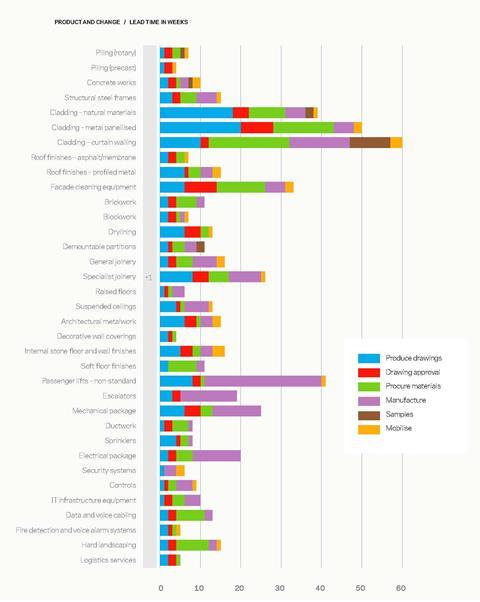

Lead times over the past quarter stayed static for all except one package. However, widespread reports of labour shortages mean firms are starting to predict increases soon

01 / Going up

▲ Specialist joinery

02 / Staying level

▶ Piling (pre-cast)

▶ Rotary piling

▶ Concrete works

▶ Structural steel frames

▶ Cladding – natural materials

▶ Cladding – metal panellised

▶ Cladding – curtain walling systems

▶ Atrium roofs

▶ Roof finishes – asphalt/membrane

▶ Roof finishes – profiled metal

▶ Facade cleaning equipment

▶ Brickwork

▶ Blockwork

▶ Drylining

▶ Demountable partitions

▶ General joinery

▶ Raised floors

▶ Suspended ceilings

▶ Architectural metalwork

▶ Decorative wall coverings

▶ Internal stone floor and wall finishes

▶ Soft floor finishes

▶ Passenger lifts - non-standard

▶ Escalators

▶ Electrical package

▶ Mechanical package

▶ Ductwork

▶ Sprinklers

▶ Security systems

▶ Controls

▶ IT infrastructure equipment

▶ Data and voice cabling

▶ Fire detection and voice alarm systems

▶ Hard landscaping

▶ Logistics services

03 / Lead times summary

Rotary piling ▶ lead times remain at seven weeks with no change reported. Precast piling ▶ lead times remain at four weeks with no change expected as workload and enquiry levels stay steady over the next six months. Concrete works ▶ lead times remain at 10 weeks as enquiry levels stay static. Concerns remain about the impact of Brexit on labour availability, but contractors do not anticipate an effect on lead times in the next six months. Structural steel frames ▶ lead times remain at 15 weeks; with workload and order levels unchanged they are forecast to stay steady for the next six months.

Cladding – natural materials ▶ lead times remain at 39 weeks, with no change forecast. Cladding – metal panellised ▶ lead times remain at 50 weeks with some firms reporting increased workload and enquiries that could lead to longer lead times in the next six months. Cladding – curtain walling systems ▶ lead times stick at 60 weeks; firms are busier, with more enquiries but expect lead times to stay steady in the next six months.

Roof finishes – asphalt/membrane ▶ lead times remain at seven weeks and roof finishes – profiled metal ▶ lead times stay at 15 weeks. With enquiries and workload remaining steady for both, neither expect a change in lead times over the next six months.

Facade cleaning equipment ▶ lead times remain at 33 weeks; contractors continue to be busier with more enquiries than six months ago but anticipate no change in lead times over the next six months. Brickwork ▶ lead times remain at 11 weeks are not expected to rise as workload and enquiries remain consistent, despite reports of a shortage of bricklayers. Blockwork ▶ lead times remain at seven weeks with no increase forecast. Drylining ▶ lead times remain at 13 weeks.

Demountable partitions ▶ lead times remain at 11 weeks with firms reporting consistent workload and enquiry level but a shortage of skilled labour; still, no increase in lead times is forecast. General joinery ▶ lead times remains at 16 weeks; shortages of labour are reported but no change is forecast for lead times in the next six months. Specialist joinery ▲ lead times have risen a further week to 26 weeks following a one-week increase in the past 12 months due to rises in workload and enquiries; further increases are anticipated.

Raised floors lead times remain at six weeks with no changes reported. Suspended ceilings ▶ lead times remain at 13 weeks with no change reported.

Architectural metalwork ▶ lead times remain at 15 weeks, with no change expected in the next six months as workload and enquiries have stabilised. Decorative wall coverings ▶ lead times remain at four weeks; no change is anticipated as workload and enquiries remain consistent. Internal stone floor and wall finishes ▶ lead times remain at 16 weeks; enquiries and workload remain stable and no change in lead times is forecast. Soft floor finishes ▶ lead times remain at 11 weeks. Increases are anticipated over the next six months as labour supply becomes an issue.

Passenger lifts – non-standard ▶ lead times remain at 41 weeks, following an increase of nine weeks in the past nine months. Companies are indicating a possible further increase in the next six months. Escalator ▶ lead times remain at 19 with no changes reported. Electrical package ▶ lead times remain at 20 weeks; there are signs of an increase in workload and enquiries and some companies forecast a rise in lead times over the next six months. Mechanical package ▶ lead times remain at 25 weeks, following increases in the previous six months due to delays in design and manufacture of mechanical equipment. Availability of skilled labour remains a concern. Companies do not anticipate lead times rising in the next six months. Ductwork ▶ lead times remain at eight weeks; with workload and enquiry levels remaining static no change is forecast for the next six months despite companies reporting problems in obtaining quality labour. Sprinklers ▶ lead times remain at eight weeks with no increase forecast.

Security systems ▶ lead times remain at six weeks with no change forecast. Controls ▶ lead times remain at nine weeks and are not expected to change over the coming six months. IT infrastructure equipment ▶ lead times remain at 10 weeks. Data and voice cabling ▶ lead times remain at 13 weeks with no change forecast. Fire detection and voice alarm systems ▶ lead times remain at five weeks; the previously reported slowdown in workload and enquiries continues and firms anticipate lead times reducing accordingly in the next six months. There is a shortage of skilled labour.

Hard landscaping ▶ lead times remain at 15 weeks. Logistics services ▶ lead times remains at five weeks and are not expected to change despite some contractors experiencing increased enquiry levels.

There continues to be very little change in lead times with only specialist joinery reporting a small increase of one week. The forecast is generally for little change, with workload and enquiry levels static. A shortage of quality skilled labour is reported by many companies.

For more details on the article and the contributors please visit www.macegroup.com/people/suppliers.

No comments yet