AIM-listed developer and land trader breached banking covenants earlier this month

AIM-listed developer Inland Homes has filed a notice of intention to appoint administrators weeks after breaching loan covenants from its bankers.

The £181m turnover firm said this afternoon it had resolved to begin the process of appointing David Hudson and Phil Armstrong of FRP Advisory as administrators and that some of its subsidiaries with floating charges over the firm have also filed notices of intention to appoint administrators.

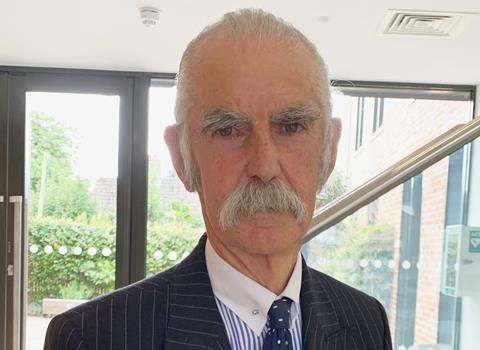

The decision comes as the firm revealed it has not yet managed to secure a waiver from HSBC regarding a £13.6m loan covenant breach and comes despite the firm’s appointment of industry veteran chief executive Jolyon Harrison to rescue the firm in the summer, in a deal which saw it take over North Country Homes for £4m and change strategy.

Inland Homes has been in turmoil for a year since it announced a profit warning and the resignation of its former chief executive Stephen Wickes last September.

The company has been unable to announce results for the year to September 2022 given ongoing investigations into related party transactions and earlier this month said it had breached the loan covenant with HSBC.

The firm previously said the breach was related to the fact it was considering “possible provisions to be made against certain asset values in its accounts with its auditors”.

Today it said in a statement to the City that further work was still required into the judgements and estimates applied to both the accounts for the year to September 2022 and for the prior year to 30 September 2021, meaning financial statements can’t be completed.

It added: “The extent of further work and cost required to complete the preparation of the financial statements and the audit for FY22 cannot be certain at this stage, and the timeframe within which this might be feasible is not known.”

It said the company continued to be in “active discussions” with HSBC to secure waivers for the breaches announced earlier in the month. It said it was now “likely to be in breach of covenants with other lenders shortly and it has already initiated discussions with such lenders”.

Inland said that given the decision to file for administration, the proposed acquisition of North Country Homes, along with the change of strategy, “cannot be implemented”.

Inland Homes’s results for the year to September 2022 had been due in February this year but have been delayed three times amid a slew of profit warnings and an investigation into “related party issues” that led to the resignation of board members. The firm’s initial attempt to replace founder Stephen Wickes as chief executive failed when former Galliard boss Don O’Sullivan resigned after just 41 days in the role.

The firm’s statement added that it had considered continuing with its current policy of seeking to complete existing construction projects at the same time as selling its land assets but had concluded that the appointment of administrators was “in the best interests of all stakeholders”.

Shares in Inland Homes will be cancelled on the Stock Exchange on 4 October.

No comments yet