Pledge by insurers to invest over the next five years is not binding and does not guarantee investment in new-build infrastructure

A pledge by six insurers to invest £25bn in the built environment over the next five years is not binding and does not guarantee investment in new-build infrastructure, it has emerged.

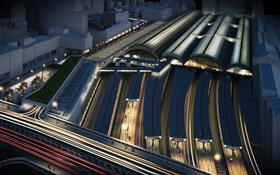

The move was announced by Treasury secretary Danny Alexander at the launch of the update to the National Infrastructure Plan (NIP) today, which included details of a £375bn pipeline of public and private infrastructure projects.

Alexander hailed the development as “a massive vote of confidence in the UK economy”.

However, while insurers said they would consider investing in energy and other infrastructure projects, sources in the sector insisted their focus would be in areas not included in the NIP, such as housing, hospitals and schools.

Speaking at the launch Nigel Wilson, chief executive at one of the six insurers, Legal and General, said his firm would start investing the money “from next year onwards” but that it would not be bound by projects identified in the NIP.

He said: “We’ll look at the housing sector, energy, hospitals and transport. We’ve got our own plans.”

The agreement, described by the government as an “aim”, does not contractually commit the insurers – which also include Prudential, Aviva, Standard Life, Friends Life, and Scottish Widows – to invest in projects and it does not state how much of the investment will go into new-build infrastructure as opposed to existing assets.

However, an insurance industry source said: “This agreement implies doubling the investment we already have in infrastructure. I think we can do more than that.”

The move follows a relaxation of regulations under the EU’s Solvency II Directive, which sets the framework for how insurers can invest their money.

The changes, confirmed in November, reduced regulations around investing money into property and infrastructure.

Richard Threlfall, head of construction at KPMG, said: “The bigger story here is not this £25bn alone but the wider impact this relaxation on Solvency II could potentially have on investment”.

The government said £115bn of the £375bn infrastructure pipeline would be delivered in this parliament, with a further £150bn delivered in the second half of the decade, and the rest after 2020.

No comments yet