Cash purchase will help Wood reduce its debt pile

Texan engineering giant Jacobs is buying its way into more UK work after agreeing to purchase Wood’s nuclear arm for £250m.

The firm currently has one eighth of its 80,000 staff in the UK, after buying rival CH2M for $3.3bn (£2.7bn) in 2017.

It is already project managing construction of Thames Tideway, as well as working on HS2, Crossrail, Heathrow, Gatwick and parliament’s refurbishment.

Now the group has said it will purchase the nuclear business of Aberdeen-based Wood.

Wood’s nuclear arm made a $14.2m (£12m) pre-tax profit in 2018 and had gross assets of $464m (£382m) at year end.

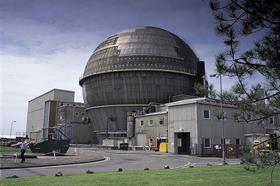

In the UK it holds a £770m contract for work at Sellafield (pictured) and had won work on the proposed Wylfa Newydd nuclear plant in north Wales before developer Hitachi pulled the project in January.

It has also worked as project manager for the €300m (£275m) Interim Storage Facility Two being finished in Chernobyl after Wood acquired Amec Foster Wheeler for £2.2bn in 2017.

Wood announced the sale, which is subject to approval by the Competitions and Market Authority, with its interim results – in which it revealed a $13m (£11m) pre-tax profit from a $4.8bn (£4bn) turnover for the six months to 30 June.

Wood is currently the fifth most-shorted group on the London Stock Exchange, with 9% of its stock being used to bet on the firm’s demise, as it attempts to reverse its unprofitability and pay down some of its $1.8bn (£1.5bn) net debt.

No comments yet