Long products | Blast furnace route and electric arc furnace route | Sections Rebar Wire rod |

| Flat products | Blast furnace route | Plate Hot-rolled coil Cold-rolled coil Hot-dip galvanised Organic coated flats |

Specifying low carbon steel

The global demand for steel, coupled with the finite supply of ferrous scrap, leads us to conclude that from a global perspective we need to incentivise all steelmakers to decarbonise and therefore the sliding-scale approach (see figure 6) developed by ResponsibleSteel and adopted by SteelZero is recommended when specifying structural steel.

Building embodied carbon targets

In the absence of UK regulation of embodied carbon and definitive targets or benchmarks, several organisations have proposed embodied carbon targets that are voluntarily adopted on some projects.

These include whole building embodied carbon targets, by the RIBA, the Low Energy Transformation Initiative and the mayor of London, and structure-only targets proposed by the Institution of Structural Engineers (IStructE).

Targets are generally limited to upfront embodied carbon, also known as modules A1-A3 or A1-A5, and expressed in terms of in terms of kgCO2e/m2 of gross internal floor area.

Work is under way to develop a UK net zero carbon building standard, which is expected to derive new embodied and operational carbon benchmarks and targets that will be based both on current practice and on future UK carbon budgets. These targets are likely to supersede the embodied carbon targets currently used.

Figure 6: Steelmaking GHG emissions intensity vs scrap input (levels A to G illustrative only)

Early design stage embodied carbon assessment

The variation in the embodied carbon of structural steel makes early design stage embodied carbon assessment and decision-making difficult since, at this stage of a project, the specific product or steel supplier (and production route) will generally not be known.

The approach adopted in embodied carbon assessment guidance developed by the RICS and the IStructE is to base the assessment on UK market-average values. For hot-rolled structural steel sections, both the RICS and the IStructE refer to the UK consumption average calculated by the BCSA, which is currently 1.64tCO2e per tonne.

Despite the limitations of setting project-level embodied carbon targets for steelwork in the context of global GHG emission reductions, it is recognised that some clients may continue to set such targets. If they do, it is recommended that a blended approach is used to achieve the target, in other words a mix of BF-BOF, EAF and reused steelwork.

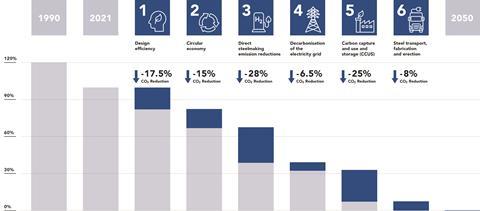

The UK structural steelwork 2050 decarbonisation roadmap

The BCSA published its 2050 decarbonisation roadmap in 2021. The scope of this roadmap is the UK structural steelwork sector, and it sets out how the sector plans to decarbonise to meet the UK net zero carbon target by 2050.

The major steelmakers who supply the UK structural steelwork sector are making good progress to address levers 3-5.

In particular, the recent announcements by British Steel and Tata Steel to transition to EAF production will substantially reduce both direct steelmaking emissions (lever 3) and the requirement for CCUS (lever 5) in the UK.

ArcelorMittal is also investing in cutting-edge low carbon steelmaking technologies in Europe.

Figure 7: BCSA 2050 decarbonisation roadmap

Want to find out more about specifying structural steel to meet embodied carbon targets?

For more details and to register your attendance, scan the QR code.

This Costing Steelwork article produced by Patrick McNamara (director) of Aecom is available at www.steelconstruction.info.

The data and rates contained in this article have been produced for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the article content.

No comments yet