Construction Products Association and Experian downgrade growth in output this year to 1.1%

The construction industry may be forced into recession this year if the turmoil in the financial markets continues, the Construction Products Association said this week.

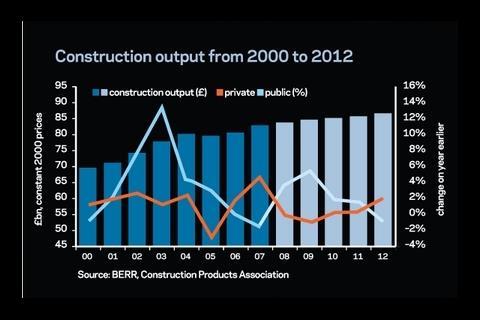

In forecasts for next year the CPA has cut its estimated growth in output for the industry to 1.1%, compared with the 1.8% predicted in the summer before the credit crunch hit the UK. But the CPA also notes that even this is “vulnerable to significant downside risks”, which “could tip the industry into recession in 2008 and 2009”.

The revision of the CPA forecasts, predicted in Building in November, has been matched by Experian, which has cut its forecast growth for next year to 1.1% from the 2.5% predicted in the summer.

In a report with the forecasts, the CPA warns that further financial problems will constrain private sector construction activity and, in particular, worsen the slowdown in the housing sector. The body concludes that, combined with the slow delivery of planned government investment, this could lead to recession in the industry.

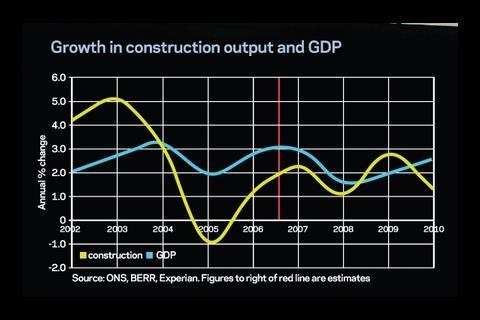

Experian says in its report: “The unfolding problems around the US sub-prime mortgage market and the level of large financial institutions’ exposure to the debts now coming to light have dented confidence in the UK, to such an extent that for the first time in many years the word ‘recession’ has been mentioned.

“While we sit very much in the soft landing camp, there is little doubt that 2008 is going to be a much more difficult year for the economy than originally predicted, with a consequent knock-on effect on the construction industry.”

Both the CPA and Experian have also revised forecasts for the housing sector downwards, with the CPA predicting a 2.3% fall in activity this year.

The CPA said the slowdown in housing threatened the government’s targets, saying for the first time that there was a significant risk of “a prolonged downturn”.

The CPA said this was likely even in the social housing sector, which is less vulnerable to the effects of the credit crunch, but still heavily dependent on private developers. It said social rented housing volumes are expected to reach 35,000 a year by 2012, well below the government’s target of 45,000 units by 2010/11.

The three-year boom in the commercial sector is also set to end, and the slowdown will again be made worse by turmoil in the financial markets. The CPA said growth would fall to 4.4% in 2008, with a 3.6% drop in activity in 2010. Data produced by Savills has indicated that the rate of decline in commercial activity is at its sharpest since March 2003.

In general, Experian is more upbeat about the industry’s prospects during the next three years, predicting an overall 5.2% growth compared with the CPA’s estimate of 3%.