Costing Steelwork is a series from Aecom, BCSA and Steel for Life that provides guidance on costing structural steelwork. This quarter provides a market update, focuses on long-span and column-free design and updates the five cost models previously featured in Costing Steelwork

Tender prices rose by 2.1% in the year to Q1 2018, reflecting lingering inflationary pressures. Materials and labour cost increases were experienced by a majority of contractors across the industry during the final quarter of 2017 and the first quarter of 2018. In general, market selling prices were unable to rise above the input cost increases experienced. Nevertheless, the combination of capacity constraints and current workload levels is still resulting in some transfer into output prices.

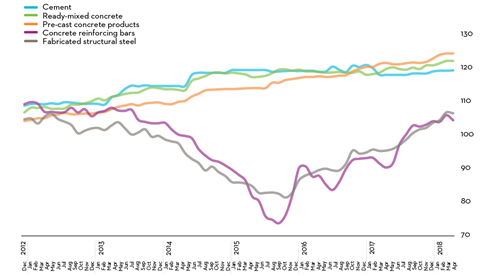

A composite measure of building costs increased by 3.6% over the year to Q1 2018. Materials costs remained a significant driver of cost inflation in the overall index. Primarily, this stems from sterling’s weakness against the euro and the dollar, which introduces inflationary pressures from the resulting higher cost of imported materials and components. Labour costs also continued to rise steadily over the first quarter, despite a brief lull where inclement weather affected wages.

Elevated input costs offer little respite to the commercial pressures in the supply chain. Expectations for much of the remainder of 2018 are that input costs will remain high or increase further. Views on output prices are more subdued now because of the patchier medium-term outlook and increased market competition. Inevitably, this combination leads to heightened pressure on already thin industry margins. A future risk that will propel input costs higher is that sterling weakens once again.

Concerns around industry labour resources remain, although generally they have eased a little over the first quarter of 2018.

Although commodity prices rose significantly on a yearly basis, the pace of change slowed in response to greater uncertainty around global economic activity and associated geopolitics. Rhetoric and action by major economies in respect of tariffs may have a knock-on effect on metals prices. Further movements in price trends could play out through the rest of 2018, as the impact of the tariffs and retaliatory measures begin to influence global economic activity and any supply responses.

Sterling lost significant ground against the US dollar recently. Stronger economic growth and a higher probability of bank rate increases in the US make US dollars a preferable foreign exchange holding to sterling. Against the euro, sterling has had little or no change.

Manufacturing input costs increased by 5.3% on a yearly basis to April 2018. This reflects a marginal pick-up in the rate of change after a slower period of input cost increases in Q1 2018. The largest upward contributions came from crude oil and metals, both of which tend to be imported and are therefore subject to the effects of weaker sterling. Factory gate output prices increased by 2.7% on a yearly basis to April 2018. This 12-month rate of change continues a downward trend for growth in output prices, although still positive, and is below the corresponding trend for input costs.

| Forecast | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|

1 |

87.7 |

96.3 |

104.6 |

111.2 |

114.4 |

116.8 |

119.8 |

|

2 |

88.9 |

99.0 |

106.6 |

112.2 |

114.9 |

117.6 |

120.3 |

|

3 |

90.9 |

101.4 |

108.8 |

112.9 |

115.6 |

118.6 |

121.5 |

|

4 |

93.6 |

103.4 |

110.2 |

113.9 |

116.4 |

119.0 |

123.0 |

The UK economy is increasingly lacklustre, posting just 0.2% growth in the first quarter of 2018. This sits in stark contrast to other comparable economies in the eurozone or among the G7. The manufacturing sector slowed substantially after a strong 2017, with slower EU export growth and capacity constraints contributing to a weaker sector here. Consumer spending is tightening very quickly, which has a significant effect on the UK’s service sector in particular, as well as on the wider economy.

UK construction (all work) output fell by 5% in March compared with the same month in 2017. This marks the continuation of a pattern stretching back to early 2017, where the yearly rate of change each month has contributed to an overall declining trend. A similar negative rate of change in construction output data occurred in March 2013. Despite this, there are still respectable levels of construction output overall but the underlying trend indicates lower output in the near to medium term.

Taken altogether, economic indicators show that within the current economic cycle the UK construction sector is in its second phase of expansion since 2014, albeit at a decelerating rate. There are two ways that the data can be interpreted. The first is that overall work volumes will remain respectable, albeit with lower positive growth rates. The second interpretation is that we are coming to the end of this second construction sector expansion phase and that a contraction is looming.

| TYPE | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

|

|

|

Steel frame to low-rise building |

98-119 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

166-188 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

188-221 |

Steelwork design based on 110kg/m2 |

|

Floors |

|

|

|

Composite floors, metal decking and lightweight concrete topping |

61-92 |

Two-way spanning deck, typical 3m span, |

|

Precast concrete composite floor with concrete topping |

98-139 |

Hollowcore precast concrete planks with structural concrete topping spanning |

|

Fire protection |

|

|

|

Fire protection to steel columns and beams (60 minutes’ resistance) |

14-20 |

Factory-applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes’ resistance) |

16-29 |

Factory-applied intumescent coating |

|

Portal frames |

|

|

|

Large-span single-storey building with low eaves (6-8m) |

74-96 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

84-115 |

Steelwork design based on 45kg/m2 |

SOURCING COST INFORMATION

When sourcing cost information it is important to recognise that it is derived from various sources, including similar projects, market testing and benchmarking, and that relevance is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents the variances in the key cost drivers, as noted later in the article. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 4), highlight the existence of different market conditions in different regions.

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

125 |

Nottingham |

107 |

|

Manchester |

102 |

Glasgow |

90 |

|

Birmingham |

101 |

Newcastle |

97 |

|

Liverpool |

100 |

Cardiff |

84 |

|

Leeds |

89 |

Dublin |

91* |

Long-span and column-free design

The requirement for column-free space was first driven by the financial services sector. Since then, this desire to provide large unrestricted open-plan space has been adopted by many other building sectors, which want to benefit from the flexibility in space planning offered by column-free floorplates

The use of long-span beams results in a range of benefits, including flexible, column-free internal spaces, reduced foundation costs, and reduced steel erection times. Many long-span solutions are also well adapted to facilitate the integration of services without increasing the overall floor depth.

The benefits of long-span beams include:

ADAPTABILITY

Column-free, fully flexible space appeals to both building owners and users. Tenants are finding that they can adapt long-span areas easily as their needs evolve, and adaptability means new tenants can easily be provided with an internal layout that works for them. In key growth markets like technology and the creative industries in particular, there is a demand for high-quality, long-span, column-free spaces as they foster collaborative working and their aesthetic appeals to the highly skilled workers in those industries.

SUSTAINABILITY

With embodied carbon and existing building adaptation becoming key drivers when designing a building, it is becoming important to design with longevity in mind, whether this be allowing for disassembly or for flexibility in use. Long-span design gives more options regarding the possible change in function of a building in its lifetime.

SERVICE INTEGRATION

Longer spans mean beams have to be deeper to give them the required increased structural strength. Using cellular long-span beams creates space that allows services to be carried through the beams, rather than below them, integrating them within the structural zone. Overall floor depth requirements are reduced, allowing more floors to be created for a building of a particular height. Alternatively, the same number of floors could be created within a shorter building, which means a reduction in cladding and other costs.

REDUCED FOUNDATIONS

With fewer columns in a building using long spans, there are fewer foundations, which are already minimised because of the relatively low self-weight of any steel-framed building. As well as saving on costs this reduces the building’s carbon footprint, because a significant proportion of a building’s embodied carbon is in the foundations. Longer spans can also contribute to the vibration performance of a building, as more mass will be mobilised in the floor system.

UTILITY

Long-span solutions can extend the life of the building. Long-span steel sections enable large open-plan, column-free spaces to be created inside buildings, providing flexible areas that can be set out in an endless variety of configurations. Such “future-proofing” means that the building’s use can be changed and the layout adapted many times – extending the life of the structure.

SITE CONSTRAINTS

Site constraints are a key driver for long-span designs. These conditions arise when there is limited or no opportunity to bring the vertical structure through an area or to bring the load down in specific zones. Typical site constraints such as these arise on projects where there are structural loading exclusion zones. These occur at station over-site developments and sites where building occurs over infrastructure assets. Longer spans mean that the building point loads can be adjusted to bring the load down in areas where support can be provided. This built-in flexibility can make the difference as to whether a site can be successfully developed.

COSTING LONG-SPAN DESIGN

While site constraints drive long-span solutions, it is an increasingly popular trend to elect to have long-span structures. This requires careful consideration in regard to costing. Where the long-span solution is a product of site constraints, the costs are seen as a base cost position and consequently the budget will have taken this into account. In comparison, the optional approach would need to be justified on both a value and a cost perspective.

OPTIONS FOR LONG-SPAN DESIGN

Typically, long-span frames are 15-16m; however, these spans are not unusual in London commercial projects and can be accommodated with simple fabricated sections, usually composite and cellular. For such projects, long span is often considered to be more in the order of 20-30m, as in these cases special measures need to be employed. Despite not being unusual, 15-16m is still a considerable

span, and the economics of how this is achieved together with the often limited structural zones means the same approaches need to be considered. Options for long-span members are detailed in the box below.

CHOOSING THE RIGHT SOLUTION

The structural solutions described offer different ways to achieve long-span design. Choosing the right solution for a specific building requires the other design and building functions to be considered, with services distribution particularly important. The main considerations are building height and the structural zone derived from the floor-to-floor height. The services and structural zone generally overlap, particularly in long-span buildings where the ceiling void is limited.

Each solution has its own merits and different scenarios will to some extent dictate the solution. The optimum solution will need to work with the specific project constraints and the proposed spans rather than being simply a cost-orientated answer. The most cost-effective option may need to be discounted, should the beam sizes not work within the available structural zone.

Where a project has opted for a long-span design then it is important that sufficient consideration is given to the structural zone and whether it is sufficient to allow an efficient design. The frame may need strengthening to accommodate a suitable response factor and ensure that edge beam deflections are kept to a minimum in order to avoid unnecessary costs being incurred in the facade.

At the initial design stages it is important to understand the implications of long-span options against more conventional spans in order to determine the value of the change. When comparing against regular spans, the beams and connections will be more expensive. However, this is offset to some extent by the reduced numbers of columns and associated foundations. The long-span option (depending on the specific solution) does reduce the piece count and consequently reduces the amount of hook time and erection duration, which should have benefits to the programme.

The extent of time savings and cost implications is project specific, but provided the options are clearly understood then it is possible to determine the optimum solution for the project.

In addition to a direct cost comparision, the utility of a long-span design for the building owner also needs to be considered, and not having long spans may reduce the value of the building.

Long-span options

The options associated with long-span members will be dependent upon the design criteria, such as structural zone, stiffness (response factors), edge beam deflections and so on. The main options are:

- Parallel beams This option consists of a pair of rolled sections, which can be effectively utilised for spans around 14-15m. As a general guide, the beam depth would be 1/20th of the beam length, so an 18m-long beam would be around 900mm deep (so a 914UB). Since the deepest rolled beam (that is most commonly available) is a 1016UB, then this is likely to restrict this option to 20m spans. However, due to beam weight, this option would be uneconomical for the longer spans.

- Composite beams This option relates to any beam (rolled or fabricated section) designed to act compositely with the reinforced concrete floor slab – for instance, steel decking and shear studs. Composite beams tend to be in the order of 25% lighter than non-composite beams, and the top flange of the beam can be reduced in width and/or thickness because the concrete is contributing to the stiffness and resistance of the cross-section. Composite beams can be designed to adequately span up to 24m and will be a little shallower than non-composite beams.

- Cellular composite beams This option is similar to the previous one for composite beams, but uses fabricated beams with web service holes, therefore introducing the benefits of integrated services.

- Tapered girders These are fabricated sections where the greater depth is towards the mid-span of the beam. The deeper section generally has openings for services, with the tapered elements being solid so the services have to pass under. The fine-tuning of the beam design to have the most efficient design does reduce weight. However, tapered sections are slightly more expensive to supply due to the additional fabrication cost. The efficiency becomes more pronounced at the longer spans.

- Stub girders These are a Vierendeel form of truss, where a solid universal column section is used as the bottom chord on which short, deeper universal beam sections sit. The composite concrete slab forms the top chord. The servicing zone is within the depth of the upper universal beam sections. The main benefit of this solution is that it can be utilised economically for spans in excess of 20m.

- Haunched composite beams Haunches are added to the ends of composite beams. This increases the stiffness and strength at the connection, which can reduce the depth of the beam over the main span. This reduced weight allows for greater spans to be achieved, particularly for spans over 20m.

- Composite trusses These are usually specified when the spans are 30m or longer. Due to the truss depth, it can be difficult to fit into the structural zone, so often they are designed as two-storey trusses and can provide clear spans of 50m or above. In terms of economy, trusses are more expensive to fabricate, but if the truss weight is only a fraction of the equivalent fabricated plate girder, then this can close the gap considerably.

Cost comparison updates

This quarter’s Costing Steelwork provides an update of the five previously featured cost comparisons covering: offices, education, industrial, retail and mixed-use

These five projects were originally part of the Target Zero study conducted by a consortium of organisations including Tata Steel, Aecom, SCI, Cyril Sweett and the BCSA in 2010 to provide guidance on the design and construction of sustainable, low- and zero-carbon buildings in the UK. The cost models for these five projects have been reviewed and updated as part of the Costing Steelwork series. The latest cost models as of Q2 2018 are presented here.

Costing steelwork: offices update

Below is an update to the offices cost comparison originally published in the Costing Steelwork Offices feature in Building magazine in April 2017.

One Kingdom Street, London, key features

- 10 storeys, with two levels of basement

- Typical clear spans of 12m x 10.5m

- Three cores – one main core with open atrium, scenic atrium bridges and lifts

- Plant at roof level

Cost comparison

Two structural options for the office building were assessed (as shown in figure 5):

- Base case – a steel frame, comprising fabricated cellular steel beams supporting a lightweight concrete slab on a profiled steel deck

- Option 1 – 350mm-thick post-tensioned concrete flat slab with a 650mm x 1,050mm perimeter beam.

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q2 2018. There has been very limited cost movement from Q1 to Q2. The costs, which include preliminaries, overheads, profit and a contingency, are summarised in figure 5.

The cost of the steel composite solution is 8% lower than that for the post-tensioned concrete flat slab alternative for the frame and upper floors, and 5% lower on a total-building basis.

| Elements | Steel composite | Post-tensioned concrete flat slab |

|---|---|---|

|

Substructure |

87 |

92 |

|

Frame and upper floors |

428 |

462 |

|

Total building |

2,573 |

2,712 |

Costing steelwork: education update

Below is an update to the education cost comparison originally published in the Costing Steelwork Education feature in Building magazine in July 2017.

Christ the King Centre for Learning, Merseyside, key features

- Three storeys, with no basement levels

- Typical clear spans of 9m x 9m

- 591m2 sports hall (with glulam frame), 770m2 activity area and atrium

- Plant at roof level

Cost comparison

Three structural options for the building were assessed (as shown in figure 6), which include:

- Base case – steel frame, 250mm hollowcore precast concrete planks with 75mm structural screed

- Option 1 – in situ 350mm reinforced concrete flat slab with 400mm x 400mm columns

- Option 2 – steel frame, 130mm concrete topping on structural metal deck.

The full building cost plans for each option have been updated to provide current costs at Q2 2018. The comparative costs highlight the importance of considering total building cost when selecting the structural frame material. The concrete flat slab option has a marginally lower frame and floor cost compared with the steel composite option, but on a total-building basis the steel composite option has a lower overall cost (£3,061/m2 against £3,087/m2). This is because of lower substructure and roof costs, and lower preliminaries resulting from the shorter programme. Materials cost increases are the primary reason for the uplift in cost.

| Elements | Steel + precast hollow-core planks | In situ concrete flat slab | Steel comp-osite |

|---|---|---|---|

|

Frame and upper floors |

286 |

247 |

259 |

|

Total building |

3,115 |

3,087 |

3,061 |

Costing steelwork: industrial update

Below is an update to the industrial cost comparison originally published in the Costing Steelwork Industrial feature in Building magazine in October 2017.

Distribution warehouse in ProLogis Park, Stoke-on-Trent, key features

- Warehouse: four-span, steel portal frame, with a net internal floor area of 34,000m2

- Office: 1,400m2, two-storey office wing with a braced steel frame with columns

Cost comparison

Three frame options were considered:

- Base option – a steel portal frame with a simple roof solution

- Option 1 – a hybrid option: precast concrete column and glulam beams with timber rafters

- Option 2 – a steel portal frame with a northlight roof solution.

The full building cost plans for each option

have been updated to provide costs at Q2 2018. The steel portal frame provides optimum build value at £670/m2; glulam is least cost-efficient. This is primarily due to the cost premium for the structural members necessary to provide the required spans, which are otherwise efficiently catered for in the steelwork solution. With a hybrid, the elements are from different suppliers, which raises the cost. The northlights option is directly comparable with the portal frame in relation to the warehouse and office frame. The variance is in the roof framing as the northlights need more. Other additional costs relate to the glazing of the northlights.

| Elements | Steel portal frame | Glulam beams + purlins + concrete columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Warehouse |

70 |

139 |

81 |

|

Office |

126 |

167 |

126 |

|

Total frame |

72 |

140 |

84 |

|

Total building |

670 |

750 |

719 |

Costing steelwork: retail update

Below is an update to the retail cost comparison originally published in the Costing Steelwork retail feature in Building magazine in January 2018.

Asda food store, Stockton-on-Tees, key features

- Total floor area of 9,393m2

- Retail area based on 12m x 12m structural grid

Cost comparison

Three frame options were considered (as shown in figure 8) to establish the optimum solution for the building, as follows:

- Base option – a steel portal frame on CFA piles

- Option 1 – glulam timber rafters and columns on CFA piles

- Option 2 – a steel portal frame with a northlight roof solution on driven steel piles.

The full building cost plans for each option have been updated to provide costs at Q2 2018. The steel portal frame provides the optimum build value at £2,547/m2, with the glulam option the least cost-efficient. The greater cost is due to the direct comparison of the steel frame solution against the glulam columns and beams/rafters. A significant proportion of the building cost is in the M&E services and fit-out elements, which reduce the impact of the structural changes. The northlights option is directly comparable to the portal frame in relation to the main supermarket; the variance is in the roof framing as the northlights require more. Additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area.

| Elements | Steel portal frame | Glulam timber rafters + columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Structural unit cost |

140 |

171 |

157 |

|

Total building unit cost |

2,547 |

2,587 |

2,557 |

Costing steelwork: mixed-use update

Below is an update to the mixed-use cost comparison originally published in the Costing Steelwork mixed-use focus feature in Building magazine in April 2018.

Holiday Inn tower, Media CityUK, Manchester

- 17-storey tower

- 7,153m2 of open-plan office space on five floors (floors two to six)

- 9,265m2 of hotel space on eight floors (floors eight to 15)

The gross internal floor area of the building is 18,625m2. The 67m-high building is rectilinear with approximate dimensions of 74m x 15.3m.

Cost comparison

Three frame options were considered to establish the optimum solution for the building:

- Base option – steel frame with Slimdek floors

- Option 1 – concrete flat slab

- Option 2 – composite deck on cellular beams (offices) and UCs used as beams (hotel).

The full building cost plans for each option have been updated to provide costs at Q2 2018. The steel frame with composite deck continues to provide the optimum build value with the overall building cost at £2,520/m2. Options 1 and 2 are arguably more typical for this building type. The base case structure is a unusual solution due to a decision to change the residential accommodation to office floors at a very late stage; time constraints precluded redesign of the tower block and hence the original Slimdek design was constructed.

| Elements | Slimdek | Concrete flat slab | Composite deck on cellular beams (offices) and UNs used as beams (hotel) |

|---|---|---|---|

|

Structural unit cost |

502 |

420 |

344 |

|

Total building unit cost |

2,723 |

2,622 |

2,520 |

This Costing Steelwork article produced by Patrick McNamara (director) and Michael Hubbard (associate) of Aecom is available at www.steelconstruction.info.

The data and rates contained in this article have been produced for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the article contents.