US practice now has more than 3,000 on its books according to Building Design’s international survey of the world’s largest firms

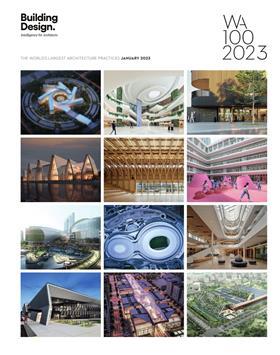

Gensler has broken through the 3,000 figure by number of architects employed for the first time in the history of the WA100, Building Design’s international survey of the world’s 100 largest firms.

The US giant, which has a fee income of over $1bn (£800m), now employs 3,069 architects, up 14% from last year’s survey which is carried out by Building’s sister title.

Diane Hoskins, Gensler co-chief executive, said it had seen “incredible growth” in the past 12 months with 19 of its 20 practice areas experiencing double digit rises.

It has also opened offices in Berlin, Riyadh and Nashville with projects completing last year including the new terminal one building at JFK International Airport in New York and the Moody Center in Austin, Texas, a 15,000-seat basketball arena.

But UK firms have seen little change in the numbers of architects they employ over the past year, reflecting the impact of the covid-19 pandemic, inflation hikes and the effects of last year’s mini-Budget which saw interest rates jump and nervous investors stall projects.

Foster & Partners remains the UK’s biggest practice with 483 architects, a drop of 19 from last time while second-placed BDP, since 2016 owned by Japanese firm Nippon Koei, stayed flat with 447 architects. And Zaha Hadid Architects also remained flat, retaining third spot with 371 architects.

New entries included Buckley Gray Yeoman, which has offices in London, Bristol and Madrid, with 71 architects.

The survey also revealed that global architects are markedly less optimistic about growth in the world construction economy this year compared to 2022.

Just under half of the firms surveyed expected growth in 2023 compared to nearly three-quarters in 2022. The number is the weakest in eight years, only surpassed by the pandemic-hit figures of 2021.

Sentiment about work prospects in China compared to recent years continue to slip with Doug Wignall, the president of US practice HDR, describing the market as “very stagnant” with many US clients shrinking their activities or pulling out.

But firms still expect to continue recruiting despite their more subdued expectations with over half of the firms surveyed saying they don’t expect to axe staff this year and just over one third saying they expect to take on between 11 and 30 people in the coming 12 months.

No comments yet