Business secretary says government backing for investment could help spark recovery

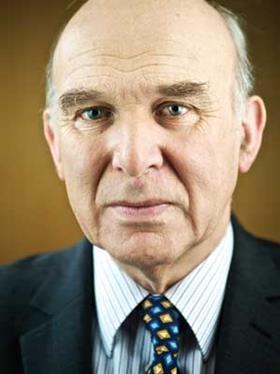

Vince Cable has reiterated the government’s desire to offer financial guarantees to developers of housing and infrastructure as part of a plan to drive growth in the economy.

In a speech to think tank Centre Forum this morning, the business secretary reiterated plans, first highlighted by David Cameron in May, to use the government’s own balance sheet to inject credit into the economy.

Under the scheme being drawn up by the Treasury, the government would use state guarantees to back investment in housing and infrastructure, guaranteeing the risk for specific projects and enabling the private sector to raise finance more cheaply.

The government’s contingent liability would only become a debt if the guarantee was ever called in and thereby could boost investment without adding to public spending.

Cable said the scheme could be used to “trigger a significant volume of housing investment … leading hopefully to a virtuous circle of new building l3ending to increased affordability and also increased private demand”.

“Insofar as these ideas reduce uncertainty, they can encourage significant investment from the private sector. Recovery requires a big expansion in social and private house building,” he said.

Cable said progress on the scheme could be made “”rapidly” in housing, including social housing.

“There is large unmet demand for social housing which may be self-financing if built, in conjunction with private housing. Indeed, some major UK contractors are doing just that with access to long term - 10 years plus finance - with access to guarantees. This activity could be multiplied,” he said.

He said the government’s strategy was aimed “providing certainty about ongoing government support to encourage greater supply chain investment”.

“This can come through regulatory certainty as much as ongoing subsidy. Co-financing private house building alongside council house building could be an extension of the same principle. The potential is large,” he added.

“The public sector balance sheet has to be used to leverage in private capital, particularly in housing. Demand has to be created, it does not emerge simultaneously.

“There is scope here to both create demand and solve a pressing supply need at the same time. Innovative approaches to public policy - making the most of the fact that our resolute action has given us a strong balance sheet - are the key to unlock this potential.”

Richard Threlfall, KPMG head of infrastructure, said state guarantees could slice 2-3% of the cost of finance and the measure was “exactly the approach Treasury should be looking at”.

“It makes a huge amount of sense and I’ve never understood why the Treasury has been so reluctant to uses its guaranteeing powers in this sort of way as at the end of the day it doesn’t cost them anything.

“The government has got no money and the economy is struggling so the best way out is to use some form on non-monetary support mechanism.”

It is expected the scheme will be in place by the autumn statement.

No comments yet