“Year the chickens came home to roost” hits Paddington developer

Development Securities has seen pre-tax profits plunge from £22.8m in 2006 to just £200,000 this year.

The developer, which is building the £1bn Paddington Central development in West London, said 2007 was “the year the chickens came home to roost” in the financial services sector, with the property sector worst hit.

The fall in pre-tax profits came from a lower gain on the re-evaluation of Dev Secs’ investment property portfolio. This was £21.8m last year, and £5.1m in 2007.

The company saw its net assets fall marginally from £231.4m in 2006 to £228.9m this year, but still plans to pay out a dividend of 7.2p per share for the year, a 6.7% rise from last year’s pay-out. Dev Secs strengthened its balance sheet with the issue of e47m worth of loan notes in September, which has allowed it to keep shareholders happy.

David Jenkins, chairman of Development Securities, said: “For the first time in many years, the contribution from our development and investment activities was insufficient to generate a significant surplus over our operating and financing costs.”

He sounded a note of warning about the future: “The impact that the projected economic slowdown in the UK will have on the strength of occupier demand for office accommodation has not yet been revealed… It is here that we must be at our most vigilant.”

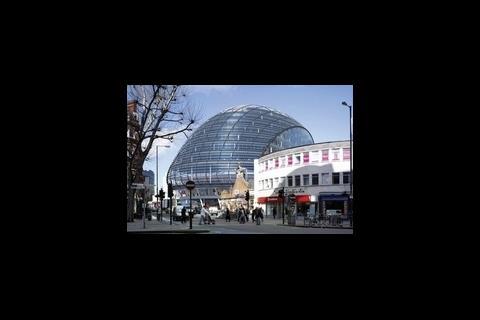

As well as Paddington Central, Development Securities has large-scale office developments under construction in Manchester, Southampton and St Bride’s, London. Its £250m Hammersmith Grove scheme – known locally as the Strawberry – is awaiting “the completion of appropriate development bank finance.”

No comments yet