Finance company delivers positive message after fears raised by ‘voluntary liquidation’ warning in September

A deal to refinance the company that provides loans for the government’s flagship Green Deal scheme is set to be struck “within weeks”, according to a spokesperson for the company.

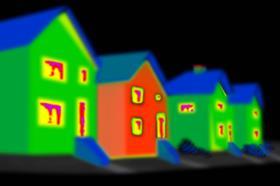

The Green Deal Finance Company (GDFC) issues and administers the finance plans that pay for energy efficiency retrofit work on homes under the government’s Green Deal scheme.

Its role is crucial as it aggregates plans allowing them to be sold at a low enough interest rate to make the scheme attractive to customers. But the future of the company has been in doubt since its chief executive Mark Bayley warned in September that it “could be wound up”.

The company has a £125m credit facility with the Green Investment Bank that is due to expire soon.

In September, Bayley, in a letter to investors, warned of the possibility of “voluntary liquidation” and sought consent for measures that would “make it much easier to wind up the GDFC at lower cost to investors if we need to go down that route”.

Speaking to Building at that time he said he was “optimistic” of a deal being done but that it would be “irresponsible for us not to be utterly frank” with the GDFC’s investors.

This week, a spokesperson for the company said: “Everything is being finalised in a matter of weeks not months. Things are moving in the right direction.”

Although the company has been talking to all its investors in both the public and the private sector, it is keen to secure money from the government because the lack of a track record for the scheme, which was launched in January 2013, means it is more expensive to borrow commercially.

A spokesperson for the Department of Energy and Climate Change confirmed that it was in discussions with the finance company but that she was “not in a position to reveal any details of those discussions”.

The GDFC spokesperson also said the firm had now issued £27m of plans to date and was nearing £28m, a 35% increase from the £20m of plans that it had issued up to the end of September.

No comments yet