Structural steelwork accounts for about 70% of multi-storey building frames built in the UK. Steel Insight will appear quarterly to provide a source of reliable information for users of this key material

Introduction

For most projects, the decision on the frame material and form happens early in the design process, often on the basis of early design principles, limited information and budget costings.

Once selected, the frame material is unlikely to change, as doing so can have significant programme implications, such as consequential impact on the design of other major elements, including cladding and M&E installations.

While for most developments the decision on frame type will not be based on cost alone, it is nevertheless a key consideration in the decision making process and it is vital to support informed decision making with realistic cost information at this early stage, before refining during the detailed design stages.

This is a challenging task as the cost of structural steel has been historically volatile and reconciling material price information with returned tender prices is not always straightforward. Steel frame costs are also heavily affected by project-specific key cost drivers, such as programme, access, spans and building form, making accurate adjustment of recently tendered rates or cost models difficult.

For those with limited previous experience of steel-framed construction, the unique characteristics of the sector may not be immediately apparent. Anecdotal stories point to design decisions being made on the basis of non- or poorly-adjusted historic steel rates, suggesting that the complexities of the industry and the significance of key cost drivers are not necessarily widely understood.

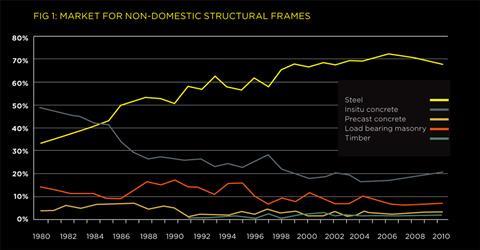

On average across the last 10 years, steel frames have accounted for 70% of all non-domestic framed multi-storey UK construction (see figure 1) and in 2010 structural steel had a 68% market share of the education sector, 55% of the health sector and 65% of the retail sector.

These statistics and a review of recent industry trends highlights the importance of maintaining current, market tested cost advice for structural steelwork.

Through a consideration of a number of key factors and consultation with the market and supply chain, budget structural steelwork estimating can be quickly and successfully tailored to specific projects.

The importance of realistic steel pricing

As the selection of frame material is a key design decision and impacts on so many related building elements - foundations, finishes, wall-to-floor ratio and cladding, to name but a few - once the decision has been made and design has progressed it is disruptive and generally abortive to make fundamental changes to the frame type or form. To do so would involve going back over design stages already completed and would involve most of the design disciplines. Where there is a programme to be maintained, this is almost impossible to achieve. Therefore, although the period of time to identify and select the best value frame is not a long one, it should not be rushed.

By its very nature therefore, the decision is commonly based on outline design proposals, with a limited amount of information available to the cost consultant.

Where the initial budget estimates of steel frame costs are not realistic, the wrong frame solution can be selected at a higher cost of not only the frame but potentially also the related building elements.

It can also have an effect on buildability, logistics and the construction programme, as the frame construction is a critical path activity.

Getting it wrong can result in higher frame costs, higher costs of associated elements, longer programme and abortive design work.

While it is clear that it is important to maximise the accuracy of early estimates of frame costs, there are a number of difficulties facing cost consultants trying to do so.

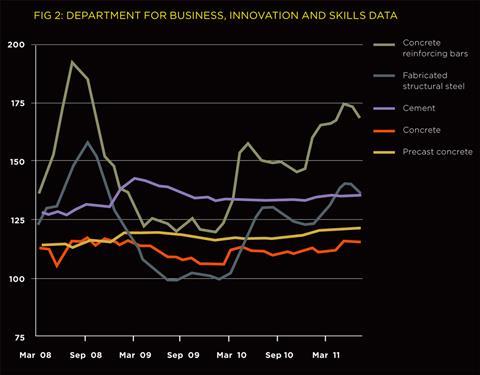

As figure 2 shows, there has been significant historic volatility in structural steelwork material prices. This makes cost models, benchmarks and previous project data difficult to adjust accurately and the use of indices not as useful a tool as for some other materials.

Similarly, the cost of structural steelwork can vary significantly between projects, which at first glance appear broadly similar. Project specific factors must be considered in order to produce a project specific cost.

It has also been historically difficult to get valuable input from the marketplace during the early design stages, reducing the extent to which current market conditions can be assessed.

Recent output trends

Trends in price can often be better understood when considered alongside trends in output and supply and this is no different for structural steelwork.

Along with the whole of the construction industry, the economic recession has had a significant impact on the UK steel industry.

As steel is required early in the construction process, the effects of the recession were felt in the steel sector quickly after the crisis hit.

A significant and sharp fall in output of almost 32% occurred between 2008 and 2009, with a continuing decline but at a much lower rate during 2010.

The British Constructional Steelwork Association (BCSA) forecasts that output will have remained fairly constant across 2011, with early forecasts suggesting a total of around 940,000 tonnes; this is, however, still some 30% less than the peak of activity in 2008.

Forecasts for 2012 and 2013 are more optimistic and the BCSA forecasts increases of 4% throughout 2012 and 5% throughout 2013, which if realised would see output recovering to over 1 million tonnes per annum by the end of 2013.

Recent cost trends

Figure 2 plots the Department for Business, Innovation and Skills (BIS) material price indices for fabricated structural steelwork, concrete reinforcing bar, cement, concrete and precast concrete since March 2008, when the index was re-based. It illustrates the volatility in both structural steel and steel reinforcement material prices over the last three-and-a-half years.

Early 2008 saw steep rises in the price of fabricated structural steelwork and reinforcing bars as the level of activity and demand for steel products reached its peak.

This was followed by sharp and significant reductions in steel prices in the second half of 2008 into 2009. As the market struggled to adapt to the reduction in demand, there was a period of overcapacity and oversupply in the market, driving prices down.

Throughout 2009 the price of fabricated steelwork continued to fall before stabilising at a low point towards the end of the year, as suppliers benefited from falling commodity prices and lower labour costs, and implemented smaller margins to secure the reduced quantity of work.

In line with the 32% fall in output across 2008 and 2009, rates for fabricated steelwork had also fallen by almost 35% by early 2010.

However, 2010 saw changes in the market for fabricated steelwork. While the output of the industry may have continued to fall, rising commodity prices and price rises introduced by suppliers, such as the £50/tn rise in March 2010, put pressure on the industry and resulted in some recovery in material prices.

The first half of 2011 saw further increases in steel material prices, with concrete reinforcing bar prices increasing by 8% between January and June. However, the most recent data from June and July 2011 shows a slight decline in material prices, as the initial optimism in early signs of economic recovery from the start of the year have largely failed to materialise.

The BIS data clearly shows volatility in structural steel material prices over the last three years and periods of increase over the last 18 months. However, an analysis of returned tender prices for steel-framed buildings over the same period shows that after an initial fall in tender rates for structural steel in 2008 and 2009, the subsequent increases in material prices have been absorbed by the supply chain in the face of continuing weak demand in the construction sector and as part of tender pricing strategies.

However, the forecast increases in structural steelwork output over 2012 and 2013 and continued material price rises must be monitored carefully as they do suggest that an increase in structural steelwork tender prices could be seen across 2012, especially in locations where recovery will be seen first.

The volatility of material price indices compared with the current relative stability of returned tender prices also highlights the danger of relying on material price trends to adjust historic data to produce accurate forecasts for future developments.

While a conclusion that could be drawn from this unpredictability is that it is almost impossible for the cost consultant to price structural steelwork realistically, relying on their usual cost databases. What it should do is encourage those doing the costing to speak to the supply chain to get a picture of current trends from those working with and buying steel on a day-to-day basis.

Making the most of available information

At the early design stages of any project, cost models, benchmarks and historic cost data are key tools used by cost consultants in the estimating of all building elements.

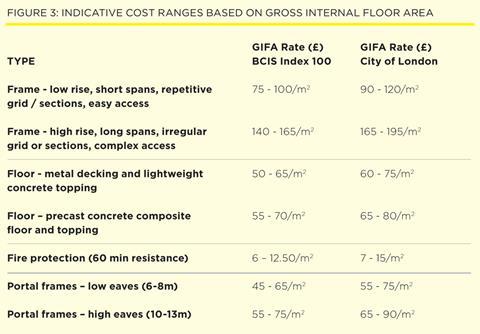

At this stage elemental costs, including those of the structural frame, will usually be expressed as a rate per m2 based on the Gross Internal Floor Area (GIFA).

Typical cost ranges for different frame types can be developed through cost models - and there are some indicative ranges given as part of this article - but how should you pitch the rate for any given project?

Rather than arbitrarily using the highest rate of a range, it is key to interrogate and understand what those rates buy and how the standard ranges can be adapted to suit project-specific factors.

To do this most accurately, the cost consultant needs to ask relevant questions of the design team and to speak to the supply chain to use this information effectively. This will build a picture of the current and short-term future market, rather than relying on indices to adjust benchmark or historic rates.

Key cost drivers

A number of factors can be considered to have a key impact on the price of structural steel frames.

1. Function, sector and building height

Different building functions across different sectors have varying typical frame costs due to different usages of the created floor space.

The usage of the building will influence the design loadings considered by the structural engineer and the building function will also result in different requirements for clear spans and floor-to-floor heights. This means that the average weight of the steel frame will vary between building types. For example, a low eaves industrial “shed” building could have a frame weight of 40kg/m2 GIFA, while a city centre office with a long spanning grid to avoid a forest of columns, could have a weight of 90kg/m2 GIFA.

Fewer columns will lead to longer spanning beams and heavier steel sections, which can increase the overall weight of the frame and therefore the cost range for the building.

Clearly, these factors need to be considered when determining the rate for the structural frame for early estimates. Confirmation of the design assumptions and principles with the structural engineer is essential to clarify this.

It is also important to remember that the rate per m2 is based on gross internal floor area, which will not account for variances in floor-to-floor heights.

If, for a specific project, these are outside the normal range utilised in cost models, a higher or lower rate should be considered to tailor indicative rates to the project.

2. Form, site conditions and complexity

The complexity of the structure is closely related to building form and function, as well as specific site conditions.

The building form will have an impact on the regularity of the structural grid and the need to introduce non-standard sections, a wide range of different sections and connections in order to achieve structural stability.

Complex structural solutions, such as transfer structures and made-up beams may also need to be introduced to overcome project-specific features or restrictions such as retained facades, adjacency of other buildings, ground conditions and so on.

The inclusion of non-standard sections will also increase the overall frame rate as fabrication costs are higher and complex connection details may also impact on installation costs, tolerances and interfaces.

3. Location, logistics and access

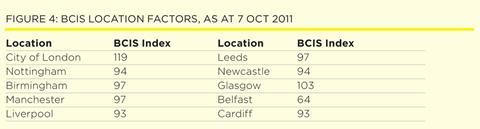

The location of a project is a key factor in price determination and indices are available to enable the adjustment of cost data across different regions.

BCIS indices currently show the City of London at 119, Manchester at 97, Cardiff at 93, Glasgow at 103 and Belfast at 64 (figure 4); these variances highlight the existence of different market conditions in different regions, which must not be overlooked.

Not only is the geographic location of the site an important consideration, site-specific features also need to be reviewed.

While the designed frame solution of two buildings may be very similar, the logistics and access arrangements will vary significantly between a congested city centre site and an easily accessible, isolated business park or industrial estate site, or even between alternative city centre sites.

Working in city centre or occupied areas can mean restrictions to working hours, noise, deliveries and craneage, all of which influence installation costs and can result in an extended on-site programme.

As the frame construction is generally a critical path activity, any increase to the construction programme will have an associated impact on project cost.

4. Programme, risk and procurement route

The rates given in this article can be considered suitable for the cost planning of projects where the structural works would commence in the final quarter of 2011 or the first quarter of 2012.

Beyond this timeframe, accurate forecasts of steel frame costs are difficult due to the uncertainty of general economic conditions and the historic volatility of material prices experienced in the UK steel industry.

One feature of the economic recession has been an increase in the relative prevalence of single-stage procurement routes, particularly design and build, compared with the previously dominant two-stage approach.

This has aligned main contractor selection and price establishment more closely and has increased the emphasis on “market pricing strategy” where, while risks may be identified, they may not be priced in to tender returns as cost has been further strengthened as the major determinant of contractor selection.

There were initial signs of improvement in the financial services sector in early 2011 and optimism that the commercial sector may begin to see returned demand. These have so far largely failed to materialise and the economic outlook remains changeable.

Even with forecasts of material prices continuing to rise over 2011 and 2012, the relatively low position of demand in relation to capacity in the structural steelwork industry - and continued intense competition in the construction industry generally - means that contractor pricing strategies will remain an important feature in securing work. This is expected to act as a downward pressure on prices.

Gardiner & Theobald’s final quarter 2011 Tender Price Indices forecast an overall decline in UK average tender prices across 2011, with a 0.5% rise forecast across 2012 and 2% rise across 2013, adjusted down from earlier forecasts.

Current costs

This article seeks to give some current indicative cost ranges for structural steel frames for three key building types:

1. Low rise and short span buildings, typically two to four storeys

2. High rise and longer span buildings, typically 10-15 storeys plus basement

3. Industrial buildings, split into low eaves of 6-8m and high eaves of 10-13m

All of the costs include allowances for a concrete core. The rates have been developed from cost models of the different building types and for each the average weight of the structural frame has been given.

As already highlighted, before using such “standard ranges” it is important to confirm the anticipated frame weight and variables such as the floor-to-floor heights with the design team, to determine whether they are above or below the average and to adjust the rate used accordingly.

Similarly, all of the other key cost drivers of complexity, site conditions, location, function, logistics, programme and procurement strategy should be considered in turn.

1. Low rise and short span buildings

Low rise buildings with a regular, short span structural grid are typical features of business park offices and teaching facilities.

A key feature of these buildings is flexibility, particularly for speculative business park developments that need to appeal to as many potential occupiers as possible.

The buildings often need to be easily subdivided into smaller units and have large floorplates. Typically they are two to four storeys, with floor-to-floor heights of 3.75-4m.

They will typically have a uniform grid of 6-9m that provides largely column-free space and relatively high floor-to-floor heights.

The lack of complex steel structures needed to construct the regular grid contributes to keeping the average steel frame weight down (typically 50-60kg/m2 including fittings) but this category can cover a lot of building types and functions. This central assumption therefore needs to be reviewed with the design team.

Due to the low rise nature of these buildings, the fire protection requirements are not as onerous as for high rise developments and 30-60 minute fire protection would be considered standard.

2. High rise and longer span buildings

High rise construction (10-15 storeys) is a typical feature of city centre construction. These buildings will often require longer structural grid spans to achieve more open space in the lettable floor areas, increasing the weight of the steel frame.

To maximise floor-to-ceiling heights, and increase flexibility for the building fit-out, cellular beams may be adopted with openings through the web for the distribution of services.

City centre buildings are generally constructed on existing confined or irregular sites, which influence the building form. This is likely to prevent the use of a regular column grid and may result in alterations to floor plates on the upper storeys.

In mixed-use schemes, transfer structures may reduce the wider grids of office or retail areas at lower levels to a more rationalised residential grid on upper floors.

All of these factors contribute to a higher average weight of the steel frame, typically 65-85kg/m2 including fittings and, along with the increased complexity, result in significantly higher structural frame ranges than for the simpler, more regular low rise buildings.

The rate range given in figure 3 is generally applicable for buildings up to about 15 storeys; tall buildings above 15 storeys start to have fewer comparables in terms of benchmarks and are likely to have a much higher proportion of complex elements, non-standard sections and complicated logistics, especially when constructed on tight city centre sites. The rate range for tall buildings can be 15-20% higher than the top of the standard range.

3. Industrial buildings

Industrial buildings can cover a range of uses, including warehouses, non-food retail, science parks and distribution centres.

The most common building form is a single storey warehouse with varying proportions of office space on a first floor mezzanine level.

The traditional structural frame for an industrial building is a steel portal frame, as flexibility of the internal space is a priority, necessitating regular column spacings and long spans for a clear internal area.

There can be variants on the standard frame design, however. For example, a steel portal frame incorporating northlights would need consideration when adjusting the standard cost ranges. The use of a northlight frame can increase the frame cost by as much as 30%.

Fire protection requirements must also be considered as part of industrial building frame costs. Commonly, fire protection is only required in single storey buildings to satisfy boundary conditions and this is a project-specific factor that will need some liaison with the design team.

Another key factor in determining the frame cost of industrial buildings is the storey height of the warehouse space. While the gross internal floor area may be the same, the weight of the steel frame of a high eaves, single storey industrial building will be higher than for a low eaves building, resulting in a higher overall frame cost per m2 GIFA.

Typical structural steel frame weights for low eaves buildings (6-8m high) are about 30-40kg/m2 overall of GIFA, including fittings, and about 40-50kg/m2 for high eaves buildings (10-13m high). However, ranges for high eaves buildings are generally wider than for low eaves buildings as they can have a much higher proportion of upper floor areas, across as many as three mezzanine levels; the frame rates for these buildings therefore need to be looked at carefully on an individual basis.

The cost table

The cost table included as figure 3 summarises the structural frame costs of the three building types and also provides some indicative cost information on floor types and fire protection.

While precast concrete products have not seen the material price volatility experienced by structural steel during the economic recession, it is worth noting that the sector has experienced change. Fewer firms are now involved in the supply of precast units, so timing of particular projects can have a significant impact on the rate. This is another sector where it is very important to liaise with the supply chain as soon as possible to get real market feedback.

The indicative range given for fire resistance is suitable for buildings with a predominant requirement for 60-minute fire resistance. Buildings with a predominant requirement for 90-minute fire resistance or higher will be outside of this range.

To use the table, first identify which frame type most closely relates to the project under consideration, then select and add the floor type under consideration. Finally, add fire protection if required.

For example, using the BCIS Index 100 rates for a low rise, short span framed building with a composite metal deck floor and 60 minutes fire resistance, the overall frame rate (based on the average for each range) would be £87.50 + £57.50 + £9.25 = £154.25 per m2 gross internal floor area. For a building in Nottingham the rate would be £154.25 x 0.94 = £145/m2 GIFA.

The costs are presented in two columns: one for the BCIS Index 100 and one for the City of London. For other locations, rates should be adjusted using location indices; figure 4 contains a selection of indices as published and updated by the BCIS.

The rates can also be considered suitable for cost planning of projects where the structural works would commence in the final quarter of 2011 and the first quarter of 2012. After this point, a consideration of inflation should be made.

Summary

The selection of structural frame material and form is a key early decision in the design process. It should be regarded as an opportunity to maximise value by ensuring that the selection is based on project-specific costings and avoiding unnecessary impacts on related elements or overall programme.

The challenge to the cost consultant is to recognise and overcome the historic volatility in material prices in relation to returned tender price data, all in the context of limited design information during early estimates.

This article has outlined a number of key cost drivers that must be considered in order to make steel frame rates project specific.

Communication with the design team to clarify the steel frame weight, potential for complex sections and required fire protection design assumptions are all essential.

Finally, consultation with the supply chain will enable current information on order books and material prices to be considered.

Through the identification of the key factors relevant to each project and the adjustment of typical rates accordingly, the accuracy of budget structural steelwork estimating can be significantly improved.

Downloads

Steel Insight PDF version

PDF, Size 0 kb

No comments yet