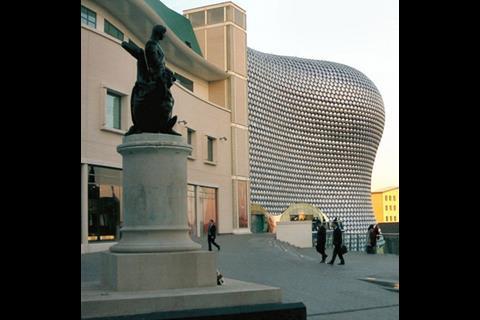

Developer has sold its one third ownership of Birmingham shopping centre to Australian government investment fund

Developer Land Securities has sold its one third ownership of the Bullring in Birmingham to an investment fund for the Australian government, for £210m, it announced today.

The group sold its share in the 1.2 million sq ft shopping centre to the Future Fund reflecting a net yield of 6.85% after settlement of outstanding rent reviews.

The Bullring opened in 2003, accommodates some 160 retailers and catering operators and delivers a total annual rental income of £45m.

Richard Akers, managing director for Land Securities Retail, said: "The Bullring was instrumental in transforming the Birmingham retail offer and has performed well for us. However, the absence of operational control over the Bullring made it an unusual asset within Land Securities' portfolio where we look to create value through successful development and active management of properties.

"The funds generated by the sale will increase the group's flexibility to exploit future opportunities."

Cushman & Wakefield acted for Land Securities and CBRE represented Future Fund.

No comments yet