Troubled contractor warns it could face a two-to-three year fight to get profitability of its UK construction business at a comparable level to rivals

Balfour Beatty has admitted it could take up to three years for its UK construction business to recover to a level of profitability similar to its rivals, as City analysts predicted the firm’s latest £75m profit warning was unlikely to be the end of the turmoil that has engulfed the UK’s largest contractor.

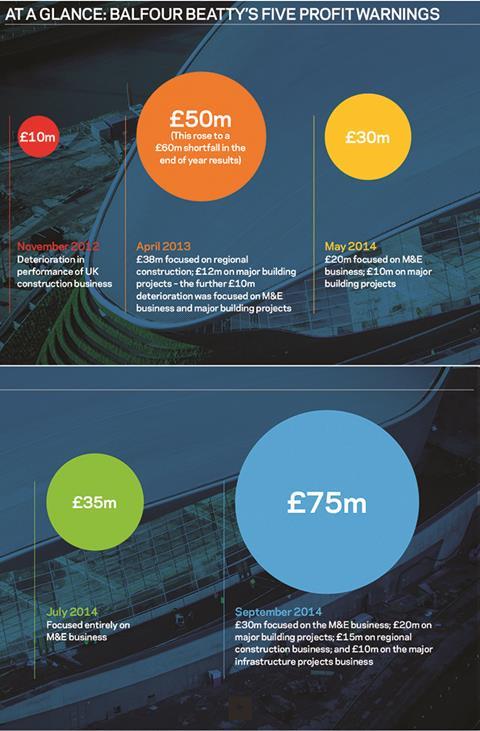

The profit warning was Balfour Beatty’s fifth in less than two years (see graphic) with the firm’s share price tumbling 25% on the news in early trading on Monday (29 September).

The share price had recovered slightly as Building went to press on Wednesday - down 16% on the closing price on Friday (26 September) - but this was still down 39% on firm’s share price from two years ago and its lowest level since 2003.

The fall in the share price saw the firm’s market value drop to £1.3bn this week – £700m less than the price Carillion valued the business at in its merger offer, which was rejected by Balfour Beatty in August.

Balfour Beatty said the latest profit shortfall was spread across its UK construction business, with the firm appointing accountant KPMG to undertake an independent review of the business, at contract level, to provide “assurance” to its investors.

The firm also announced group executive chairman Steve Marshall would be stepping down from the firm after a new chief executive and non-executive chairman have been appointed. Marshall took on the executive role after the exit of former group chief executive Andrew McNaughton following a £30m profit warning in May. Marshall’s departure will mean the £10bn-turnover construction giant will have lost two chief executives in a year.

Marshall played the leading role in the merger talks with Carillion over the summer that collapsed in acrimony after the two construction giants failed to agree over Balfour’s planned sale of consultant arm Parsons Brinckerhoff.

The firm said it was close to appointing a new chief executive, with an announcement expected in the coming weeks.

Quizzed by analysts this week on whether the appointment of KPMG indicated a “breakdown in trust within the organisation” and a failure in the “core skill set that contracting companies should have in order to be able to profitably execute and deliver contracts”, Marshall said: “We have to speak plainly. The company has had a series of surprises. And it has been surprised itself. So it isn’t about trust between any part of the company.

“The problem is we have all been surprised by what has happened in this business and therefore, certainly, I and the board judge that the right thing to do to give the company the assurance it needs and, frankly, the investors the assurance they need is to have an independent review.”

Marshall said KPMG would report to the board before the end of 2014.

He said the latest write-down was “obviously eye-catching, but it obscures the work that is actually going on to heal the business”.

But when quizzed about the 12-18 month period outlined in May to get the business back on track, Marshall said there was still “a lot of healing work to do” and there would “doubtless be work to do beyond that [the 12-18 months] as well”.

He said that “in practice” the full recovery of the business to a position where its margins were in line with its competitors could take “two years or three years”.

City analysts this week described the latest profit warning as a “bombshell” and “apocalyptic”. They added that they expected more bad news to emerge from the KPMG review.

Kevin Cammack, analyst at Cenkos, said the appointment of KPMG emphasized the “sheer lack of confidence and controls in anyone and anything” in the UK construction business.

“KMPG’s appointment is basically to re-assure external investors and of course because they no longer have confidence in anyone internally,” he said.

“I’m speechless really and unsure where Balfour Beatty goes from here. A full break-up of the group may be the best may forward … but clearly a lot depends on the new chief executive and market confidence in him.”

Stephen Rawlinson, analyst at Whitman Howard, said that although Carillion was unable to come back for a bid for Balfour Beatty for another six months, due to City regulations, the firm was now ripe for a takeover.

He said: “What might Carillion be thinking now, close shave or another opportunity to have a pop?”

No comments yet