The increase in housebuilding doesn’t look that impressive when you plot it on a graph

The latest official housing figures provide a bit of a puzzle. The uplift in the actual figures doesn’t look that spectacular when you plot the graphs, so why is there so much fuss?

The tale on the street is that housebuilding is booming. Brick shortages, skills shortages, rising prices, it has to be a boom.

And picked judiciously the figures are powerful. Private starts were up 29% in the third quarter compared with last year. Housing associations also started a whole bunch more in the third quarter than they did a year earlier.

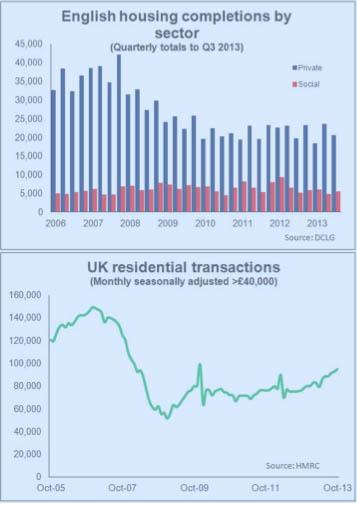

But when you pan out from the immediate data and look at the trend in a longer-term context (see top graph), which includes the pre-crash norm, the uplift looks pretty pitiful really, given the immense challenge we have to house the nation.

Sure if you look at growth in private starts over the past three quarters (see second graph) the trajectory is impressive. If we had steady growth along that path it would take about a year to get back to levels we saw in 2007.

But that’s fantasy. The reality is that the completions figures (see third graph) still look pretty flat. Yes, these will rise as starts feed through to completions, but don’t expect anywhere near the trend we see in the starts.

What’s more we’ve seen bigger rises both in percentage and volume terms in private sector starts in the past. The current surge, on these figures, isn’t that special.

Perhaps then it’s the sense of an improvement in the wider market that is engendering a wave of near euphoria within some circles about the performance of house building.

Let’s look at residential transactions (bottom graph). The rise there is pretty strong if we take the data from March onward. But still, taking a bigger picture view, things are still a long way off normal.

And that word “normal” possibly holds the key.

We have got used to low levels of building, low levels of sales. We have adjusted our expectations and, more importantly, our whole industry to a new level.

As I will keep saying, the construction industry is very flexible, it can adjust quickly. But such rapid adjustments are not without consequences.

Even with a very flexible industry, it will be a long while yet before we are anywhere near back to where we were and that leaves a further haul to get us to where we should be.

Add to that the hurdles that face the industry on the way, the withdrawal of Help to Buy and rising interest rates, and the gloss rather quickly comes off these figures.

Worse still, it is hard not to be angered by how, politically, the level of housebuilding was allowed to fall to such a pitiful level.

Brian Green is an independent analyst, commentator and consultant working in construction, housing and property

No comments yet