Global economic volatility, the UK vote for Brexit and currency fluctuations have triggered big movements in the relative construction costs of world cities. Simon Rawlinson and William Waller analyse the results of the 2016 Arcadis annual survey of global construction costs

01 / Summary

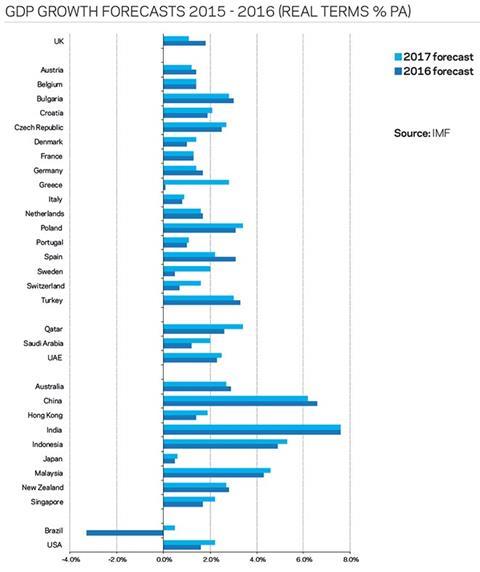

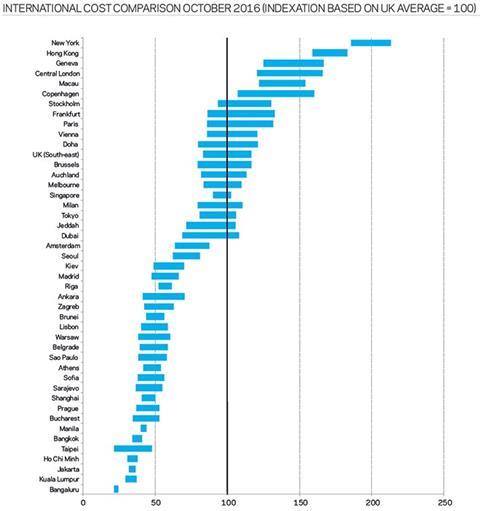

World cities, including London and New York, continue to be some of the most expensive locations in the world to build, but a slowdown in the global economy led by China and the resource economies, such as Brazil and Saudi Arabia, points to wider changes affecting the world’s construction markets. London’s position at the top of the cost rankings has inevitably been affected by changes in exchange rates, but in other markets, such as in Chinese cities, a slowdown in construction inflation is also driving changes in the rankings. The slowdown in construction markets first seen in 2015 has continued over the past 12 months. Rapidly expanding markets such as the US, India and Ireland are the exception rather than the rule and are likely to see significant competition for contractors and construction labour. By contrast, construction inflation has been eliminated from many international construction markets. The slowdown is affecting previously buoyant markets including Hong Kong and Beijing as well as London, where there were signs of a slowdown even before the EU referendum.

The most dramatic downturns have been seen in Brazil and Saudi Arabia, where the effects of low commodity prices and wider political changes have spilled over into levels of investment in construction. Despite this gloom, many locations in Asia and Europe continue to grow modestly and there have only been moderate changes in construction workload – with correspondingly little impact on local prices.

Commodity price deflation continued into the early part of 2016 but since then prices have recovered quite strongly, albeit from a very low base. As the benefits of the deep cuts seen during 2015 rarely made it through to prices charged to clients, the recovery in raw material costs is not likely to be a significant short-term price driver.

However, in markets such as the UK, where further measures were adopted to counter the ‘dumping’ of low-cost imports, suppliers have increased the price of some materials such as structural steel. Following action to correct supply and demand imbalances in many commodity markets, prices can be expected to recover steadily over the next two to three years.

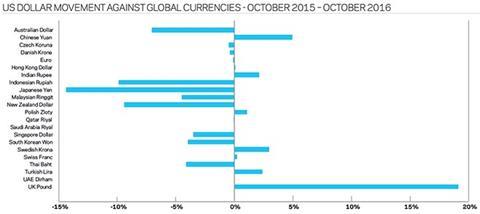

Exchange rate adjustments have continued to be the most significant factor determining relative international construction costs. The currencies of many Asia-Pacific economies, including Japan and Indonesia, have strengthened over the past year, recovering losses against the dollar and euro seen in 2015. The relationship between the dollar and euro remains pretty much unchanged. The big story is the impact of the devaluation of sterling since mid-June, although in global terms the 5% devaluation of the yuan against the dollar over the past year will have a greater impact on costs and trade. The cost differentials shown in this article are based on data on 5 October 2016.

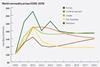

Currency movements have resulted in a significant reduction in the relative cost of construction in the UK compared with other markets. However, even with these large fluctuations, the chart shows that construction in key Asian markets, including Jakarta and Kuala Lumpur, still costs a fraction of equivalent costs in the US and UK when compared on the basis of a straight currency exchange.

In this year’s rankings our assessment is based on typical developments in city locations, illustrating the significant product quality, supply chain and cost differential factors specific to city locations including London, Geneva, New York and Hong Kong. The findings also point to significant cost differentials within the eurozone, with costs in peripheral locations such as Lisbon and Athens still at a 50% discount to average costs in south-east England.

02 / Global trends in commodity prices and currencies

Commodity price trends

There has been a continuation of low or falling commodity prices in the past 12 months, albeit at a slower rate than in the preceding year. While the mining and oil and gas industries are feeling the pain, for construction it has helped keep a lid on inflationary pressure on input costs. A further benefit of low oil prices has been the support it has given to other sectors of the economy, including manufacturing and logistics, which has driven demand for construction-related work.

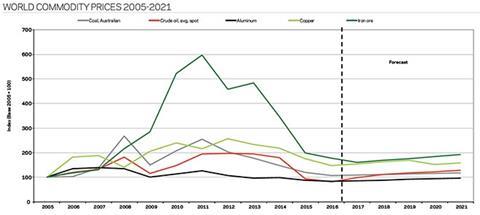

The pace of commodity price movements has decelerated markedly. Copper has been the biggest faller, down 13% over the year. Coal and crude oil have seen more modest falls of 9% and 8% respectively and iron ore and aluminium have been subject to more marginal drops of 6% and 5%. All commodities are trading at levels similar to those following the crash of 2009 and are up from the price trough in January and February 2016.

Most commentators hold the view that prices have levelled off, and there is little indication that prices will fall significantly below 2009 levels.

The oil industry has suffered from dramatic movements in prices in the past 12 months, at one point falling to less than $28 per barrel (bbl) in January 2016 before to recovering to about $50/bbl in October.

The worst downturn seen since the 1990s is the result of a complex geopolitical and economic picture. Oil production has been growing at a strong pace in many major producing countries, with the US, Russia, Saudi Arabia, Iraq and Canada all increasing production in an effort to eliminate weak competitors. There are signs that aggregated production is beginning to drop following a recent agreement by OPEC producers.

In the medium term, the impact of falling exploration investments and instability in key producing countries such as Nigeria, Libya and Venezuela will have a wider impact on global supply. Demand looks to remain static overall, with falls in Europe and developing countries resulting from economic slowdown and greater energy efficiency. However, there are signs of increased demand elsewhere, such as in China and the US.

Like oil, iron ore prices have also seen substantial price falls over the past two years, due to increased supply, predominantly from Australia, and falling demand in key markets such as China. Major iron ore producing countries are suffering as a result of depressed GDP growth and rising unemployment. The significance of iron ore production in the economy of Western Australia is the same, for example, as oil production is in Iran or Kuwait.

According to World Bank forecasts, commodity prices will increase gradually over the next five years. Crude oil is expected to make the biggest recovery, with prices rising to almost $70/bbl, a 130% rise from the low point of early 2016.

Helpfully, $70/bbl will be above the level needed to enable many Gulf oil producers to balance their budgets, enabling a recovery in public spending programmes that have been pared back over the past two years.

Inevitably there is a high degree of uncertainty attached to these forecasts – associated not only with the potential for additional supply or geopolitical disruption but also further fall in demand. Furthermore, as seen following the fall in the value of sterling, the strength of a country’s currency relative to the dollar plays a key role in defining the local cost of commodity-based goods.

Currency trends

The volatility of the currency market has continued over the past year as prominent currencies have recovered against the US dollar. The post-Brexit collapse of the British pound stands out for its speed and scale. The relatively strong performance of the US, including raised expectations for interest rate hikes, has sustained the value of the dollar in 2016, although some Asian currencies have recovered from 2015’s cyclical lows.

In a reversal of last year’s strong performance, sterling has been the world’s worst performing currency, falling by more than 20 % against the dollar. The depreciation of sterling began at the start of 2016 but quickly accelerated after the EU referendum and has since persisted.

Devaluation could be a significant inflationary factor for UK construction as the cost of imported materials is an influence on 20%-30% of the value of many projects. The Chinese yuan and Indian rupee also saw depreciation against the dollar of up to 5%.

For overseas investors, construction in these locations is cheaper. Dollar-denominated investors such as Middle Eastern and Norwegian sovereign wealth funds will be in a strong position in 2017, albeit that returns on existing investments will fall in value. The US dollar looks set to strengthen further given expectations of an interest rate rise and continuing economic growth. The relative resilience of the euro in the past year will continue to be tested as the UK and EU adjust to the emerging post-Brexit future, as well as competing with capital flows responding to the strength of the dollar.

Deteriorating growth prospects in the UK and uncertainty surrounding the Brexit negotiations will maintain pressure on a weak pound and the Chinese yuan can also be expected to depreciate, guided by government intervention. The balance between construction cost growth and the attractiveness for overseas investors is shifting in a range of construction markets around the globe, including the UK, US and Hong Kong. This could lead to a demand/supply imbalance which, in turn, could result in price corrections.

Such a situation could affect inward investment from dynamic countries such as Malaysia, China or India, which in recent years have played an integral role in the growth of city construction markets such as London, New York and Dubai. It could also boost construction demand in those countries as capital flows into the market as a result of economic growth, making it an attractive overseas investment proposition.

03 / Europe

Despite falling energy prices and quantitative easing, the eurozone’s recovery remained weak in 2015 and a combination of political uncertainty and the impact of Brexit could knock future forecasts backwards.

The European Commission forecasts GDP growth of 1.6% in the euro area for 2016 and 2017, driven mostly by accelerating private consumption, low finance costs and reduced pressure on deleveraging as deficits fall to about 2.2% of EU GDP.

However, the commission reports that risks to its forecast are increasing, which are related to slower growth in emerging markets, continuing risks associated with the rebalancing of the Chinese economy, and disruption to markets caused by a rise in US interest rates. A further risk comes from the political scene, where many of the EU’s major markets, including Germany, France, Italy and the Netherlands, will see either a general election or a referendum in the next 12 months. Given the febrile nature of national politics in the EU, it is quite possible that even more instability will be added to the post-Brexit mix.

A rebound in infrastructure investment had been expected in 2016, driven partly by the €350bn Juncker Infrastructure Investment Plan. Analysis carried out in May 2016 suggests €11bn of project funding has been approved so far. However, evidence suggests that Juncker Plan funding is replacing other sources of funding rather than driving new investment and, as a result, may not deliver a significant increase in overall infrastructure spend. Construction markets in Europe grew by 1.5% in 2015, with activity in Central and Eastern Europe growing at the fastest rate. Current forecasts published by Euroconstruct foresee an increase to 2.6% per year, with most growth coming from the largest six markets, including Spain and Poland. Construction investment in the EU last year mostly expanded in non-eurozone members including Poland and the UK. Ireland, Spain and Hungary are all expected to see a rapid rate of growth following a steep decline in activity since the financial crisis. The Irish construction market could grow by 40% over the next three years.

Germany

Germany’s economy is forecast to grow by 1.6% in 2016. Private consumption and public investment have supported growth and export performance has improved as well. Employment is at a record high and the government’s much criticised budget surplus enabled the country to absorb the shock of mass migration from Syria and Iraq without much impact on public spending. However, business investment levels remain weak. In the upcoming year, Germany is expected to continue its growth trajectory supported by wider growth in the eurozone, a robust labour market and increasing domestic demand.The German construction market is forecast to grow by between 1.4% and 1.8% per year over the next two to three years, largely driven by strong activity in the residential sector and investment in transport and energy infrastructure. House prices should remain robust in a low interest rate environment supported by quantitative easing. In addition, the influx of migrants, which resulted in net immigration of more than 1.1 million in 2015, has created huge demand for temporary and low-cost housing. Despite a healthy budget surplus, the infrastructure sector has not experienced much growth ahead of the 2017 national elections. Rail spend on track renewal will increase on the back of a €28bn three-year programme unveiled in 2016, but large-scale spending on Germany’s worn-out road network will rely on the introduction of tolls for non-German drivers. Investment in the energy transmission sector is likely to accelerate to make use of renewable energy resources in the north that currently cannot be used to power the nation’s southern industrial heartlands.

France

Over the past three years, France’s economy has been relatively weak. GDP is expected to grow by 1.3% during 2016. Local factors including terrorism and industrial action appear to have held back growth during the summer, when the economy contracted by 0.4%. Construction continued to contract in 2015, falling by a further 4%, caused largely by a weak housing market. However, there are signs of recovery, including an increase in house sales rates supported by very low interest rates and the impact of the 2014 Pinel Act to encourage investment in rental markets such as housing. The non-residential sector is growing faster than expected too. Infrastructure spending is starting to pick up and could be a reliable driver of growth over the next three to five years. Work on the Grand Paris Orbital rail system has started and the TGV network continues to expand. The privatisation of airports at Lyon, Nice and Toulouse could also trigger future expenditure. Overall, construction in France can be expected to grow by between 1% and 1.5% over the next two to three years.

Poland

Poland’s construction market continues to outperform the wider EU, growing at 3%-4%. Infrastructure investment, supported by a €23bn allocation of funding from the EU, is a major driver of growth.

Poland’s housing market will also expand, supported by government initiatives to promote affordable housing for the 40% of the population who are priced out of the private sector. Completions have increased by 16% during the first half of 2016, but most programmes are at an early stage of development.

Growth has benefited from solid domestic demand and foreign direct investment including big automotive investments by LG and Daimler. However, disputes between the Polish government and the EU on several fronts, including non-renewable energy, could derail some planned investment, risking a repeat of the slowdown of 2013, when EU project funding was delayed.

Spain

Spain continues to see growth from a very low base, which contributed to above-average growth rates of 3% to 5% in 2015. Tourism has been strong and investment in rail aligned with the EU TEN-T network should sustain growth in construction markets at 2%-3% per year over the next three to five years.

However, key market sectors, including housing and renewables, face problems from over-supply and cannot be expected to drive growth in the medium term. Prices remain flat as labour is plentiful and demand for materials stays low.

Netherlands

The pace of economic recovery in the Netherlands has gathered pace over the past year and is currently running at well over 2% – twice the rate of the eurozone. Unemployment has fallen rapidly over the past few years, which combined with low interest rates has given a big boost to the rapidly growing housing market. Overall, even with a flat infrastructure market, construction output is expected to grow by over 4% annually over the next two years. A rapid recovery is proving to be inflationary and prices are currently rising at more than 7% per year.

04 / Americas

Continuing growth in the US has been sustained despite a slowdown in investment in the oil and gas sector and an increase in interest rates. Job creation, low interest rates and GDP growth have supported steady rather than spectacular growth in the US construction sector.

Other countries in the continent are facing different fortunes. Mexico, for example, is benefiting from its increased competitiveness due to low energy and labour costs, while Brazil faces a tough future as the policies of the discredited Workers’ Party are unpicked.

Prospects for investment in resource industries remain poor given continuing conditions of oversupply.

United States

The strength of the US economy helped to underpin global growth as China’s rate of expansion faded in 2015, but the US is now growing at about 1.5% per year. Construction output growth is expected to increase at around 3% per year, driven by the housing market, the recovery of large metro areas such as Los Angeles and Houston, and continuing investment in manufacturing as the pace of “reshoring” (reintroducing domestic manufacturing) accelerates. Housing continues to be a bright sector but build rates remain 30% below the pre-crisis peak, so there should be potential for growth. Infrastructure is talked up as having massive market potential given the $3.6tn renewals programme identified by the American Society of Civil Engineers in 2014. The scale of the problem is underlined by a water scandal in Flint, Michigan, where spending cuts have resulted in the lead contamination of an entire city water supply network. However, the recently concluded $300bn FAST programme for road transport merely represents a continuation of existing levels of federal spend. As more than 80% of US infrastructure is either in private or municipal ownership, funding models other than federal spending will need to be identified. The spread of the PPP model, now supported in 35 states, is probably the only available route to attract infrastructure investment in the foreseeable future.

Mexico

Mexico’s economy continues to grow strongly, but the government is having to make significant budget cuts to compensate for revenue losses associated with state interests in the oil and gas industry. Housing continues to recover following a market crash in 2013 supported by low-cost finance aimed at the delivery of up to 500,000 new homes. Industrial investment is also benefiting from Mexico’s access to the North American Free Trade Agreement trade zone and its low production costs compared with China. However, infrastructure spend is expected to fall in the short to medium term as government implements a new PPP vehicle, FIBRA E, which includes an element of locally raised private capital. The transportation budget, for example, has been cut by 20% during 2016. Looking ahead, large-scale investment in high-speed rail and the $11bn Mexico City Airport should result in Mexico becoming the largest construction market in South America.

Brazil

By contrast, Brazil’s economy remains mired in recession, with GDP forecast to contract by 3.2% this year. Falling commodity prices have played a role in slowing rates of investment, but the impeachment of president Dilma Rousseff is prompting a wholesale review of many public sector programmes in transport and housing. Overall, construction workload is forecast to fall by at least 3.5% during 2016. New fiscal measures introduced by the current president, Michel Temer, aim to return the economy to growth by 2017. It is hoped that these measures will lead to a recovery in demand from the commercial and private residential sectors.

05 / Gulf and Middle East

The steep fall in the oil price since 2014 and the strength of the US dollar continues to have long-term impacts on construction markets in the Gulf Co-operation Council (GCC) countries. Oil-dependent economies, including Saudi Arabia and Kuwait, have trimmed back their public spending programmes and all GCC states have increased their focus on economic diversification. Deficits have grown considerably over the past two years and, despite cuts to spending programmes and subsidies, GCC members including Qatar, Kuwait and the UAE need the price of oil to be $65/bbl to $70/bbl to balance the books.

Saudi Arabia

Saudi Arabia has been driving large long-term investment programmes in transport, energy infrastructure and affordable housing. The ability of the state to fund these programmes and aspects of public spending has been challenged as oil prices fell to below $30/bbl in early 2016. In addition, GDP growth has fallen from 3.5% in 2015 to around 1% this year.

During 2016, public sector wages, benefits and subsidies have all been cut, but this has not been sufficient to sustain investment in the state-funded capital development programme. Not only have new projects been cancelled, but the rate of construction and payment on existing projects has also slowed as liquidity has tightened. Private sector spend has contracted, by about 10%, but it is hoped the long-term nature of the infrastructure spending plan, focused mainly on rail, will keep this programme intact. In the meantime, there remains an annual requirement to deliver 300,000 affordable homes to meet a deficit of 1.65 million units. The proposed introduction of land taxes to encourage the productive development of urban land as housing and the establishment of a state-backed delivery company are expected to accelerate the delivery of a priority housing programme.

Looking forward, Saudi Arabia’s revised Vision 2030 acknowledges the role of infrastructure investment in supporting the development of a diversified economy. The vision also sets out an expanded role for PPP, even though there is no enabling legislation at present.

UAE

Recent developments in the UAE have demonstrated the wider impact of uncertainty associated with falling commodity markets on construction markets. Despite the significant levels of investment needed in connection with Expo 2020 and wider transport inter-connectivity, the development pipeline has taken a hit as a result of greater caution by local investors.

Dubai benefited from strong residential, retail and hospitality markets up to 2014 but this market has cooled and markets have been flat in 2016. Projects are now being initiated ahead of the Expo but these will not be procured until mid-2017 at the earliest, potentially contributing to further weakness in construction inflation in 2016 and early 2017. Transport infrastructure remains a big priority in the UAE even though the existing infrastructure is some of the best in the world. Ambitious plans for rail, metro and airport expansion form the background to programmes worth more than $70bn, which will continue to be developed albeit at a slower rate than planned.

Qatar

Qatar continues to race towards the delivery of the World Cup, and it could be argued that the wider slowdown in the GCC has been beneficial given the scale of the programme to be delivered. Qatar continues to experience positive GDP growth despite the wider fall in energy prices. Despite a recent slowdown in the pace of delivery, infrastructure investment will continue to be a big priority both in connection with the World Cup and the wider 2030 Vision and investments include the world’s largest greenfield port development, 8,500km of roads and a combined $75bn rail and metro programme.

As Qatar proceeds towards the World Cup, it continues to face infrastructure delivery challenges, including the sourcing of labour and materials and local logistics.

The nation’s industry will also soon need to start planning for the slowdown in work that will inevitably follow the peak of World Cup-related expenditure.

06 / Asia–Pacific

The effects of China’s continuing transition away from an investment-driven economy are having a particular impact on Asian markets that have previously seen Chinese inward investment. In some cases real estate markets are suffering from over-supply exacerbated by a slowdown in demand from Chinese tourists and investor occupiers. Whilst economic growth levels in emerging Asian economies such as Malaysia, Indonesia and Philippines are way in excess of the developed world, growth rates in established hubs including Hong Kong and Singapore are similar to those seen in the US and eurozone.

Growth rates in many construction markets have eased significantly over the past 18 months as commercial and residential development rates have peaked. Whereas double-digit growth has been common across the region, expansion at around 5%-7% per year is the best prospect for many construction markets. Looking forward, demand is expected to be tied into large-scale investment in transport and energy infrastructure, much of which will need to be funded by PPP, and affordable housing, which will need central government support.

Given the importance of private funding, the maintenance of investor confidence in the face of potential turbulence from China will be vital for the health of Asian construction markets.

China

China adopted its 13th five-year plan in March, which sets out a shift to innovation-driven growth with a focus on technology, web connectivity and sustainability. China is trying to wean itself off investment-fuelled growth and the rate of construction market expansion is expected to fall to 5%.

The residential market has been a source of real concern but destocking in many cities has helped the market to stabilise – house prices are rising in 60 cities, even though starts were increasing at 10% in 2016. A focus by government on affordable housing suggests growth is likely to be sustained. This segment could drive demand for 6-7 million units per year.

The other element of China’s economic rebalancing is an effort to drive more development in central and western regions of the country. Three vast programmes, including the Beijing-Hebei Axis and One Belt, One Road initiative, which will connect a billion consumers within 60 economies, have huge potential to diversify the economy while sustaining investment.

Despite many examples of over-investment in housing and industrial manufacturing capacity, China still has an infrastructure deficit, particularly affecting rail, power and water utilities. One of the challenges associated with the delivery of this programme is the sustainability of the finance model, including the risk of non-performing loans on existing programmes. Steps are being taken to diversify sources of investment including the identification of opportunities for PPP worth more than $300bn.

Hong Kong

Hong Kong markets are stabilising at peak levels of activity, which have seen projects affected by significant resourcing challenges. Output in 2015 reached yet another record – up by 100% compared with 2010. While big projects such as the Zhuhai Macau bridge link and the Guangzhou-Shenzhen High Speed Rail link are well advanced, new programmes – the third runway at Chek Lap Kok, expansion of the East Kowloon Central Business District and maintenance of a large-scale housing programme totalling 480,000 units over 10 years – are expected to sustain workload at current levels.

Hong Kong’s residential, hospitality and commerce markets depend on mainland demand, which so far has been sustained. The private sector represents around 30% of overall activity, so the health of the construction market is closely linked to wider Chinese markets.

Operating at peak levels spells a problem for Hong Kong authorities related to a shortage of at least 10,000 construction operatives. This shortage has been driving up prices and delaying project completions. Hong Kong has an ageing workforce and the labour force problem is difficult to solve as solutions based on migrant labour are not acceptable to the local population. Initiatives to increase industry productivity are gaining a higher profile in Hong Kong.

Singapore

Singapore’s construction market has seen a continuing correction since 2014 triggered by over-supply and a slowing economy. The residential sector has the highest vacancy levels since 2005 and public housing delivery has also been scaled back down to around 18,000 units compared with 22,000 delivered in 2014. Output in 2015 totalled US$27bn, down by 30% compared with 2014.

This year output is currently forecast to be between US$ 27bn and US$32bn – down on previous forecasts but representing a stable market after a steep correction. Sustained workload in the public sector – particularly in public housing and civil engineering has supported the industry during the correction, and as a result, prices have remained broadly stable. Looking forward, continuing investment in aviation, metro, road and high-speed rail is planned to sustain the local industry and sustain Singapore’s competitive position. Output is forecast to increase by about 2% per year.

Like Hong Kong, Singapore also faces a labour shortage. In an effort to incentivise local contractors to invest in their workforce, the Singapore government has increased the cost of levies charged on the wages of mid-skilled overseas workers.

Malaysia

Malaysia is following a similar pattern of slowing investment as Singapore and Hong Kong. The high-end residential market is saturated and there are few expansion drivers to help accelerate the absorption of excess commercial development. As a result, the forward pipeline for commercial development remains at a cyclical low point. However, Malaysia’s investment target to reach developed nation status by 2020 is sustaining public sector spending focused on public transport and energy generation and transmission.

India

India is one of the world’s fastest growing construction markets and has the best prospects for sustained growth given India’s positive demographics and relatively low level of development. Growth rates of 7% per year place India at the top of the rankings for potential construction market growth. However, there are big barriers that could delay growth, including a distressed PPP sector blighted by stalled projects and the need to attract foreign investment.

India’s development programme is characterised by the scale of delivery required at the local level. Some 60 million houses must be delivered in 300 cities over 15 years, for example, and the roads programme could deliver more than 6,000 km of highway in 2017/18 alone. However, there are signs that the Modi administration is promoting transformational investment too, including a push to increase manufacturing output to 25% of GDP by 2022 and plans for a programme of 100 smart cities characterised by investment in urban mobility and affordable housing as well as smart public infrastructure.

Should India reach its potential, it could be on track to become the third largest construction market within the next 15 years. But for this pace of development to occur, there will need to be profound changes in land markets as well as in PPP finance and the capability and capacity of the construction supply chain.

Australia

Construction markets in Australia continue to be affected by a big overhang caused by the slowdown in commodity markets but there are signs of a recovery in infrastructure and housing markets. Prospects for growth are closely aligned to an ambitious A$184bn PPP transport infrastructure plan focused on motorway construction which relies on user payments and which, as a result is exposed to high levels of political risk. Growth of 1% is forecast for 2016, albeit output fell by nearly 4% in the second quarter and is down 10% in the year. The housing market has been a bright spot with prices rising by about 30% since 2012, driven in part by high levels of overseas investment. Some analysts believe that the peak in the cycle has been reached although output continues to rise at around 4% per year. Looking forward infrastructure is likely to be the brightest sector with road, metro and airport development providing the bulk of the opportunities.

Methodology

The comparative cost assessment is based on a survey of construction costs in 45 locations undertaken by Arcadis, covering 13 building types. Costs are representative of the local specification used to meet market need. The building solutions adopted in each location are broadly similar and as a result, the cost differential reported represents differences in specification as well as the cost of labour and materials – rather than significant differences in building function. Costs in local currencies have been converted into a common currency for the purpose of the comparison, but no account has been taken of purchase power parity. High and low cost factors for each building type have been calculated relative to the UK, where average costs for south-east England = 100, using US dollar as the currency unit. The relative costs plotted in the chart represent the average high and low cost factor for each of the 13 buildings included in the sample. Construction costs are current in Q4 2016. Exchange rates were current on 5 October 2016.

Acknowledgments

We would like to thank our correspondents in 45 locations who contributed cost data and market intelligence.

No comments yet