But new work continues to rise

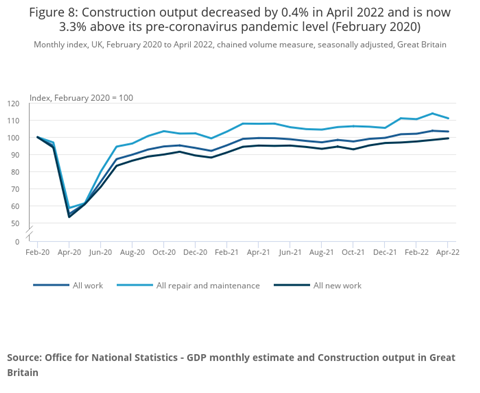

Construction output dropped by 0.4% in April after five months of consecutive growth, the ONS has reported.

The decline, driven by a fall in repair and maintenance work, comes on the back of record levels of output in March, with total output valued at £14.99bn.

April’s output remained 3.3% above its pre-pandemic level and new work has continued to rise (0.9%).

But Simon Rawlinson, partner at Arcadis, said that, given the amount of supply chain disruption, the continued growth of new work was a “testament to the robustness of the industry and in particular the stability provided by both the housing market and infrastructure”.

He added that the ONS data showed that “for the time being at least, the industry is in good health”.

A strict lockdown in Shanghai, high haulage costs and a rise in energy and material costs as a result of the war in Ukraine have all put pressure on construction’s supply chain in recent months.

Mark Robinson, group chief executive at Scape, said the decline in output would “do little to alleviate concern” the impact of inflation, which reportedly hit 25% for construction product last week.

Trends and prices data dashboard

Your one-stop-shop for the all the latest price changes and trends in the building materials, energy, housing and construction labour markets.

Building’s trends and prices data dashboard pulls together figures from 14 different datasets into easy-to-use line graphs, bar charts and animated visualisations.

“It’s clear that contractors are facing a turbulent period as input costs continue to rise,” he said.

“With inflation set to increase as much as 10% by the end of the year, firms should be using the peak summer months to scenario plan for further price rises.

“While the prospect of an upcoming economic recession is a reality, the industry has performed strongly for more than two years now and should be looking to maintain momentum by working with clients to build flexibility into their project specifications.”

Clive Docwra, managing director of property and construction consultancy McBains, said the figures were a “reminder that recovery in the construction sector is still subject to dips”.

He said growth in February and March had been “propped up” by work resulting from heavy storms, which saw repair and maintenance output grow 3% in March.

“It means the recovery is based on fragile foundations,” said Docwra.

“Private commercial new work, for example, decreased by 3.8% in April and confidence among some developers remains low with the likelihood of further interest rate rises leading to a pause on some significant investments.”

In total, four of nine sectors saw a decrease on the month in April 2022, with private housing repair and maintenance experiencing the greatest decline (6.5%).

>>> Housing growth tumbles as runaway inflation dogs industry, bellwether report says

No comments yet