With uncertain prospects for finance, recovery in office development is likely to remain cautious. Refurbishment and reuse will remain alternatives but the low-carbon agenda will transform both these and new build, say Iain Parker and Graham Jones of Davis Langdon, an Aecom company

01 / INTRODUCTION

Times remain uncertain, but exciting, for the City of London office development market. With the dust beginning to settle following the global credit crunch, the fortunes of the sector are as inextricably linked to the future success of the city.

The gradual return to health of financial and professional services, and an anticipated rise in levels of employment, will inevitably lead the call for high-quality office space and, in turn, directly affect the pipeline of development over the coming cycle.

Furthermore, according to research by CBRE, a return of the investment market driven by the current lack of supply will see rental income, not capital growth, become the key performance driver in the central London office market in 2011. This is set to be driven further by the expiry of major leases over the next few years, with Aon and Schroders in the market this year for 200,000ft2 and 250,000ft2 respectively. Nabarros will be looking for 150,000ft2 in 2014, with Pricewaterhouse Coopers’ lease on 350,000ft2 of space at 1 Embankment expiring in 2015.

As corporate investors compete for prime commercial real estate in a diminishing supply pool, there is cause for optimism as many of the blue-chip developer-led schemes that became the first and highest profile casualties of the credit crunch, are dusted down and brought to market.

In terms of the supply side response, the availability and affordability of development funding will frame the ability of the central London office sector’s ability to respond.

Juxtaposed against the current funding climate is the government’s low carbon construction programme, with its call for an integrated supply chain and improved efficiency through the adoption of Building Information Modelling (BIM). With the government’s aim of reducing carbon emissions by 80% by 2050 now committed to statute, the programme could, in the words of chief construction adviser, Paul Morrell, “be read as a business plan for construction, bringing opportunities for growth”.

02 / MARKET SECTOR REPORT

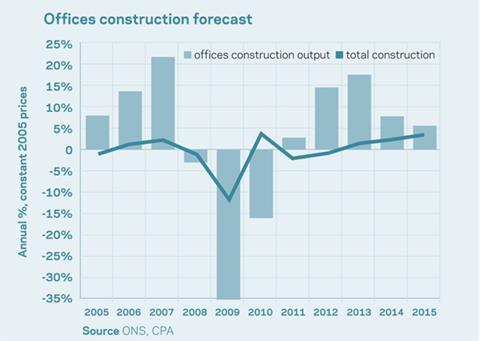

The offices market was one of the sectors worst hit by the 2008/09 credit crunch, impacted by scarcity of finance and investor risk aversion, as well as job losses in banking, financial and business services sectors. The office investment and occupier market saw a sharp downturn and the flow of office construction dwindled.

However, in 2010, as the country began to emerge from recession, commercial property led the way, with a weak sterling attracting overseas investors looking primarily to spread the risk within their investment portfolio through trophy City investments.

Prime rents have been rising since the beginning of 2010, with city prime rents sitting at £55/ft2, an increase of 26% on £43.50 at the end of 2009. This indicates a return of confidence among financial occupiers, according to DTZ, with city prime rents to rise to £67.50/ft2 by the end of 2014.

With office completions in 2011 expected to be at their lowest level for at least 20 years, a supply squeeze in new office space is clearly a prospect.

The increase in demand and a return in confidence should herald a restart of many stalled projects, a number of which were revived in 2010, including tower schemes in the City such as British Land’s Leadenhall development.

A key issue that will either drive or restrict office development will be the availability of finance. Speculative development finance is unlikely to be available in the short term as banks remain risk-averse.

The number of banks providing development finance has shrunk dramatically since 2008, and although there are many that say they do provide funding, in reality most do not.

The recovery in office development in the UK is, therefore, likely to remain cautious, with owners looking at re-use and refurbishment as a viable alternative to new build.

Nevertheless, the recovery in offices new build is expected to pick up gradually this year, led by projects in London, with growth expected to accelerate from 2012, once work starts on large projects brought back on line.

03 / FISCAL INCENTIVES

When set against the current financial climate and its associated strictures in lending, it is worth considering how the post-tax cost of commercial buildings can

be reduced significantly when proper consideration is made of the various fiscal incentives available to an owner.

With increasing HM Revenue & Customs scrutiny the process has to be started early, and with as much as 40% of the construction cost of a commercial office to category A available as a capital allowance, the stakes are high.

Enhanced capital allowances

Enhanced capital allowances (ECAs) are one of the key incentives offered to promote sustainable buildings. ECAs can offer a number of significant tax savings on new developments, but only if they are considered early. Opportunities to claim this 100% tax relief can be found throughout the M&E services within a building. Take lighting as an example: full tax relief can be claimed on the cost of appropriately certified fittings, which can be a significant number on a City tower.

Part L of the Building Regulations is one area where ECAs tend not to be considered in city developments. Often photovoltaic cells or wind turbines are specified to get to the required level of on-site renewable generation. However, neither qualifies for ECAs. ECAs can be claimed on other technologies such as biomass, combined heat and power and ground source heat pumps, which are often overlooked for these schemes.

Refurbishments and fit-outs offer even higher returns of allowances - as much as 80% of construction cost. In the case of refurbishment relief, expenditure on repairs and maintenance could be available in full.

To claim the full potential of capital allowances and other reliefs such as land remediation relief, early professional advice should be sought.

Feed-in tariffs

Juxtaposed to ECAs are the new government incentives, feed-in tariffs, set to go live from April 2010, and the Renewable Heat Incentive, set to be introduced in July 2011.

The feed-in tariffs are designed to incentivise small-scale renewable energy generation with capacities up to 5MW, including technologies such as solar PVs, wind, hydro and anaerobic digestion. The tariffs are set by the government with payment ranging from 9p/kWh generated for anaerobic digestion up to 41.3p/kWh for PV installations. Payment is further supplemented by an “export tariff” of 3p/kWh for surplus energy exported back to the grid. The tariffs are applicable over 20 years - 25 years for solar PV - and are index linked against the RPI. The return is up to 8% a year. In practice this means the capital costs should be earned back between two and three times over the duration of the tariffs.

Renewable Heat Incentive

The Renewable Heat Incentive will encourage investment in energy installations that utilise renewable fuels and sources. This includes biomass boilers, solar thermal, heat pumps (ground and water source), on-site biogas, deep geothermal - energy from waste (the biomass proportion of municipal waste) and injection of biomethane into the gas grid.

The tariffs pay up to a maximum of 8.5p/kWh for hot water and heat that is self-generated and are index linked over 20 years. It is anticipated that participants could earn enough money through the tariffs to recover the initial capital outlay within seven to nine years. The tariffs give building owners and occupiers the opportunity to “green up” their operations economically. These also make it easier to gain benefits under BREEAM, LEED, CRC and their associated planning gains.

The UK office market is moving towards a greener product - with the British Council for Offices’ guide for 2009 heavily biased towards sustainable measures - but the key stumbling block is whether the market will pay an uplift either in rent or purchase price for a “greener” building (with a higher BREEAM/LEED rating and/or DEC grade).

The lesson for the commercial development community is that building an office with as high a green rating as possible is a good way of attracting tenancy and also future-proofing the built product.

04 / SECTOR RESPONSE

About half of all carbon emissions emanate from the built environment. No surprise then that, with new statutory targets to reduce carbon emissions in the UK by 80% by 2050, there is intense scrutiny of the carbon performance of both new-built assets and the existing stock.

So what might this mean for the central London offices market? Although the definition of zero carbon remains a little vague, certainly until “allowable solutions” are better defined, the government has said that new non-residential buildings will have to meet this standard by 2019, with definitive markers laid down along the way - the first being as soon as 2013.

And in practice? From October last year, key changes to Part L (conservation of fuel and power) of the Building Regulations came into effect, with its key target to reduce building CO2 emissions by 25% compared with the 2006 target.

Will this speIl the end of the glass monoliths of the 2000s, as new fabric energy efficiency standards come to bear?

Joint research released in July of last year by Davis Langdon and Arup, pre-dating the release of the revised Part L, modelled a range of potential specification responses and their associated cost differential. In short it found that across a range of facade conditions ranging from 35-70% glazed area, the cost premium for Part L 2010 compliance ranged from about 1-8%; dependant upon the relative mix of a range of factors from glass specification, the degree of active facade strategy deployed and MEP system typology.

A position paper by Davis Langdon and Aecom in December 2010, revisited the central premise of the previous research by asking whether highly (double) glazed facade solutions were still deliverable under revised Part L regulations, without compromising on cost, user comfort or the opportunity to reduce carbon emissions.

Unsurprisingly it urged caution against a blanket response, with each project’s response to be treated on its own merits.

Nevertheless, with careful specification and selection of the correct high-performance glass - considering “g” (solar gain), “U” (heat loss) and “LT” (light transmission) values - selective use of associated internal/external shading solutions and careful consideration of internal heating/cooling systems, then in most cases it was still possible to meet or even better the minimum requirements of the revised Part L 2010, without any detrimental effect on commercial viability.

Looking at an issue of growing importance as we begin to drive down operational impacts - what of embodied carbon? Some of the big developers are already setting targets and measuring performance in this area. Although a standard method of measurement across the industry is not available, tools do exist to help designers identify what options to consider.

What is certain is that design teams will need to work harder on the carbon performance of the building in early design. And with that, explore how the energy supply will be achieved using the most cost-effective, lowest carbon method.

A host of new regulations introduced over the past few years, including Part L, energy performance certificates (EPCs) and the London Plan, are all beginning to drive change. It is also estimated that many proposed developments that already have planning permission have an estimated EPC rating of below C. So over the next few years we may see a disconnect between user aspirations and the available market product.

Under recently announced government plans, all commercial buildings will have to display their actual energy performance on site within the next 18 months. Such a move would mean that the use of DECs will be mandatory for all commercial buildings by October 2012.

The question of energy supply, or specifically power, to the central London market is also a primary consideration. As we stand, hopefully on the cusp of the next phase of development, the city’s existing primary 11kV supply is at, or near saturation. Over the next two years a total of three new circuit routes are being installed to deliver the required power through the 33kV supply. As a result, developers will face a proportionate charge to pay not only for the installation of the infrastructure, but also for their share of the necessary power reinforcement.

The incorporation of life cycle costing, and the growing emphasis on the whole life value of the asset, will increase the importance of considering at concept and design stage to how the building will operate.

With the introduction of innovations such as green leases and Building Information Modelling (BIM), it becomes clear we need to think differently about the way we scope, design, procure, let and operate our commercial buildings in the future.

05 / THE CASE FOR BIM

Much has been made recently of the potential impact that the widespread adoption of Building Information Modelling (BIM) could have on the industry and the potential to reduce costs. Endeavour House, a BAA development, saw an overall 9.8% reduction in project cost though the adoption of collaborative 3D modelling for spatial co-ordination, clash detection and the identification of areas of ambiguity.

In respect of the central London office market, the perceived cost of initial model set-up and development and further along the cycle; the traditional divide between developer and tenant, bringing with it a myriad issues surrounding ownership; and transfer of the model probably present the biggest current obstacles to widescale adoption.

However, these costs and barriers are expected to reduce if the government takes the lead from a client perspective and accepts the recommendation for a five-year roadmap to adopt BIM in public sector projects.

06 / THE FUTURE

So where are we on the curve? In simple terms, there is no escaping the demand and supply equation. The austere economic climate and the generally poor availability of development finance are set to frame both the ability and the manner in which the city offices sector may be able to respond to whatever demand there is.

Whether the next wave of development focuses on new build or comes to reflect a mixed picture of new build and creative re-use and refurbishment, there can be no doubt that the low carbon agenda will begin to dictate the product that the sector offers by way of satisfying that demand.

If not already present, a presumption in favour of sustainable development will become the norm, with the assimilation of fundamental industry developments such as BIM set to determine how far and quickly the industry can go towards a zero carbon position.

07 / CITY OF LONDON OFFICE, Q1/2011

Price inflation

The next 12 months look set to be a period of intense competition, putting further downward pressure on prices, fighting against another year of rising material costs.

Spare capacity, even in London, will remain the dominant force on pricing dynamics. But with strong cost pressures coming through, it seems unlikely that all these costs will continue to be absorbed. As such, it is expected that tender prices in Greater London over the year to Q4 2011 will rise 1.5-2.5%. The second year should see the office construction market even more active and some price and margin recovery should be possible, leading to an anticipated price rise of 2-4%.

Procurement

Driven by the financial climate and increasingly stringent funding criteria, the market has witnessed a re-emergence of single-stage design and build as a challenge to the previously dominant two-stage design and build.

Construction management, with or without a guaranteed maximum price mechanism, is present but generally limited to those developers that can raise funding without a lump sum price and have the intent and resource capability to manage the risks. Benefits include speed, proactive management of the process and the opportunity for both client and designers to work directly with specialist contractors.

The cost model

The cost model revisits the high-quality city office scheme first depicted in 2004. The scheme is arranged over 13 floors, including one basement, with a gross internal floor area of 21,300m2 and a wall to floor ratio of 0:40.

The scheme is steelframed, with rates representative of the current market place. It incorporates a unitised curtain walling facade with solid spandrel panels and selective high performance glass with external brise soleil for solar control, to comply with Part L and thermal comfort criteria. This provides a balance between transparency and environmental control. Air treatment is by four-pipe fan-coil unit.

The cost of category A work to a net office area of 15,340m2 - NIA:GIA ratio of 0.72 overall is typical of current fit-out costs procured through general contracting.

Costs are Q1 2011, based on a central London location and construction management procurement. Site organisation and management costs, fee and contingencies are included in the costs, but demolitions and site preparation, external works and services, fit-out costs beyond category A, tenant enhancement, professional fees and VAT are excluded.

Part L 2010 / BREEAM 2008

The model (see attached) depicts a typical condition for Part L 2010 compliance with a BREEAM rating of “very good”.

In line with the commentary on Part L compliance in the section above, and in respect of internal shading/solar control, the landlords’ contribution toward category A

fit-out for internal blinds should be made and would add an anticipated +£18/m2 GIA to the base model.

Renewables

Although not included within the model, provision for renewables should be made in the region of 5%, as an extra-over allowance against the cost of the shell and core MEP services installation. Typically, this would deliver a combination of some, but not all, of the following: solar PV, CCHP, solar hot water and borehole cooling.

Full provision of up to 5% would equate to an additional +£26/m2 GIA to the base model.

Benchmark range

Dependent upon the overall scheme efficiency, in terms of design economics, specification, construction methodology and procurement route, benchmark analysis currently gives a range of £1,940-£2,370/m2 GIA inclusive of Category A finish. By comparison, the cost model depicted here, to Category A fit-out, sits at

£2,161 /m2 GIA, excluding provision for renewables or internal solar shading, as identified above.

Downloads

Office shell and core works

Other, Size 74.06 kbOffice fitout works

Other, Size 27.94 kb

No comments yet