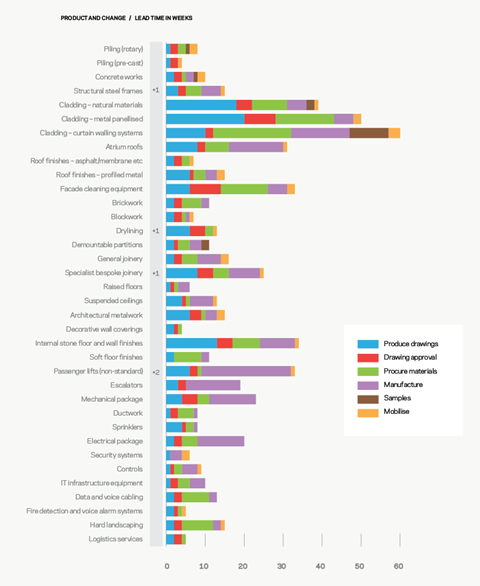

More packages experienced an increase in lead times than in the previous quarter, while a growing number of companies are struggling to find skilled labour as workloads increase

01 / Going up

▲ Structural steel frames

▲ Drylining

▲ Specialist joinery

▲ Passenger lift – non-standard

02 / Staying level

▶ Rotary piling

▶ Piling (pre-cast)

▶ Concrete works

▶ Cladding – natural materials

▶ Cladding – metal panellised

▶ Cladding – curtain walling systems

▶ Atrium roofs

▶ Roof finishes – asphalt/membrane

▶ Roof finishes – profiled metal

▶ Facade cleaning equipment

▶ Brickwork

▶ Blockwork

▶ Metal doors

▶ Demountable partitions

▶ General joinery

▶ Raised floors

▶ Suspended ceilings

▶ Architectural metalwork

▶ Decorative wall coverings

▶ Internal stone floor and wall finishes

▶Soft floor finishes

▶ Escalators

▶ Electrical package

▶ Mechanical package

▶ Ductwork

▶ Sprinklers

▶ Security systems

▶ Controls

▶ IT infrastructure equipment

▶ Data and voice cabling

▶ Fire detection and voice alarm systems

▶ Hard landscaping

▶ Logistics services

03 / Lead times summary

Rotary piling ▶ lead times remain at eight weeks, after a reduction last quarter due to reduced demand. In the next six months, demand is anticipated to generally remain the same. Pre-cast piling ▶ lead times remain at four weeks; workload and enquiry levels over the next six months remain level – no change expected. Concrete works ▶ lead times remain level at 10 weeks, with concerns regarding the impact of Brexit on availability of labour, but contractors do not anticipate this impacting the next six months. Structural steel frames ▲ lead times have increased by one week to 15 weeks following a dip last quarter and are forecast to remain consistent despite a reduction in workload.

Cladding – natural materials ▶ lead times remain at 39 weeks; workload and enquiries have grown but no change is forecast for the remainder of 2018. Cladding – metal panellised ▶ lead times remain at 50 weeks with no change reported. Cladding – curtain walling system lead times have been restated at 60 weeks due to better information, although there is wide fluctuation between forecasts from curtain wall specialists.

Atrium roof ▶ lead times remain at 31 weeks with no changes reported. Roof finishes – asphalt/membrane ▶ lead times remain at seven weeks; contractors do not anticipate changes in the next six months. Roof finish – profiled metal ▶ lead times remain at 15 weeks. Workload and enquiries remain the same and therefore no changes are anticipated.

Facade cleaning equipment ▶ lead times remain at 33 weeks and contractors are still busier with enquiries compared with six months ago but do not anticipate any change over the next six months.

Brickwork ▶ lead times remain at 11 weeks. No changes in lead times are anticipated over the next six months. Blockwork ▶ lead times remain at seven weeks and are not expected to increase over the next six months. Drylining ▲ lead times grew by one week to 13 weeks, with workload and enquiry levels on the increase.

Demountable partitions ▶ lead times remain at 11 weeks, with busier workloads and increased enquiry levels, but no increase is forecast in the next six months. General joinery ▶ lead times remain at 16 weeks with companies continuing to forecast potential increases. Specialist joinery ▲ lead times increased by one week to 25 weeks due to rising workload and enquiries; companies are expressing concerns over the impact of Brexit on availability of labour.

Raised floors ▶ lead times remain at six weeks with no change reported, despite a reduction in workload and enquiry levels. Suspended ceiling ▶ lead times remain at 13 weeks with no change reported.

Architectural metalwork ▶ lead times remain at 15 weeks; companies report being busier, with higher levels of enquiries. Decorative wall covering ▶ lead times remain at four weeks, with no change forecast. Internal stone floor and wall finish ▶ lead times remain at 34 weeks. Enquiry levels and workload are stable with no change forecast. Soft floor finish ▶ lead times remain at 11 weeks; no changes are anticipated.

Passenger lift – non-standard ▲ lead times bounced back to 33 weeks, up two weeks; companies do not anticipate further change. Escalator ▶ lead times remain at 19 with no change reported.

Electrical package ▶ lead times remain at 20 weeks; companies do not forecast a rise in the next six months. Mechanical packages ▶ lead times remain at 23 weeks; availability of skilled labour is an issue but firms do not anticipate change. Ductwork ▶ lead times remain at eight weeks; companies report being busier. Sprinklers ▶ lead times remain at eight weeks, with no increase forecast despite firms turning away work due to lack of skilled labour.

Security systems ▶ lead times remain at six weeks with no changes reported. Controls ▶ lead times remain at nine weeks; enquiries and workload are stable with no changes anticipated in the next six months. IT infrastructure equipment ▶ lead times remain at 10 weeks. Data and voice cabling ▶ lead times remain at 13 weeks with no changes forecast. Fire detection and voice alarm systems ▶ lead times remain at five weeks; companies report a slowdown in workload that is forecast to reduce lead times. Hard landscaping ▶ lead times remain at 15 weeks. Logistics services ▶ lead times remain at five weeks with no change forecast.

Lead times continue to bounce around the highest levels since these records began in 1998. The dip in lead times across three packages last quarter, which potentially signalled a peak, has been replaced by an increase in lead times across four packages – steelwork, drylining, specialist bespoke joinery and non-standard passenger lifts. Many companies report that while enquiry levels and workload remain level, a shortage of skilled labour is becoming an issue, with a number expressing concern about the impact of Brexit on the availability of labour going forward.

Data capture and analysis by Mace Business School. For more details on the article and the contributors please visit www.macegroup.com/people/suppliers.

No comments yet