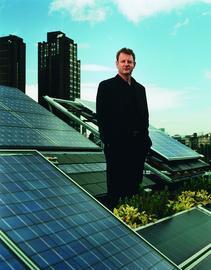

Jeremy Leggett, CEO, Solar Century. Profile in association with ferroli

Sandwiched in a file of press cuttings in the reception of Solar Century’s Waterloo offices is a letter from prime minister Tony Blair. It thanks the company’s founder and CEO, Jeremy Leggett, for a recent tour of the building, during which the prime minister witnessed solar power at work first hand. But despite the PM’s recent visit, it quickly becomes clear that Leggett is disappointed with the government’s approach to energy issues.

“The government is not joined up in its policy making and seems pretty unembarrassable about the gulf between its rhetoric about global warming and what it is actually doing about it,” he says. “If you accept, as so many of us now do, that global warming is the number one threat to a survivable future, then energy should be treated accordingly. Energy should be the first thing anybody thinks about in policy and the government should deliver on the things it said in the energy white paper.”

Leggett’s had a frustrating morning, having just returned from what he describes as a “full and frank” discussion with the energy minister. “The energy minister is sold on renewable micropower but we think that the government doesn’t have a strategy and they need to get one pretty quick. You can’t plan business sensibly when you don’t have sustained market enablement and support from the government of the kind the Germans, Japanese, Spanish and Californians at state level have.”

It’s a failure of collective will, says Leggett: “We're living in an age where it is not beyond our wit and wisdom to erect zero emissions buildings that provide all their own energy and export electricity too. All this can be done with existing technology – it’s very frustrating.”

There are promising signs, however. The London mayor’s energy strategy requiring 10% of every new development’s energy to come from renewables is a healthy start. “As I understand it there are 40 plus local authorities who are saying to developers you must have 10% renewables generation on site,” says Leggett. “And you don’t need much more of that type of thing before you’ve got a tipping point in terms of market dynamics.”

Investment in renewables is also on the rise. Leggett, who serves on the board of the world’s first – and profitable – renewable energy private equity fund, says investment is flowing into the sector. “Many of us now think there is going to be an explosion of investor interest in the sector this year.”

Solar Century, now in its sixth year of trading, proves the point. Scottish and Southern Energy, one of the UK’s big six power generators, has just purchased 7.5% of the firm’s share capital, worth £1m, as part of its investment in small renewable microgeneration companies. “They see it as their future long term,” says Leggett. For Solar Century the benefit will be SSE’s 6 million-strong customer base. The two firms have entered into a collaboration agreement by which Solar Century’s expertise in solar energy will combine with SSE’s electrical contracting business to market the provision and installation of photovoltaic panels. Leggett explains: “You need catapult partners; you can’t do this sort of thing on your own and it opens up a much bigger market to us.”

Ask Leggett if money wouldn’t be better spent on improving energy efficiency rather than investing in renewables and he is honest. “Yes it would, if all you’re looking at is carbon bangs per buck.” However, consumers don’t always behave logically. “We get lots of clients who say they are not that interested in energy efficiency but they want a solar system. Once they can see what electricity they are generating and using they become energy efficiency fanatics; it captures their imagination and they don't want to see it wasted.”

The one nut Leggett has yet to crack is getting a volume housebuilder on board as a client. “I'm told it is a very conservative industry that is very resistant to change.” Should this change, things could get interesting; bulk procurement could mean drastically lowered capital costs. “The price comes down as the manufacturing scales up quite remarkably: doubling manufacturing could see the price go down 20% all other things being equal.”

On the subject of the payback period of photovoltaics, Leggett says he urges people not to compare it with the retail price of polluting power. He argues the case for off-setting the cost of the PV installation against the rainscreen cladding, combining the aesthetic benefits of PVs with 30 years of free electricity. “But even if people do want to compare us to the retail price of polluting power today, what about in five, 10, or 20 years time when the capital cost of the PV installation has been paid for? What is the price of polluting power going to be then?” You can pay your money and take your choice; Leggett knows what his will be.

Source

Building Sustainable Design

No comments yet