Jeddah, the Bride of the Red Sea, is a city steeped in history and culture, capitalising on its heritage as a regional hub to place itself as a leading city of the Middle East. Ciara Walker, Paul Souaid, Khaled Jame and Julio Maggi of Arcadis consider the large-scale investment driving Jeddah’s transformationM

01 / Introduction

Jeddah is a city at the centre of Islamic culture and religion, providing land and water access to the two holy cities Mecca and Medina. It is now recognised as the tourism capital of the Kingdom of Saudi Arabia (KSA), as well as the kingdom’s most cosmopolitan city.

Economic opportunities for the city include:

- The trade from the port connected to Europe and the Indian subcontinent

- The religious tourism and large-scale investment in luxury accommodation

- Planned regeneration of historic Jeddah, made a Unesco World Heritage Site in 2014, providing further tourism opportunities

- High levels of planned commercial development in and around the Kingdom Tower.

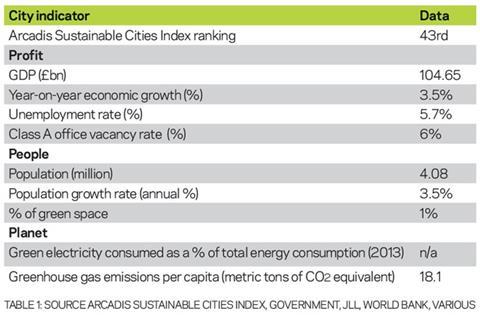

The city is seeking to capitalise on religious tourism by investing in luxury accommodation, retail and hotels. But its rapid growth in the past 30 years has been without strong planning, resulting in infrastructure in need of updating and a city in need of a strong hand directing its development. The city government has recognised its infrastructure challenges, ranging from sanitation to public transport, and since the creation of the Jeddah Strategic Plan in 2009 has been investing to correct them. The estimated 4.08 million population is growing at 3.5% per year presenting another challenge as 2.25 million people are expected to be added between 2010 and 2029.

Pilgrims and tourists

The Hajj pilgrimage brings 2-4 million pilgrims to Jeddah a year and many stay on as tourists. In 2014, 2.08 million pilgrims travelled through Jeddah to Mecca.

02 / Economic and political overview

The potential disruption anticipated due to the succession of King Salman bin Abdulaziz al-Saud this year did not materialise, and there was little change to domestic policy. In Jeddah the head of the city is the regional emir, and the city is mainly governed by the municipality. The government works through various government agencies, such as the Jeddah Development and Urban Renewal Company (JDURC), which undertakes many of the regeneration projects in the city.

Due to a larger population than other oil rich Middle Eastern countries, the Saudis have more difficulty channelling oil revenues into a content populace. Large-scale infrastructure projects in the country are used both to keep the population happy and provide employment opportunities, as opposed to direct rebates to the population. In fact, spending on social infrastructure makes up to 44% of the KSA budget.

A high GDP of £104.65bn in Jeddah in 2014 was just behind that of the capital city, Riyadh (£106.6bn). Huge investment in the city is beginning to pay off, and GDP is growing strongly, with Lloyds estimating GDP growth at 8.08% a year over the next 10 years. GDP per capita is also growing despite population growth, up 2.4% in 2014 compared 2013, growing to £14,002 – lower than the £16,516 average for KSA, but still much higher than the Arab world average of £4,928.

Unemployment is an issue for the Saudi population, with 32.5% of Saudi women unemployed and 5.9% of men, significantly higher than the foreign workforce. The reliance on foreign labour (only 45% of those employed are Saudis), as well as the need to provide employment for Saudis drove the quota programme of Saudisation.

The large-scale exclusion of women from the workforce had historically left a resource of often skilled labour untapped: in recent years restrictions on female employment have been lifted, resulting in 48% growth since 2010, although they still only make up 16% of the workforce, despite making up a majority of university graduates.

Will the low oil price force cuts to projects?

Forty per cent of the revenues of the KSA come from oil and gas; when the price of oil is low, the government balance sheet suffers. The break-even oil price for KSA is around £68.24 a barrel and with prices at £32.18 a barrel at the time of writing, KSA are not breaking even. So far planned investment in Jeddah has not been affected, but the Saudi government ran a deficit for the first time since 2011 this year, and anticipation of prolonged low oil prices could trigger cutbacks.

Saudisation

Foreign companies are required to hire a quota of Saudi nationals in order to pass on capability and build capacity in the local construction industry, as well as decreasing the reliance on foreign labourers. The quotas vary depending on the role – for example, 25% of consultants/ engineers are required to be Saudi, compared to 6% of construction labourers. This programme has already added 750,000 Saudis to the workforce (15.6% rise), and has had more success in KSA than other Arab states passing similar laws, due to stronger employment demand by the population.

03 / Construction sector

The construction sector in Jeddah is benefiting from significant investment in infrastructure, housing, tourism and retail development by the government alongside private sector investment, with the value of awarded contracts in the Mecca region (within which Jeddah sits) reaching £1.1bn in Q2 2015. However, a lack of planning in the development of the city resulted in large unplanned settlements due to land grabbing by the local population, estimated to house around 900,000 people in 2009. The government has recognised this issue and is working to bring these settlements into legality.

Jeddah’s construction industry relies heavily on foreign companies’ expertise and capabilities to design, manage and construct the many large scale and complex construction projects ongoing in the city. Despite this reliance on foreign companies, legislation favours Saudi companies, and it is often in the interest of international companies to work with a Saudi partner, a practice which may impact foreign direct investment in the long term. Due to the scale of construction in the city immigrant labour is used extensively, in part due to the lack of Saudis willing or able to do construction work. As such, labour shortages, or the lack of specialised skills, can be a challenge in the Jeddah construction market.

Land in Jeddah is very expensive in part due to the perceived permanence of the city; Jeddah’s reason for existence as a religious hub is permanent and not dependent on oil, making land in Jeddah a particularly attractive investment. This could be affected by a new KSA-wide “white land tax” to be implemented later this year obliging owners of undeveloped land to develop or risk having their land confiscated, with prices likely to decrease if land speculation is discouraged.

04 / Sustainability

Due to the city’s rapid development, environmental and sustainability issues were for the most part not addressed until the 2009 Strategic Plan. As such, the waste and water system was in dire need of expansion and updating, and actively damaging the environment of the city. Examples include Musk Lake where wastewater was being dumped directly into the lake since the 1980s, resulting in some 10 cubic metres of foul water, and the £16.4m draining and treatment of the lake in 2010. Flash floods in 2009 and 2011 left hundreds dead, prompting the development of more resilient flood defences. These issues resulted in a £1.56bn programme of water and sanitation projects scheduled for delivery, an example of Jeddah proactively tackling its structural challenges.

The government is addressing other issues such as air quality and green space in the city through a variety of masterplans, but despite strong environmental laws implementation is weak and public awareness of environmental challenges, though increasing, still needs improvement.

05 / Residential and mixed use

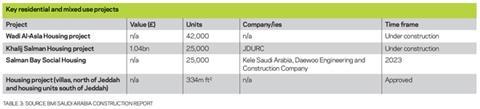

There is strong demand for housing in the city, both at the luxury side of the market, and in the affordable sphere; 20% of housing demand to 2025 will be in the high income range, 30% in the middle income and 50% affordable. This demand pressure is expected to drive an annual need for over 43,000 units, growing to 58,000 by 2025.

The 2009 Strategic Plan aims to produce 283,000 housing units between 2010-2030 to meet the immediate deficiency in supply (including 80,000 affordable and 151,600 replacement housing units for currently inadequately housed population) as well as providing 670,000 units to accommodate population growth.

Despite significant additions (60,000 units 2012-15) demand looks set to remain ahead of supply for some years; 12,000 units were completed in the first half of 2015, with a similar level of supply expected in the second half of the year.

On the affordable side of the market there is an ongoing housing shortage which the city’s government is addressing, with about half of housing units planned for the coming decade classified as “low income” by the JDURC. Private developers have traditionally found it difficult to cater to lower income needs but some are managing to bridge the affordability gap.

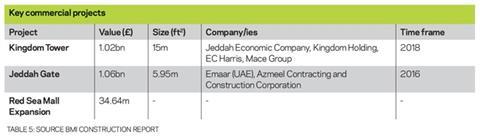

At the high end of the market, Jeddah has some of the most ambitious mixed use projects in the region, including the huge investment in the Kingdom Tower (£1.02bn) which pales in comparison to the investment in the surrounding Kingdom City (£8.5bn), a 2.1 square mile luxury city.

Given the amount of luxury space expected from this development alone, the completion of these units could flood the market and offer lower returns. The effect of this is already being seen in the villas market where residential transaction values have declined by 28% in Q2 2015 compared to Q2 2014, and rents have fallen by as much as 20% year-on-year. The apartment market has performed better, with sales and rents increasing 11% and 14% respectively, but if delivery of high-end supply is not managed effectively, we could see the same effect in this market.

06 / Commercial

Significant investment is being made in commercial space, whether offices, retail or hotels, as part of the large-scale urban renewal the city is undergoing. A stated mission of the city is to cater to religious tourism, and the extensive expansion of hotel and retail space underlines this aim.

The retail and hotel sectors are in a similar situation, where there will potentially be an oversupply of space when planned developments come online over the next few years. As such, performance of these sectors is considered to be peaking.

In retail, rents remain stable, with an increase of 2% or less and vacancy rates are also relatively stable, increasing marginally from 6.8% to 7.2% in Q2. Similarly, hotel occupancy in the year to May 2015 stood at 75%, slightly lower than May 2014 and as a result revenue per available room lost 3.4%. Overall the Jeddah hospitality market remains very strong with healthy occupancy levels and the third highest average daily rate in the region, after Dubai and Riyadh, showing the market is geared towards the luxury end (more than 70% of planned rooms are four or five stars, and internationally branded).

There have been no significant retail completions in the H1 2015, and limited additions are planned for the second half of the year, which should result in vacancies and rentals remaining largely unchanged. Further ahead into 2016 and 2017, new supply is expected, potentially increasing retail space by more than 35% in the next two years. Some delays are expected due to insufficient capacity, which could soften the impact of this substantial supply entering the market.

In the hotels sphere, no major completions were recorded in Q2 2015, and the sector also experienced delays in construction, partly due to shortages in foreign labour and likely resulting in delays to the 2,400 rooms currently scheduled to complete over H2 2015. Similarly to retail, there is a potential for oversupply in the market, with 40 hotels totalling 8,000 rooms due to enter the market by 2019. However delays to delivery are expected, which could lessen the impact of the effective doubling of the size of the market in the span of five years.

The office property market remains stable, with healthy demand for space from government agencies, and consistent, if low, supply of 969,000-1,292,000 ft2 per annum mostly in small to medium-sized developments. This moderate supply drives rental growth, with Grade A and B office space rents increasing by 6% annually. Office vacancies remain stable at around 6% stock, which is a 2% decrease year-on-year.

Combined with strong economic growth, the steady delivery of office space has contributed to the sector’s healthy performance compared to other cities in the region, where ambitious oversupply is outpacing demand and leading to higher vacancy rates. However, this is likely to change in the medium term as close to 11 million ft2 of office space comes online from various large commercial and mixed use developments.

07 / Infrastructure & social infrastructure

There has been massive investment in infrastructure in Jeddah, ranging from the port, airport and roads to a new metro system and high-speed rail connections. The most prominent recent project is the Al Haramain high-speed rail line for £9.1bn, primarily aimed at connecting the city to Mecca and Medina to grow the number of religious tourists and make their journey easier, as well as to connect Jeddah to the economic benefits of the King Abdullah Economic City when it is complete. Investment and planning for social resilience will help manage the flow of tourists, especially during the Hajj period.

The £7.8bn investment in the metro system is in its design phase with Arcadis appointed as part of a team to develop the architectural vision of the new comprehensive public transport system, a much needed improvement as only 12% of the population lives within 10 minutes’ walk of public transport.

Expansions are also planned for both King Abdulaziz International Airport and Jeddah Islamic Port. The airport expansion is to accommodate 80 million passengers per year by 2035, the £4.68bn first phase of which completed in 2014 increasing capacity from 17 million passengers a year to 30 million. The Jeddah Islamic Port capacity was increased by 45% in December 2009 with the opening of the Red Sea Gateway terminal at a cost of £332m.

Jeddah has proven skilled in the past five years at recognising the most urgent needs of the city and investing heavily to meet them. Similarly, the city is tackling severe congestion problems, with 41 road contracts announced in 2012 worth approximately £510m to ease congestion and pollution.

Though social infrastructure is invested in on a large scale throughout KSA, it has taken a back seat to transport and housing investment in Jeddah, and is mostly developed as part of housing developments rather than significant standalone projects. Jeddah has prioritised its investment towards the areas of most need, infrastructure and housing, and the aim to develop social infrastructure as part of new housing communities will likely improve the cohesion of city planning.

08 / Outlook

Over the last five years the speed of development in Jeddah has grown dramatically thanks to the increase in public funding and government initiatives, as well as significant private investment in its booming economy. Real estate and construction will likely remain the major beneficiaries of this spending in years to come, especially in housing projects and new transportation infrastructure. The Municipality of Jeddah has proven very effective at tackling the major issues which could hold the city back, such as the housing shortage, or the previously dire condition of water and waste infrastructure.

Ultimately the city is gearing itself to attract investment in a range of economic activities, capitalising on their existing religious tourism by investing heavily in tourism and retail to capture the spending of the higher income pilgrims and transforming the city into a regional coastal resort hotspot. The cosmopolitan and cultural city is positioning to maximise the value to be gained from its strategic location by rapidly fixing its infrastructure issues and this investment will take Jeddah from the leading regional city it is today to a truly global city on the world scale.

Click on chart to expand.

Click on chart to expand.

No comments yet