Business parks are back, but this time they need to be sustainable and mixed-use. Neal Kalita of Davis Langdon examines how developers can meet the evolving needs of planners and occupiers without breaking the bank

The business parks sector

Business parks are a cost-driven sector where the aim of the developer is to construct buildings that are flexible both in use and configuration, as efficiently as possible.

In making their decision as to which headquarters to move into, organisations are attracted to the holy trinity of “lifts, loos and views” - but of course the space must also support the needs of their staff and the way they do business. Organisations are looking for a building that balances quality, cost-effectiveness and flexibility of the space set in landscaped surroundings.

Business parks have had to evolve since their last boom time during the dotcom era. Increasing limitations on car parking, changes in letting strategies, growing awareness of sustainability and a trend towards being part of a mixed-use scheme are all combining to challenge and renew the business park model.

Development opportunities

After a period of subdued activity, business parks are back in vogue, riding on the back of a general recovery in demand for office space. As a sign of this confidence, an increasing number of developers are willing to speculatively build preliminary phases of parks in a bid to meet future anticipated need.

The North currently has the most business park space under development, followed by the South-east. One reason for the northern bias is the current lack of availability of grade A office space in those regions, whereas there is plenty of vacant space left from previous phases of development in the South-east.

However, in the South-east, the demand for grade A specification office space is growing and is complemented by a demand for cost-efficient second-hand space. With rents being held back by available supply, developers need to keep close control over the costs and specifications of their schemes.

Site-specific issues

The following factors contribute to attracting occupiers to an out-of-town business park:

Transport The location of the business park adjacent to a major road intersection is a key deciding factor for many organisations. Direct links with the established road network reduces the pressure on local secondary roads, but due consideration must be paid as to how traffic bottlenecks are avoided at rush hour.

With all large developments, developers will be expected to produce a travel plan that details all the uses that will generate significant amounts of traffic. These plans assess how the developer intends to achieve the local authority’s transport objectives in relation to the proposed business park. As part of the plan, local public transport routes should be integrated, linking to existing bus and rail networks and thus enabling staff to leave their cars at home.

Business parks are generally subdivided into plots with dedicated parking. The layout of these plots, along with each building’s orientation, has a significant impact on the way the park is organised and on the ease of navigation and circulation around it. Clear way-finding around the site is important and, as far is as practicable, the site layout should afford users the shortest travel distances around the site, particularly if they are reliant on public transport.

Amenities Next is the availability of established on-site amenities such as retail and leisure. These provide occupiers’ staff with support facilities that reduce the need for them to leave the park at lunchtime, helping to reduce levels of traffic.

There are inherent difficulties in locating shops and other facilities on business parks, as they have low occupation densities and little passing trade. As a rough guide, a local corner shop needs a catchment area of 6000 homes to provide the demand to sustain it in the long term. Providing this level of demand in a business park is very difficult and there is the risk that units might be left vacant.

In urban developments such as Chiswick Park, clustering the offices and incorporating the retail offering within the office shell have addressed this problem. For out-of-town schemes, having a mix of residential and commercial uses on the site contributes to the viability of the amenity offer.

Location The location in terms of its fit with the organisation’s core business and the potential to support its growth is another factor that may appeal to prospective occupiers. Many businesses, particularly those in the high-tech sectors, benefit from locating in clusters as they can take advantage of co-operating with other co-located operators in their industry and of the readily available source of talent from academic institutes in the area. A prime example of this is Cambridge.

Catering for different needs The need to cater to the widest variety of occupiers and at the same time attract high-end organisations to a business park development is a difficult balancing act. A way round this is to provide office space in different configurations that support the differing needs of prospective occupiers:

a) Ways of supporting multiple small organisations with incubator status:

- Provide buildings that can be readily subdivided into smaller units

- Cost efficiency is key, which means the quality of building can be lower than buildings catering to more established occupiers

- Shorter leases and a more relaxed approach to the quality of an occupier’s covenant and other aspects of letting risk are necessary but enable the business park to “grow their own” occupiers.

b) Support medium-sized organisations in larger buildings with a higher specification:

- Floorplates of these buildings are larger

- The ability to subdivide is still important

- Increased complexity because of the sophistication of building services installation required.

c) Support a large corporation looking for a headquarters that will have its own entrance and reception:

- Some building layouts allow more than one organisation to be accommodated in self-contained units under one shell, with only limited sharing of WCs, public spaces and other facilities.

- Opportunities for a pre-let may give the occupier a greater opportunity to tailor the building to their own needs - subject, of course, to the additional cost of occupier’s enhancements.

Density The density of a development is expressed as a ratio of gross internal floor area to the site area. In out-of-town developments the standard has generally been 0.45, although densities of up to 0.55 have been attained.

It is difficult to estimate how this impacts on the prospective organisations’ opinion of the business park, but for the developer, sweating the asset through higher densities typically means higher quality and cost balanced against greater intensity of land use.

Provision of car parking This is potentially a major problem, and since PPG 13 was first issued, planning authorities have been exerting downward pressure on permitted parking provision. Whereas in the 1990s, a ratio of one space per 35 m2 GIFA was common, new consents are in the range of one space per 50 m2, and this requires some form of rationed parking allocation. In higher density business parks, undercroft or grade and single deck options may need to be considered to accommodate the reduced levels of parking now permitted.

Building-specific issues

Base specification

In a developer-led, out-of-town business park, the base specification for the building is to provide flexibility at a target cost that appeals to the widest occupier audience.

The most common features found in offices of this type are:

- Column grid, span range: 7.5 m to 9 m

- Floor-to-floor height range: 3.75 m to 4 m

- Two-to -four storeys

- Air-conditioning (primarily for developments in the South-east)

- Category A fit-out.

Business park building design has always tended towards a standard model, and developers who aim to add value can differentiate their product through:

- Distinctive external architecture

- hIgh-quality common parts

- Investment in a secure, high-quality external environment.

Flexibility and adaptability of the internal space is a requirement from both occupiers and investors. Certain considerations can impact on the flexibility of a building, and these are outlined below.

Layout and subdivision options

Internally, well-executed sub-division options are critical to maximising the efficiency and flexibility of the floor space and its long-term value. Where, because of the building layout, subdivision requires additional circulation and/or means of escape outside of the existing core, about 5-10% of lettable floor area can be lost.

The drivers that will ensure efficient subdivision are:

- Optimising the design around means-of-escape dimensions

- Ease of access to common parts from all areas of the floorplate

- Transfer the location of fire-escape stairs to outside the building perimeter to reduce the loss of lettable area.

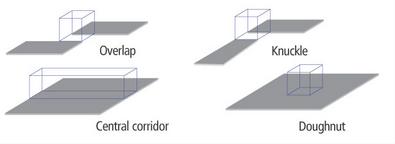

Examples of generic layout options are set out below. Each floor can be subdivided into at least four suites for separate tenancies. Means of escape is provided through the core (in blue) and external staircases.

The configuration of the building has a direct impact on the quality of subdivided space. Where the floorplate is arranged around a “knuckle” or “overlap” arrangement, the four suites can be created without loss of lettable area - however, the resultant units are long and thin, which may not suit the space requirements of all occupiers. By contrast, “central corridor” and “doughnut” layouts afford more subdivision options but may need additional circulation around the core, which reduces overall development efficiency.

Floorplate and wall-to-floor ratio

> In speculative buildings, the floorplate should generally be uniform to facilitate space planning and subdivision. Generous structural grids providing largely column-free space are also valuable. Where occupiers taking a pre-let have influence over the planning of the building, this may result in a less regular and potentially more interesting architectural and structural solution.

Red Kite House, developed for the Environmental Agency by HR Wallingford, is one example of how a building with a sustainable agenda and a willing owner can break the constraints of the 1.5 m planning grid to achieve a curvilinear shape that in turn contributes to its green credentials.

> Floorplate depth is critical to establishing space planning and building services options. The BCO guide suggests window-to-window depths of 15-18 m. A 15 m floorplate could potentially be naturally cross ventilated, whereas an 18 m solution may need an increased ceiling height for good-quality daylighting.

In addition to determining ventilation options, deeper floorplates also reduce the contribution of facades to overall building energy consumption. Although narrow-plan buildings are best for daylighting and cross-ventilation, more work has to be done at the facade to combat solar gain, fabric heat loss and glare.

> The floorplate, building plan and complexity of the facade solution will have a direct impact on the wall-floor ratio. For a cost-effective solution, a good ratio is 0.40 with 0.35 regarded as very efficient.

As the wall-floor ratio falls, however, requirements for more complex building services solutions tend to increase. The worst outcome, of course, is a building with high services content, an expensive facade and a poor wall-floor ratio.

Building systems

In terms of M&E systems, air-conditioning is expected by most occupiers. Fan coil units, or in some cases VAV systems, are the preferred options, because of a range of issues including flexibility, performance, control and economy in use.

In recent years, displacement systems, often featuring some form of static cooling, have been specified in some business parks. Displacement can be a greener option with lower carbon emissions and operating costs. However, it gives less flexibility to the occupier and less close control of internal conditions. As a result, in some instances occupiers have retrofitted conventional air-conditioning into “green” business park buildings.

Developers pursuing the displacement option should consider providing additional plant and riser space to accommodate this eventuality.

The new Part L

The impact of Revised Part L on the design of business parks could be quite substantial, with the established aesthetic of highly glazed, lightweight clad buildings likely to be replaced by more solid, energy-efficient buildings.

The new Part L requires a 28% reduction in carbon emissions for a ventilated building compared with the 2002 benchmark. The main approaches to achieving this can be summarised as follows:

- Minimise CO2 emissions from building operation Achieved through reducing energy consumption in heating, cooling, ventilation and lighting. Measures include the use of more efficient central plant, energy reclaim, or more effective controls such as dimming lighting in response to daylight levels.

- Minimise heat loss and gain Achieved by using thermally efficient materials and insulation in the facade thereby minimising air leakage and infiltration, and potentially exploiting the thermal mass of the building itself to regulate temperature.

- Avoid excessive solar gain Achieved either through facade technology or perimeter shading from landscaping or by orientating the building to minimise the effect of direct sunlight.

Sustainability

Sustainability is increasingly a key requirement of planning authorities and occupiers. For the developer, incorporating sustainable technologies into a development may occur on a building-by-building basis, or by waiting for demand to reach a critical mass to trigger site-wide sustainable development.

Sustainability can also encompass the use of the landscape through sustainable urban drainage systems and through the inclusion of existing natural features into increasing the site’s green credentials. Red Kite House has achieved a BREEAM rating of “excellent” through its use of some of the sustainable technologies, listed here:

- Roof wind turbines to aid natural ventilation on upper floors

- Rainwater harvesting systems to supply WCs

- Installing solar panels on the roof to provide hot water

- Focused landscaping designed to improve perimeter shading.

Developers’ aims and critical success factors

For developers, the key factor in determining the success of a business park investment is to ensure full development value is secured over its economic life. This is achieved by fully letting the park not only in accordance with planned development phases, but also in ensuring that the park lets well in the second-hand market.

In order to meet this objective, a developer’s generic aims for such schemes include:

- Efficiency in providing space that will attract occupiers while maximising the value of the building or buildings by optimising the net lettable area

- Ensuring the development comes to market in time to capitalise on increases in demand

- Maximising the differential between cost and value

- Ensuring the quality of the office product is in line with rental income projections for the location.

Procurement

The construction phase is key to getting the development right and the selected procurement route will have a significant effect in enabling the developer to secure a design that is well targeted at its market, permits phasing of the development in line with market conditions, and manages development risk.

The procurement route selected should allow design to flourish within the constraints of the business park model. Where appropriate, the client should also examine using the knowledge of specialist contractors at an early stage in the design development to maximise efficiency and cost effectiveness. The developer’s objectives for the procurement route can be summarised as follows:

- Design and construction of relatively simple buildings

- Meeting strict cost and time targets

- Facilitating learned lessons from phase to phase thus encouraging improvement

- Achieving a favourable balance of risk between client and the supply chain.

- Design-and-build and traditional lump-sum contracting are common contractual approaches on business park schemes.

A business park development is potentially a source of a sustained stream of workload for the local economy. The developer should be able to exploit local buying power, the efficiencies of an established team and the incremental lessons that can transfer from one phase to another.

However, the developer must guard against the project team becoming comfortable, and some form of tendering is therefore important to ensure prices remain competitive from phase to phase and to maintain the focus of the incumbent design team and contractors.

A key benefit of using the same construction team over a multiphase development is greater continuity over later development phases that provides:

- Greater confidence from planners that the submission for later phases will be in line with their expectations

- A better understanding of the developer’s priorities

- Continued refinement of design solutions implemented in the early phases.

Out-of-town business park cost breakdown

The cost model features a standard office building located in the South-east. The specification includes: GIFA of 65,000 ft2, two storeys arranged around a central “street”, steel frame and standard FCU’s fitted.

The model covers shell-and-core works, fit-out costs to category A specification and external works. Preliminaries and contingencies are also included in the costs.

Rates are at first quarter 2006 price levels and total cost of the development including the external works equates to £114/ft².

Exclusions include the cost of demolitions, external works and services beyond plot boundary, fit-out costs beyond Category A, tenant enhancement, professional fees, VAT and specific site abnormalities.

The rates may need to be adjusted to account for specification, site conditions, procurement route and programme.

Credits

Thanks for the valuable input and insight to Richard Partington and Jim Richards of Richards Partington Architects and Steve Marriott of Scott Brownrigg. The cost model was produced by Tony Lewis of Davis Langdon.

No comments yet