All articles by Michael Hubbard – Page 2

-

Features

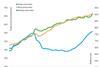

FeaturesMarket forecast Q1 2019: Slowing down

Tender prices are likely to rise at a slower rate over the next couple of years, as output wavers and business confidence stays low

-

Features

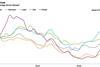

FeaturesMarket forecast Q4 2018: Losing confidence

Tender prices in the year to Q4 kept climbing in the wake of rising building costs, as construction output rebounded in Q3 – but new orders dropped

-

Features

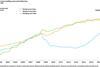

FeaturesMarket forecast: Past the peak

The initial market reaction to the Brexit vote was muted, with output soon recovering strongly, but the trend seems likely to have turned, just as our exit from the EU is imminent. Michael Hubbard of Aecom reports

-

Features

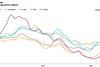

FeaturesMarket forecast: Treading water

The industry is still looking strong, with growth and confidence holding up, but some weaker areas are beginning to show even as supply constraints continue

-

Features

FeaturesMarket forecast: On the slide?

Brexit looms ever larger, with no answers as yet, while output continues a gradual decline and firms struggle to turn rising input cost pressures into higher market selling prices

-

Features

FeaturesMarket forecast: Maintaining margins

Technically the construction industry is in a recession, but many firms continue to report stable activity levels for now

-

Features

FeaturesMarket forecast: Holding steady?

Technically the construction industry is in a recession, but many firms continue to report stable activity levels for now

-

Features

FeaturesCost update Q2 2017

Materials cost inflation continues to rise, although the effects of sterling’s weakness are filtering out slightly and the increase in input costs has slowed.

-

Features

FeaturesMarket forecast: Consistently uncertain

Construction data – both hard and soft – remains consistently inconsistent. Overall construction activity is slowing, but this doesn’t tell the full story

-

Features

FeaturesCost update Q1 2017

Building, electrical and mechanical costs are rising at varying rates along with materials costs as sterling continues to fluctuate but wages have fallen slightly year-on-year

-

Features

FeaturesMarket forecast: Carry on regardless

The UK construction industry maintained notable growth rates and posted high output numbers but uncertainty endures on both the domestic and international stage

-

Features

FeaturesCost update Q4 2016

The fall in the value of sterling has caused building costs and consumer prices to rise, while manufacturing input has taken a hard hit in the last year

-

Features

FeaturesMarket forecast: Still on the up

The trend continues for rising optimism and workload, though materials costs and wage rates are also increasing, while market uncertainty may have some surprises to pull, says Michael Hubbard of Aecom

-

Features

FeaturesMarket forecast: Medium term limbo

Brexit continues to cause uncertainty, with increasingly mixed views about the medium-to-long-term emerging across the market. But as Michael Hubbard of Aecom reports, for now, business is looking good

-

Features

FeaturesCost update Q2 2016

Labour cost inflation continues to be the prime driver for an overall rise in building costs, but increased material costs are also playing their part

-

Features

FeaturesMarket forecast: Not the whole story

As we look at the Q2 figures, people are ready to blame Brexit for plunging the UK construction economy into a darker period. But the reality is more complex. Michael Hubbard of Aecom reports

-

Features

FeaturesCost update Q1 2016

Labour cost inflation remains the primary culprit for a continued rise to building costs, but the rate at which materials costs are growing is still moderate

-

Features

FeaturesMarket forecast: Certain uncertainty

Q1 sees the UK construction industry with a more uncertain outlook but it’s not all down to the EU referendum – there are a number of complex factors at play

-

Features

FeaturesCost update Q4 2015

Labour costs continue to be the primary driver of building cost inflation in last year’s final quarter, with a mixed picture still for building materials

-

Features

FeaturesMarket forecast: Pressure drop

Market conditions remain positive across the country, but boosts to regional activity put the squeeze on local supply chains and tender prices

- Previous Page

- Page1

- Page2

- Page3

- Next Page