Economic recovery in the UK and currency fluctuations have triggered big movements in the relative construction cost rankings of cities around the world. Simon Rawlinson and Kevin Nimoh analyse the results of the Arcadis annual survey of global construction costs

01 / Summary

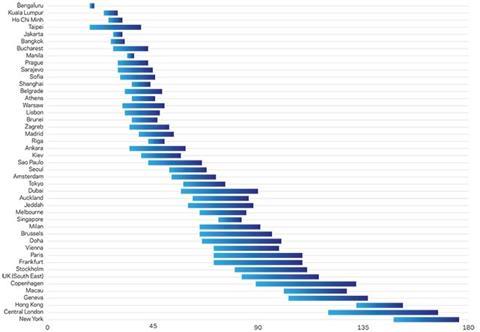

In 2015, Arcadis has recalibrated its international cost data in 2015 to focus on cost differences between major global cities. The results show that New York, London and Hong Kong are among the most expensive locations in the world to build but also represent some of the best development opportunities.

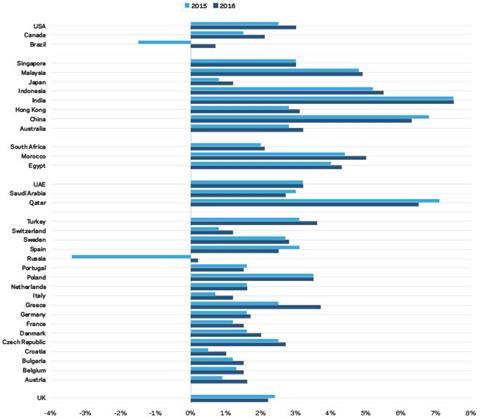

A major theme emerging in 2015 has been how a general slowdown in global construction activity has eliminated construction inflation from most international construction markets. There are relatively few locations that have seen significant price inflation during the year. However, many of the “world cities” in the survey, particularly London and Hong Kong, have seen significant resource constraint and consequential cost inflation over the past 12 months. Other locations in Asia and Europe have seen much less pressure on construction markets. With Asian markets losing some momentum during 2015, and European countries only recovering slowly, we do not anticipate much change during the year. In contrast, London and other world city markets will continue to see significant competition for contractors and construction labour.

In most locations, deflation seen in many commodity markets, and over-supply of key materials such as steel have also helped to keep price inflation in check. The falling oil price is also expected to boost GDP in non-producer countries, which should support broader sources of demand for construction.

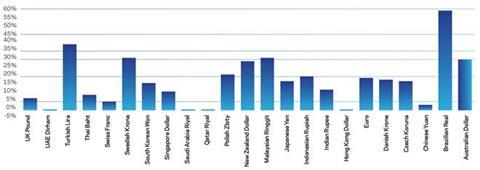

In a continuation of trends seen in 2014, the most significant factor determining relative international construction costs this year have been large exchange rate adjustments that have affected almost all currencies relative to the US dollar and sterling. Contrasting countries including Australia, Malaysia and Sweden have seen currencies fall in value relative to the US dollar by 30% in the past year. Some of these falls intensified after the revaluation of the Chinese renminbi against the US dollar during August 2015. The cost differentials shown in this article are based on data current in late August 2015.

Currency movements have resulted in a reduction in the relative cost of construction in many European and Asian markets compared to the US and UK. The chart on page 48 shows construction in key Asian markets, including Jakarta and Kuala Lumpur, cost a fraction of equivalent costs in the US and UK.

This year’s rankings focused on city locations. The assessment does not include the highest cost levels associated with luxury developments. However, the data confirms the existence of significant product quality, supply chain and cost differential factors that are specific to “world city” locations including London, New York and Hong Kong, as well as long-established high cost locations such as Switzerland.

It also points to big cost differentials within the Eurozone, with costs in peripheral locations, including Lisbon and Athens, now at a 60% discount to average costs in South-east England.

02 / Commodity Price and currency trends

Commodity price trends

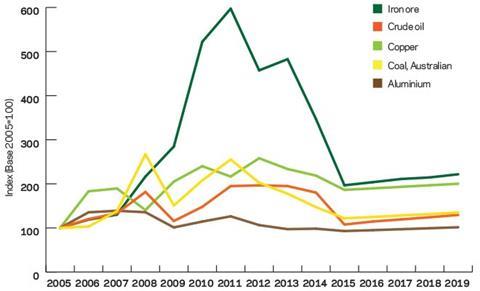

Falling commodity prices over the past year have helped to minimise inflationary pressure in construction markets. Lower energy prices have also supported the manufacturing, leisure and retail sectors – potentially boosting demand for construction in many markets.

The most significant commodity price movements have involved crude oil, iron ore and nickel, with prices down by 40-60% over the year. Copper and aluminium have also seen significant falls of 25% and 15% respectively. Copper is trading at levels not seen since the aftermath of the crash in 2009.

A toxic mix of falling demand, increased supply and high stakes competition between commodity giants explains these price movements. For oil, high production by the Organization of the Petroleum Exporting Countries (OPEC) led by Saudi Arabia is intended to push high cost suppliers in Europe, US and Canada out of the market. The crash in iron ore prices, following a 35% fall last year, is also a direct result of major suppliers in Australia continuing to increase production even as demand in China and the developed world has fallen. Falling commodity prices have had a significant impact on producers in emerging markets – leading to a fall in export income and downward pressure on GDP growth.

According to the World Bank forecasts, commodity prices are expected to remain steady over the next five years with some increase in prices from the lows of 2014/15. Crude oil is expected to make the biggest recovery with prices increasing to $72 per barrel. However, there is inevitably a high degree of uncertainty attached to these forecasts, associated with, among other things, the potential for additional supply, geopolitical disruption or a further fall in demand.

Currency trends

The past year has seen large fluctuations among the major currencies as the US dollar has strengthened. Many emerging market currencies have also engaged in a cycle of competitive devaluation, with interest rates being cut to maintain growth in the face of increasingly tough export markets. The recent devaluation of the Renminbi is the latest example, which triggered further currency movement in Asia.

Over the past year, both the US dollar (see chart on page 45) and sterling have appreciated significantly against other currencies. This has been a further deflationary factor, particularly for UK construction where 20-30% of work by value is imported and for other markets with a dollar peg such as Dubai. However, it does mean that for overseas investors, construction in these locations has become even more expensive when paid for in local currency. Clearly dollar denominated investors will be in a strong position during 2015.

In the coming year it is possible that competitive devaluation will continue, particularly if imports into China from emerging markets fall further. Such a situation could affect inward investment from dynamic countries such as Malaysia or India which in recent years have played an integral role in the growth of world city construction markets such as London, New York and Dubai. In the meantime, anticipation of early interest rate hikes in the US and UK are likely to sustain the strength of sterling and the US dollar.

03 / Europe

Falling energy prices, quantitative easing and a depreciating euro were some of the tailwind factors encouraging the European Commission (EC) to remain optimistic about the Eurozone’s recovery in the latest economic forecasts. The EC forecasts growth of 1.5% in the eurozone, driven mostly by accelerating private consumption. A rebound of investment is expected in 2016, exemplified by the still-to-be-defined “Juncker Infrastructure Investment Plan” proposed by the EC worth up to €350bn. Recent GDP data has confirmed that the engines for the EU’s growth include Germany, Poland, the UK, Ireland, Spain and the Netherlands. Even France, Italy and Austria, previously laggards, are showing some signs of recovery. Expansion in the construction investment in the EU last year mostly took place in non-Eurozone members including Poland and the UK. Across the EU, the construction industry is expected to grow for the next three years to 2017 by a not unreasonable 2.3% a year, with the most buoyant markets expected to be in the UK, Czech Republic and Poland. New build residential and civil engineering sectors will be the main drivers of construction output in the EU.

Germany

In 2014, Germany’s economy grew by 1.6% driven mostly by private consumption and investment. Exports underperformed. Due to continuing expenditure restraint and rising tax revenues, Germany recorded its second consecutive annual budget surplus in 2014. In the upcoming year, Germany is expected to continue its growth trajectory supported by the depreciation of the euro, a robust labour market and growing domestic demand. It is forecasted that the German construction market will grow by 1.95% in 2015, largely driven by strong activity in the residential sector. House prices should remain robust in a low interest rate environment supported by quantative easing. For commercial and industrial buildings, the incentives to invest in more capacity are not as strong. This is partly due to low confidence as well as Germany’s lacklustre export performance. Despite a healthy budget surplus, the infrastructure sector will be deprived of much needed investment until at least the 2017 election, as a balanced budget and reduction in debt-to-GDP ratio remain top political priorities for the ruling coalition. However, the passing of the National Reform Programme (NRP) in April 2015 and the EU’s Connecting Europe Facility (CEF) may provide some support for the infrastructure sector, with €10bn expected to be spent on public infrastructure in the latter programme.

France

Over the past three years, France’s economy has been weak. Forecasts show France’s economic growth is expected to gain momentum during 2015 and 2016 on the back of lower energy prices and higher private consumption, with GDP forecasted to reach 1.1% in 2015 and 1.7% in 2016. Growth will be accompanied by efforts to cut a 4% budget balance, so public spending is unlikely to increase by much. Construction suffered a deep contraction in 2014 of over 4% on the back of a particularly steep fall in residential construction that is expected to continue into 2015. Housing demand has fallen in response to high levels of uncertainty and unemployment. Elections in 2014 also delayed public-sector project approvals. Infrastructure spending has fallen, particularly due to the need to cut the deficit, although work has continued on rail projects, including High Speed Rail links in the west and the Grand Paris Metro programme. The commercial market has been stronger, focused on major cities such as Paris and Marseille. Construction investment is projected to contract further in 2015 before picking up in 2016, supported in part by the Investment Plan for Europe.

Poland

Poland is the fastest growing economy in Europe, outstripping the UK at 3.4%. Growth benefits from solid domestic demand, strong investment activity and improved labour market conditions. Growth is forecast to continue at the same rate in 2015, despite external headwinds such as the Russia-Ukraine conflict which has had a significant impact on some sanction-hit export markets. The Polish construction market grew by 4.7% in 2014 and is expected to grow by 3.9% in 2015, a brisk recovery after the correction in 2013 which resulted from a slowdown in EU funding. A new wave of EU funding, the housing market revival supported by low interest rates and the government’s “Apartments for Youth” scheme are all positive growth factors.

Spain

Spain is seeing growth from a very low base and is expected to expand by nearly 3% in 2015. Factors influencing this recovery in growth and domestic demand include a limited return to job creation, particularly in hospitality, growing business confidence and lower energy prices. It is predicted this growth pattern will continue in 2016 mainly driven again by domestic demand. Such economic growth is influencing the construction market which is expected to see a modest upswing in hospitality and residential investment aimed at the tourist market. However, public investment is only expected to contribute modestly to total investment in construction. Prices remain flat as labour is plentiful and demand for materials remains low.

Italy

The economy is expected to return to modest growth in 2015. The recovery will strengthen in 2016, with government deficit set to fall to 2.6% of GDP, creating headroom for increased expenditure. In 2015, construction investment is set to continue contracting, albeit at a reduced pace. The residential and infrastructure industries remain subdued.

Netherlands

The Netherlands grew by 0.9% in 2014, boosted by construction investment and strength in consumption. Over the course of 2014, the housing market improved providing a significant contribution to the economy. In the short term, investment in construction is expected to maintain much of the momentum in 2014 and grow about 4% annually in 2015 and 2016.

04 / Americas

The broadening economic recovery in the US has helped cushion the construction industry from a loss of momentum in previously fast-growing markets such as housebuilding. Demand for office space in cities is translating into substantial commercial activity. Markets in Canada and Brazil are more vulnerable to an investment fall-off but, as yet, volumes of work remain high.

Canada

Canada’s post-crash winning streak looks to be coming to an end. GDP growth in 2015 is forecast to be 1.5%, the weakest performance seen since 2009. Oil and gas investment has started to fall, but with committed, long-term construction investment on big pipeline projects, spend cannot be turned off quickly. However, with large scale investments such as a $5bn rail investment for coal cancelled, the fall in commodity prices can be seen to be having a direct impact on the construction pipeline – dampening prospects for years to come. Canada’s housing market is also slowing, albeit that output will grow by 5% in the current year. High real estate prices, the prospect of higher interest rates and a weak jobs market have taken the gloss off what has been one of the western world’s strongest residential markets.

USA

The strength of the US economy has helped to underpin global growth as China’s rate of expansion fades. Activity in Q1 2015 was weak but the economy came back strongly in Q2 at an annualised rate of 3.7%. Construction output growth eased during 2014 and 2015 as rebounding sectors such as housing began to return to normal, after growing by over 12% in 2013. In total the US construction industry is now worth $650bn per annum but is expected to grow by no more than 1% per annum over the next two-to-three years. The strongest private sector is housing, where starts are at their highest level since October 2007. However, growth in the industrial sector is being held back by the strong dollar – creating headwinds in a sector which was previously boosted by low energy costs and re-shoring of manufacturing capacity. Public spending on infrastructure is set to grow by 2-3% in 2015 and beyond, barely making a dent in the $3.6tn programme identified by the American Society of Civil Engineers in 2014. Federal spending, in particular, is unlikely to change prior to the 2016 elections due to gridlock in Congress. However, some states are introducing sources of revenue to fund local investment – including fuel taxes or new sources of borrowing.

Brazil

Brazil’s economy has entered recession, with GDP forecast to contract by 1.7% this year. Falling commodity prices for key products such as coffee and reduced demand from China have really hit revenues, whilst interest rates have been hiked to nearly 14% to combat high inflation – currently running at 8.7%. If these headwinds weren’t enough, then the Petrobras scandal, which has implicated a number of Brazil’s largest contracting firms, has led to a further seizure in construction markets – with many contractors suspended from public-sector tender lists and unable to obtain finance to take projects forward. Overall, workload is forecast to fall by at least 4% during 2015 and will continue to contract in 2016. Private investment will be discouraged by punitive interest rates so public programmes will have a key role in sustaining the industry, including the Minha Casa, Minha Vida affordable housing programme. Despite the slowdown in construction markets, skilled labour resources remain constrained and inflation remains a problem in Brazilian markets.

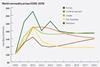

US dollar movement against global currencies - August 2014 to August 2015

International cost comparison August 2015 (indexation based on UK average = 100)

05 / Gulf and Middle East

The fall in the oil price over the past 10 months and the strength of the US dollar will have long term impacts on construction markets in the Gulf Cooperation Council (GCC) countries – as national budgets come under greater scrutiny and assets in markets such as Dubai become more expensive. Political unrest has also been a negative factor. All GCC states have raised public expenditure over the past three-to-four years in order to accelerate economic diversification and reduce levels of inequality but with the collapse in the price of crude during 2014/2015, constraints on spending will grow. Qatar, Kuwait and the UAE, for example, need the oil price to be about $70 per barrel to balance the books, so deficits will grow quickly. This is not an immediate problem – national debt is low and countries such as Saudi Arabia have plenty of assets that can be sold to fund long-term investment. However, the GCC region is not immune to wider shocks in the global economy. Dubai, for example, receives a lot of investment from other oil economies such as Russia and Iran – which will also have been affected by the price crash. A strong dollar also makes tourism and property investment expensive for key Asian markets.

Saudi Arabia

Saudi Arabia is in the midst of large, long-term investment programmes in transport, energy infrastructure and affordable housing. Its construction market, currently worth $45bn per annum is forecast to continue to grow at about 10% over the next three-to-four years. The value of project awards made in early 2015 did not fall when compared to pre-price crash levels. Massive transport programmes including Metros in Riyadh and Jeddah underpin long-term expenditure programmes, whilst a deficit of 1.35 million affordable homes means that the housing construction market also has strong foundations. The accession of King Salman in early 2015 could have been expected to have caused some delay in decision-making in connection with public sector investment. However, the signs so far are that the new regime is having a positive impact on construction markets – particularly in connection with the affordable housing programme, where land supply has been a major constraint. Overall expenditure is expected to remain at elevated levels although long-term programmes associated with sustainability and economic diversification are likely to be delayed.

UAE

Development in the United Arab Emirates shows that even where oil is not a major part of the economy, as in Dubai, the uncertainty associated with falling commodity markets can take the gloss off an otherwise strong construction market. Investor caution is currently the greatest risk to markets that are reliant on global demand for real estate, tourism and trade, so the current focus of investors is on projects which deliver near term revenue. Dubai has benefitted from strong residential, retail and hospitality markets over the past two years and is set to see a further increase in workload in these sectors including refurbishment and infrastructure associated with aviation and the forthcoming Dubai Expo. However, there are signs that private sector activity might be slowing a little. House price and rental inflation has fallen – signs that measures introduced to cool the housing market – including higher sales taxes and limits on borrowing are having an effect. Transport infrastructure remains a big priority in the UAE even though the existing infrastructure is some of the best in the world. Plans for rail, metro and airport expansion form the background to programmes worth over $70bn.

Qatar

Qatar continues to race towards the delivery of the World Cup, with other programmes in some cases being put on hold to prevent bottlenecks in logistics or materials availability. Progress in the completion of primary infrastructure for major developments such as Lusail City also means that private developers will shortly be in a position to ramp-up their own development programmes. Infrastructure investment will continue to be a big priority both in connection with the World Cup and the wider 2030 Vision. Recent budget commitments for 2015/16 have seen investment increase year-on-year. One of Qatar’s greatest challenges is access to bulk raw materials; demand for Gabbro aggregate, for example, is forecast to peak at 60 to 80 million tonnes per annum over the next few years. To manage availability risks, the Qatari government has set up its own materials-sourcing capability to ensure supplies for key investments such as the Ashghal Social Infrastructure programme.

06 / Asia

The effects of China’s transition away from an investment-driven economy are felt globally but are set to have a particular impact in the wider Asian markets which have prospered not only from booming export markets, but also from substantial inward investment from China-funded businesses. While most Asian economies continue to see levels of growth that are the envy of other developed economies, there are a growing range of factors which are holding back built asset investment, including measures taken to cool residential markets in many of countries that have boomed in the past two-to-three years. Falling exchange rates have also increased the costs of servicing dollar denominated debts and PPP charges.

Growth rates in many construction markets have eased significantly over the past 18 months as commercial and residential development rates have peaked. Looking forward, maintenance of investor confidence in the private sector in the face of potential turbulence from China will be vital for the health of Asian construction markets. However, given significant investment backlogs linked with infrastructure and affordable housing in many countries, construction markets are likely to be less exposed than other parts of these economies.

China

China is moving towards a safer, more sustainable pattern of economic growth, but as recent events have shown, an orderly transition cannot be assured. GDP growth is forecast at 6.9% for 2015, its lowest level in 25 years. Some of the biggest reforms needed to change the direction of the Chinese economy have implications for construction and property, including land reform, off-budget financing by local government and the liberalisation of state-owned enterprises, which include many of China’s largest contractors.

Construction has been a huge driver of the economy over the past 25 years but there are signs of a structural shift that is likely to result in slower, more sustainable rates of growth. Overall, construction can be expected to grow by 4 to 5% going forward. Property underpins about 25% of GDP, and there are plenty of signs of oversupply, particularly in third and fourth-tier cities where residential inventory levels are equivalent to two-to-three years’ take-up. Greater emphasis in the future on affordable housing and some support to mortgages for the second homes market will help to accelerate absorption.

While there is a glut of housing in many locations, China still has an infrastructure deficit, particularly affecting rail, power and water utilities. In addition to a huge high-speed programme, China is delivering light rail and metro projects on a vast scale as well as nuclear and renewable programmes which dwarf anything seen in other construction markets. As part of wider reforms, private investment is being attracted into infrastructure projects and over 1,400 opportunities were announced in 2015, worth in total over $300bn. While the shift to a private finance model is likely to take a while to become established, it is further evidence of the steps being taken to diversify finance and demand.

Hong Kong

Hong Kong has seen buoyant market conditions as a result of strong growth in both the private and public sectors. Output in 2014 reached record highs. High levels of public sector investment into the metro and high-speed rail, for example, have had the effect of creating a labour resource constraint in Hong Kong – totalling 10,000 people. Not only are labour shortages inflationary, but they are also resulting in project delays. Despite worries about overheating, the Hong Kong residential market has remained in balance, with sales prices and rentals increasing during 2014 – pointing to the success of earlier measures taken to deflate housing bubbles through land release and increased transaction taxes. The office market is also in good health with high levels of demand and rising rents coinciding with a healthy development pipeline which should keep contractors busy through to 2017/18.

Looking forward, Hong Kong’s challenges are constraints associated with an ageing, shrinking workforce, where 30% are aged over 55, and risks associated with a slowdown in mainland China. Hong Kong residential, hospitality and commerce markets are highly dependent on demand from the mainland and further uncertainty could undermine confidence in the development industry.

Singapore

Singapore’s construction market has enjoyed a strong recovery since 2010 so a recent slowdown in residential and commercial markets represents quite a correction. In the private sector, both the residential and industrial sectors are weak in 2015 and the office market is also suffering from oversupply. While output in 2014 totalled US$28bn, this year output is currently forecast to range from US$21bn to US$25bn – quite a drop. Sustained workload in the public sector – particularly in public housing and civil engineering – has supported the industry during the correction, and as a result, prices have remained broadly stable. Looking ahead, continuing investment in road and rail can be anticipated as these aspects of infrastructure have not received much investment in recent years.

Malaysia

Malaysia is seeing a similar pattern of expenditure, with a slowdown in commercial markets resulting from an oversupply of office and residential development and a recent weakness in the market for Chinese buyers. As such, the forward pipeline for commercial development is at its weakest for several years. However, Malaysia’s investment plan target to reach developed nation status by 2020 is sustaining public sector spend despite the impact of falls in oil prices and other commodities.

GDP growth forecasts 2015 - 2016 (real terms % PA)

Details of the survey

The comparative cost assessment is based on a survey of construction costs in 45 locations undertaken by Arcadis, covering 13 building types. Costs are representative of the local specification used to meet market need. The building solutions adopted in each location are broadly similar and, as a result, the cost differential reported represents differences in specification as well as the cost of labour and materials rather than significant differences in building function. Costs in local currencies have been converted into a common currency for the purpose of the comparison but no account has been taken of purchase power parity. High and low cost factors for each building type have been calculated relative to the UK, where average costs for South-east England = 100, using US Dollar as the currency unit. The relative costs plotted in the chart represent the average high and low cost factor for each of the 13 buildings included in the sample. Construction Costs are current in Q2 2015. Exchange rates were current on 26 August 2015.

Acknowledgments

We would like to thank Constance Lau of Arcadis in Hong Kong and Mark Williams of Arcadis in London for their assistance in the production of this article, as well as our correspondents in 45 locations who contributed cost data and market intelligence.

No comments yet