Costing Steelwork is a series from Aecom, BCSA and Steel for Life that provides guidance on costing structural steelwork. This quarter provides a market update as well as updating the five cost models previously featured and giving details of general cost drivers for framing materials

For a digital edition version of this update, click here

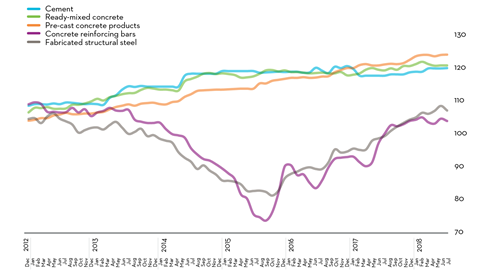

Materials and labour input costs are rising year-on-year, with expectations of further increases over the second half of 2018. Anxiety around industry resources eased a little in Q2, but this proved shortlived after recent indicators showed significant concerns on labour availability remain.

Supply chain cost and capacity will continue to dominate price drivers for contractors in the near term. Supply chain prices are expected to continue to rise year-on-year as constrained capacity dictates the price to secure staff. Extended lead times also highlight the pressure on resources and demonstrate constrained market capacity.

Wage growth offers a reliable indicator of supply and demand dynamics given its historical correlation with industry output. Wage growth has held up over the year at 3% overall, despite a dip in the second quarter because of adverse weather. While there are differences in trends among site disciplines, nominal wage levels continue to be sound. Some downward adjustment is expected as output falls. However, current labour market dynamics appear to be moving outside previous frames of reference, and acute labour shortages will provide support to wage growth for some trades.

Materials prices have experienced a short-term boost. Along with underlying strong demand from industry, anecdotal evidence suggests there may be some stockpiling of key components by the supply chain in preparation for possible customs changes. Materials cost inflation is expected to maintain an upward trajectory for the remainder of 2018.

Rising input costs have provided ongoing impetus to tender prices, which rose over the year by 1.9% at Q2 2018. The rate of price inflation has slowed and has now levelled out after a number of years at above-average rates of change. Selling prices are unable to keep pace with the rate of input cost inflation, creating commercial pressures. Although there has been some pass-through into output prices, there will remain an inability to recover all the input cost pressures, particularly as competition increases with a weaker overall outlook for future work. Clearly, this assumes a continuation of current input cost trends.

Enquiries throughout the supply chain have stayed relatively high but there now appears to be a lower rate of conversion into orders for a growing number of firms. Data for new orders at Q2 2018 supports this, with both yearly and quarterly changes negative at -7.5% and -6.6% respectively. Quarter-on-quarter movements in new orders saw a mixed picture across the larger construction sectors with private housing decreasing by 20.8%, commercial increasing by 2.1% and infrastructure posting an increase of 28%. For these sectors, movements on a yearly basis all recorded negative changes.

| Forecast | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

1 |

96.3 |

104.6 |

111.2 |

114.1 |

116.8 |

119.5 |

123.2 |

|

2 |

99.0 |

106.6 |

112.2 |

114.9 |

117.3 |

120.3 |

123.9 |

|

3 |

101.4 |

108.8 |

112.9 |

115.6 |

118.1 |

121.2 |

124.7 |

|

4 |

103.4 |

110.2 |

113.9 |

116.4 |

118.8 |

122.0 |

126.4 |

In contrast, headline sentiment surveys for the industry set out a generally confident mood. Underlying momentum in present workload offers support to these views. More signs of construction industry confidence were revealed in ICAEW’s UK Business Confidence Monitor for Q2 2018. Construction saw its survey confidence measure rise to the highest level in 12 months, but as the survey notes, construction’s rise only takes it to a moderate overall level compared with other economic sectors. One area of concern highlighted was the very high level of staff turnover and difficulty securing non‑management skills. These measures were the highest among all the surveyed sectors.

Despite the talk of a Q2 rebound, a different view arises after smoothing the output data. On a year-on-year basis, output for construction has been above zero since mid-2013. Looking at the smoothed year-on-year data for new work output in May 2018, the industry saw zero growth. A crossover from positive to negative growth in the smoothed data would be significant and signals a contraction.

Further monthly volatility in upcoming output data can be expected. While monthly data might make headlines, it is the trends that usually reveal the story. Short-term cyclicality should not be overlooked as a reason for the improved data in recent quarters. Restocking cycles after a period of destocking, better weather and consumer expenditure are likely to have given the economy a boost.

Many activity indicators show industry sentiment and confidence holding up, despite some reversals in recent months. Future scenarios for activity, employment prospects and broad outlook are also generally positive for both SMEs and larger firms.

Sourcing cost information

When sourcing cost information it is important to recognise that it is derived from various sources, including similar projects, market testing and benchmarking, and that relevance is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents the variances in the key cost drivers, as noted later in the article. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 4), highlight the existence of different market conditions in different regions.

To use the tables:

- Identify which frame type most closely relates to the project under consideration

- Select and add the floor type under consideration

- Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£108.50 + £76.50 + £17 = £202.00

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

| Type | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

|

|

|

Steel frame to low-rise building |

98-119 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

166-188 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

188-221 |

Steelwork design based on 110kg/m2 |

|

Floors |

|

|

|

Composite floors, metal decking and lightweight concrete topping |

61-92 |

Two-way spanning deck, typical 3m span, |

|

Precast concrete composite floor with concrete topping |

98-139 |

Hollowcore precast concrete planks with structural concrete topping spanning |

|

Fire protection |

|

|

|

Fire protection to steel columns and beams (60 minutes’ resistance) |

14-20 |

Factory-applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes’ resistance) |

16-29 |

Factory-applied intumescent coating |

|

Portal frames |

|

|

|

Large-span single-storey building with low eaves (6-8m) |

74-96 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

84-115 |

Steelwork design based on 45kg/m2 |

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

126 |

Nottingham |

111 |

|

Manchester |

101 |

Glasgow |

90 |

|

Birmingham |

98 |

Newcastle |

96 |

|

Liverpool |

96 |

Cardiff |

84 |

|

Leeds |

89 |

Dublin |

92* |

Cost drivers - framing materials

Key cost drivers to be considered when selecting framing materials, how structural steel provides key benefits and the improved options that choosing to use steel in preference to other framing materials can provide on a project

Market influences

External factors such as currency exchange rates, buoyancy of the market, labour availability and commodity prices all influence market dynamics and as such should be considered at the time of developing the estimate/cost plan. It is advisable always to include exchange rates in the basis and assumptions of the cost document. This is a difficult risk to mitigate. However, early engagement with the supply chain and utilising the selected steelwork contractor’s knowledge to complete the design can reduce risk and improve certainty.

Offsite manufacture

Offsite manufacture results in a reduction of on‑site labour, which as a consequence reduces health and safety risks. As is well known, components for the steel frame are manufactured offsite. This well-established offsite construction process mitigates programme risks too, as materials can be fabricated earlier for incorporation into the building. The reduced erection time on site is a clear benefit and can facilitate earlier hand over of areas for fit-out. This allows a certainty of overall timescales, which has time, cost and flexibility benefits. The client should be aware this may require earlier engagement with the supply chain and early completion of the design.

Programme

Steel frame installation and its ability to be pre‑manufactured offers programme advantages due to certainty of delivery and speed of installation. Speed of erection is a key consideration: the tendency is to adopt methods which allow for a quick turnaround on site. It is important to ensure certainty of programme, particularly when planning projects that have advantageous or critical completion dates. Typical dates/events to which this would apply include: retail projects, whose major window for sales is the Christmas period including the pre- and post‑sales events in November and January; sporting events such as the World Cup and Olympic Games which have dates that cannot be moved; and finally the start of school term/year. Due to the criticality of certain dates, offsite manufacturing or other methods of construction should be considered to ensure the milestone programme dates are met.

Programme certainty

The criticality of opening dates makes time the priority on a large number of projects. While the steel frame erection can be carried out in a reduced period, the project could have sustained delays during earlier activities. Should delays be incurred, then there needs to be a review of what mitigation measures can be undertaken. Steel erection being a dry activity involving the assembly of components means that there are no curing periods; therefore it readily allows acceleration measures to be taken into consideration. This could be achieved by introducing a back shift or other out-of-hours works to erect components that have been fabricated ready for incorporation.

Site constraints

Steel-framed solutions allow sites to be considered for development that otherwise might not be eligible, such as rail infrastructure over-site developments. This is prevalent with mixed-use developments, where links with public transport and increased footfall have particular benefits to retail uses. Retail uses in isolation might not be sufficient to warrant the expense incurred in building over a station, and therefore other uses need to be factored in. It would be difficult to realise these development opportunities without the use of steelwork.

Erection time

Due to the extent of prefabrication in structural steel assembly, the on-site erection time is significantly reduced. This speed of construction is particularly important when working on projects that have restricted timescales, for example extensions to schools during non-school periods. The main continuous non-school period is during the summer shutdown, which restricts the available time to carry out the works. The adoption of a steel frame works well with the restrictive periods available and allows for the outer shell to be in place, leaving only internal works which can be better accommodated during the school term time as required.

Lightweight

The reduced weight of a steel-framed building has a beneficial effect on the foundation design. It allows the building to be constructed over restricted load areas such as railway station boxes and transfer structures. As a framing solution this allows for transfers to be introduced without compromising the building as a whole. This allows the building to bridge over buried infrastructure and the like, which assists in being able to increase the massing of buildings and can make all the difference to whether a building is viable for development or not.

Adaptability and future flexibility

Tenant alterations are considerably less complex with steel-framed buildings, particularly major alterations such as the introduction of internal accommodation stairs or double-height spaces. When designing buildings it is important to realise that the building’s day-one requirements are likely to change over time. There is a continual need for end-users, particularly retailers, and their buildings to remain relevant, with a need to be able to respond faster to the changing requirements of the customer.

While other frame solutions can offer a level of flexibility that is usually incorporated in the base build to suit changes that will occur at a later stage, a steel frame can offer more flexibility and is also more readily adaptable than other framing solutions; in particular, it can easily accommodate late unforeseen changes that are not unusual with commercial tenants, allowing for tenant changes in retail or office buildings.

Structural zone

There is an optimum structural zone where beams work efficiently; however, with the introduction of services and the desire to increase floor-to-ceiling heights this zone can become compromised. The reduced structural zone may make the frame less efficient and increase steel member weights. This further reinforces the need for coordinated design and modelling of the building, particularly in 3D, to allow the optimum massing to be achieved.

Structural alignment / repetition

As with all framing solutions, it is more efficient and cost-effective to have alignment through the structure, thereby removing the need for transfers. Consistency of floorplate is desirable and the stacking of cores/floorplates allows the mechanical, electrical and plumbing services to be routed efficiently throughout the building. These are requirements that can be readily achieved with a steel frame.

Service integration

Service integration is easily accommodated with a steel frame through the use of cellular beams. This integration of services leads to economies in the construction by reducing the floor-to-floor height, which has the double benefit of reducing the external cladding required and reducing heat loss through the envelope.

In multi-storey buildings, service integration can allow extra floors to be provided within the same overall building height. When penetrations are required within the beam depth to allow services to distribute throughout the floorplates, the size and positioning of these can have an impact on the performance of the beam.

Ductwork distribution can result in oversized penetrations; should this occur, there will be a requirement to stiffen the holes in order to maintain the integrity of the beam. This involves the welding of additional plates and angles to the beam.

The effect of improved service integration in terms of reduced overall building height should also be considered. This is linked to the structural zone and the required design coordination on a project.

Does your steelwork contractor stack up?

Once a steel framing solution has been chosen, it is important to ask whether you are working with the right steelwork contractor.

BCSA steelwork contractors are required to have a fabrication facility in the UK or Ireland that meets stringent quality standards and undergo a competence assessment relating to the company’s work facilities, track record and technical and management experience. However, there are still some companies out there without the skills, experience and financial standing to be taking on structural steelwork projects.

On paper, they might look like legitimate steelwork fabricators. Some have ISO 9001 and CE marking certification and have undergone well-known prequalification assessments. But incredibly, they don’t have a fabrication facility at all. These “desk and stool” companies take on steelwork projects as if they’re an actual steelwork contractor that undertakes fabrication, and then they re-subcontract it all out.

There are even examples where “desk and stool” companies have passed off their subcontractors’ workshops as their own. What’s wrong with this?

- First, their certifications are not for steelwork fabrication. They are for their office and paperwork processes because that’s all that’s available to be assessed on.

- Their knowledge and understanding of structural steelwork will be far more limited than someone who manages a steelwork fabrication facility day in, day out.

- They won’t have the wide range of experienced, permanent staff that a qualified steelwork contractor employs directly, such as designers, detailers and welding engineers.

- They won’t be keeping up with key technical issues or changes in regulations and standards, which means that they may not comply with the current requirements or with the project specification.

- They may not be undertaking rigorous design checks, including for temporary conditions, on every project to ensure that the structural steelwork is safe at all times.

- They won’t be in direct control of health and safety in the factory, as the factory is not theirs.

- And lastly, they may not have the financial standing to provide cash flow or manage project delays, which could put the contract and the overall project at risk.

Use the right steelwork contractor for the job – a BCSA member.

Cost comparison updates

This quarter’s Costing Steelwork provides an update of the five previously featured cost comparisons covering: offices, education, industrial, retail and mixed-use

These five projects were originally part of the Target Zero study conducted by a consortium of organisations including Tata Steel, Aecom, SCI, Cyril Sweett and the BCSA in 2010 to provide guidance on the design and construction of sustainable, low- and zero-carbon buildings in the UK. The cost models for these five projects have been reviewed and updated as part of the Costing Steelwork series. The latest cost models as of Q3 2018 are presented here.

Costing steelwork: offices update

Below is an update to the offices cost comparison originally published in the Costing Steelwork Offices feature in Building magazine in April 2017.

One Kingdom Street, London, key features

- 10 storeys, with two levels of basement

- Typical clear spans of 12m x 10.5m

- Three cores – one main core with open atrium, scenic atrium bridges and lifts

- Plant at roof level

Cost comparison

Two structural options for the office building were assessed (as shown in figure 5):

- Base case – a steel frame, comprising fabricated cellular steel beams supporting a lightweight concrete slab on a profiled steel deck

- Option 1 – 350mm-thick post-tensioned concrete flat slab with a 650mm x 1,050mm perimeter beam.

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q3 2018. There has been no real cost movement from Q2 to Q3. The costs, which include preliminaries, overheads, profit and a contingency, are summarised in figure 5.

The cost of the steel composite solution is 8% lower than that for the post-tensioned concrete flat slab alternative for the frame and upper floors, and 5% lower on a total-building basis.

| Elements | Steel composite | Post-tensioned concrete flat slab |

|---|---|---|

|

Substructure |

87 |

92 |

|

Frame and upper floors |

428 |

462 |

|

Total building |

2,573 |

2,712 |

Costing steelwork: education update

Below is an update to the education cost comparison originally published in the Costing Steelwork Education feature in Building magazine in July 2017.

Christ the King Centre for Learning, Merseyside, key features

- Three storeys, with no basement levels

- Typical clear spans of 9m x 9m

- 591m2 sports hall (with glulam frame), 770m2 activity area and atrium

- Plant at roof level

Cost comparison

Three structural options for the building were assessed (as shown in figure 6), which include:

- Base case – steel frame, 250mm hollowcore precast concrete planks with 75mm structural screed

- Option 1 – in situ 350mm reinforced concrete flat slab with 400mm x 400mm columns

- Option 2 – steel frame, 130mm concrete topping on structural metal deck.

The full building cost plans for each option have been updated to provide current costs at Q3 2018. The comparative costs highlight the importance of considering total building cost when selecting the structural frame material. The concrete flat slab option has a marginally lower frame and floor cost compared with the steel composite option, but on a total-building basis the steel composite option has a lower overall cost (£3,061/m2 against £3,087/m2).

This is because of lower substructure and roof costs, and lower preliminaries resulting from the shorter programme.

| Elements | Steel + precast hollow-core planks | In situ concrete flat slab | Steel comp-osite |

|---|---|---|---|

|

Frame and upper floors |

286 |

247 |

259 |

|

Total building |

3,115 |

3,087 |

3,061 |

Costing steelwork: industrial update

Below is an update to the industrial cost comparison originally published in the Costing Steelwork Industrial feature in Building magazine in October 2017.

Distribution warehouse in ProLogis Park, Stoke-on-Trent, key features

- Warehouse: four-span, steel portal frame, with a net internal floor area of 34,000m2

- Office: 1,400m2, two-storey office wing with a braced steel frame with columns

Cost comparison

Three frame options were considered:

- Base option – a steel portal frame with a simple roof solution

- Option 1 – a hybrid option: precast concrete column and glulam beams with timber rafters

- Option 2 – a steel portal frame with a northlight roof solution.

The full building cost plans for each option have been updated to provide costs at Q3 2018. The steel portal frame provides optimum build value at £670/m2; glulam is least cost-efficient. This is primarily due to the cost premium for the structural members necessary to provide the required spans, which are otherwise efficiently catered for in the steelwork solution. With a hybrid, the elements are from different suppliers, which raises the cost. The northlights option is directly comparable with the portal frame in relation to the warehouse and office frame. The variance is in the roof framing as the northlights need more. Other additional costs relate to the glazing of the northlights.

| Elements | Steel portal frame | Glulam beams + purlins + concrete columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Warehouse |

70 |

139 |

81 |

|

Office |

126 |

167 |

126 |

|

Total frame |

72 |

140 |

84 |

|

Total building |

670 |

750 |

719 |

Costing steelwork: retail update

Below is an update to the retail cost comparison originally published in the Costing Steelwork retail feature in Building magazine in January 2018.

Asda food store, Stockton-on-Tees, key features

- Total floor area of 9,393m2

- Retail area based on 12m x 12m structural grid

Cost comparison

Three frame options were considered (as shown in figure 8) to establish the optimum solution for the building, as follows:

- Base option – a steel portal frame on CFA piles

- Option 1 – glulam timber rafters and columns on CFA piles

- Option 2 – a steel portal frame with a northlight roof solution on driven steel piles.

The full building cost plans for each option have been updated to provide costs at Q3 2018. The steel portal frame provides the optimum build value at £2,547/m2, with the glulam option the least cost-efficient. The greater cost is due to the direct comparison of the steel frame solution against the glulam columns and beams/rafters. A significant proportion of the building cost is in the M&E services and fit-out elements, which reduce the impact of the structural changes. The northlights option is directly comparable to the portal frame in relation to the main supermarket; the variance is in the roof framing as the northlights require more. Additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area.

| Elements | Steel portal frame | Glulam timber rafters + columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Structural unit cost |

140 |

171 |

157 |

|

Total building unit cost |

2,547 |

2,587 |

2,557 |

Costing steelwork: mixed-use update

Below is an update to the mixed-use cost comparison originally published in the Costing Steelwork mixed-use focus feature in Building magazine in April 2018.

Holiday Inn tower, MediaCityUK, Manchester

- 17-storey tower

- 7,153m2 of open-plan office space on five floors (floors two to six)

- 9,265m2 of hotel space on eight floors (floors eight to 15)

The gross internal floor area of the building is 18,625m2. The 67m-high building is rectilinear with approximate dimensions of 74m x 15.3m.

Cost comparison

Three frame options were considered to establish the optimum solution for the building:

- Base option – steel frame with Slimdek floors

- Option 1 – concrete flat slab

- Option 2 – composite deck on cellular beams (offices) and UCs used as beams (hotel).

The full building cost plans for each option have been updated to provide costs at Q3 2018. The steel frame with composite deck continues to provide the optimum build value with the overall building cost at £2,520/m2.

Options 1 and 2 are arguably more typical for this building type. The base case structure is an unusual solution due to a decision to change the residential accommodation to office floors at a very late stage; time constraints precluded redesign of the tower block and hence the original Slimdek design was constructed.

| Elements | Slimdek | Concrete flat slab | Composite deck on cellular beams (offices) and UCs used as beams (hotel) |

|---|---|---|---|

|

Structural unit cost |

502 |

420 |

344 |

|

Total building unit cost |

2,723 |

2,622 |

2,520 |

This Costing Steelwork article produced by Patrick McNamara (director) and Michael Hubbard (associate) of Aecom is available at www.steelconstruction.info.

The data and rates contained in this article have been produced for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the article contents.

No comments yet