Design, procurement and construction processes have become more complex over time, and the added complications of covid-19 and Brexit have piled on the pressure. Steve Watts of Alinea examines in detail the factors affecting productivity and considers how we can bring about improvements to get more for less

01 / Introduction: the productivity puzzle

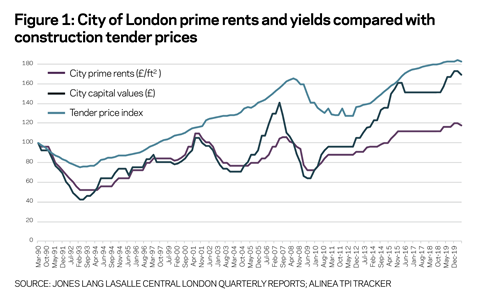

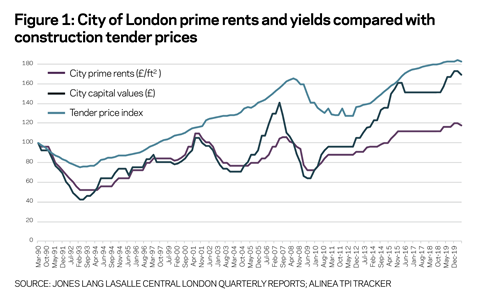

Life has become ever more complicated, and property development is no exception. It has always been an endeavour with finely balanced risks and rewards, and in which profitability is influenced by a range of factors, some easier to control and predict than others. The graph below of prime City of London rents, capital values and construction price inflation over the last 30 years (figure 1) shows office development in the capital has faced ever‑increasing cost pressures and values that have been supported by yield compression.

The need to create better buildings, using a widening definition of quality, against ever more restrictive constraints on the supply chain, means the whole process of briefing, design and construction needs to be more efficient and certain, so that all parties involved can enjoy more consistent rewards.

One of the sectors weathering covid-19 well, even thriving through it, is technology – Nasdaq, a tech-heavy stock index, has leapt by 40% this year. Technology has often been seen as the saviour of productivity, yet back in the late 1980s Robert Solow, a Nobel Prize-winning economist, said that “you can see the computer age everywhere but in the productivity statistics”. Unfortunately, those statistics have not fared any better since, despite more powerful computers and better software being more readily available and at lower prices.

In 2015 the then chancellor George Osborne wrote in the annual Budget that “productivity is the challenge of our time. It is what makes nations stronger, and families richer.” He added: “The UK has a long-term productivity problem.”

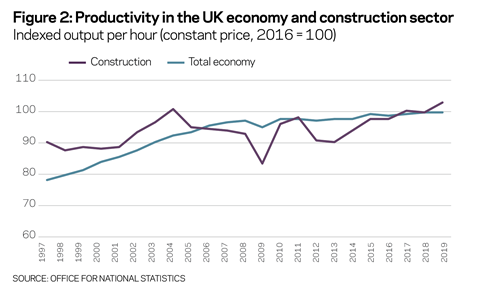

Five years (and several crises) later, it seems some improvements have been made: in 2019, across all industries both output per hour and overall (total factor) productivity improved. At the end of 2019 the Office for National Statistics reported that construction’s output per hour had improved by just over 5%, yet anyone involved in the industry knows there is still much waste and inefficiency.

02 / The cost of regulatory and product changes

As the construction tender price index in figure 1 indicates, over the last decade construction has increased in price by around 40%. Prices are influenced considerably by the changing state of the construction market (fluctuations in supply and demand), material and labour price inflation and external factors such as currency exchange rates.

However, a large part of the increase in cost (30%-35%), looking specifically at office buildings, has resulted from changes to the product and how it is delivered to market. These can be grouped as follows:

- Sustainability measures: power and energy management systems, metering, rainwater harvesting and greywater use, all-electric buildings.

- Fire protection: additional fire-fighting lifts, compartmentation, fire rating of mechanical ductwork, and other responses to Grenfell.

- Health and wellbeing: fresh air rates, aesthetic trends such as the expression of staircases and structure, WELL standard enablement, extensive roof terracing, and other amenities.

- Functional enhancements: increased flexibility for tenants, better Category A fit-out standards, improved look and feel of spaces, better facilities management, cycle storage and showers.

- Construction process: investment in logistics such as consolidation centres, latent defects insurance, improved recycling and waste management, soft landings initiatives and more involved commissioning.

Most of these have a sound rationale behind them. However, against the backdrop of a recession, receding and uncertain demand, further enhancement of offices to meet the net zero carbon agenda and other challenges such as Brexit and covid, it would seem we need to refresh our judgment of what is essential and valuable.

The cost of sustainability

Climate change has accelerated up the agenda of design team meetings. It is an added challenge, and an important one, for buildings to be designed in consideration of their full impact on the environment, from cradle to beyond the grave.

To make buildings sustainable means more than reducing their carbon footprint: it is equally about their cost footprint (over the same time horizon), their impact on the health and wellbeing of occupants, and increasingly on the social value they help to create beyond their site boundaries.

Quality in design means so much more than it did a decade ago, and assessing a scheme’s commercial attributes has become that much more involved, with an underlying further pressure on viability.

03 / The cost of covid-19

The cost in MEP responses

Covid-19 has prompted some projects to implement changes to base-build mechanical, electrical and plumbing (MEP) systems, which can be grouped under “air” and “touch”.

Air

The importance of fresh air has come to the fore as teams look to reduce recycling and achieve better-quality air at increased rates:

- Dedicated fresh air into toilets rather than just recirculated air from the office

- Air purification to lift cars via filters

- Bipolar ionisation (BPI) to air-handling units – active filtration to deactivate airborne mould, bacteria, allergens, viruses and so on

- Enhanced fresh air rates, above British Council for Offices minimum of 12l/s +10%, up to 20l/s

- Fresh air supplied beneath raised floors creating positive upward movement of air, so that potentially harmful air pollutants can be extracted at a high level

- High-efficiency particulate (HEPA) air filters to fan coil units – a fine grade filter.

Touch

Reducing levels of contact with surfaces in a building is being achieved by:

- Passive infrared sensor (PIR)-operated toilets, urinals and wash handbasins

- Indicator systems to control numbers entering toilets

- Motorised doors to office areas and touchless proximity buttons for exits

- Thermal imaging cameras at entrances

- QR code readers on turnstiles

- App-based lift-call systems, similar to QR codes, with no need for swiping

- Turnstile integration with lifts

- Escalator ultraviolet handrail sanitisation.

Site restrictions and enduring risks

The covid-19 lockdown in March stopped the industry in its tracks. With over 50% of sites shutting down, albeit some only briefly, site productivity was immediately affected, falling to levels below 20%.

Contracting teams scrambled to respond, and the second quarter saw sites return to more encouraging levels of activity. Site teams collaborated impressively to mitigate the impacts of social distancing and the Construction Leadership Council sprung into action, issuing a series of site operating procedures, among other guidance. Efficiencies were realised through a combination of streamlined processes, reduced levels of management, and trades not working on top of each other, enjoying less interference and increased camaraderie.

However, a number of projects were paused or put on hold, making longer-term pipelines look precarious. On those projects that continued, restrictions have caused programmes to be extended, in some cases significantly. Contractual law fell on the side of employers in that extensions of time could usually be obtained but damages for loss and expense could not. While some employers did what they could to ease cash flows across the supply chain, contractors and their subcontractors were left with increased costs that could not be recovered. Developers, for their part, were left with projects that would take longer and cost more to complete.

Finances have been adversely affected and there remains uncertainty about how, in any future pandemics, they will be dealt with – practically, contractually and commercially. What seems clear is that sensible discussions must take place around the nature of particular risks, where they should sit, and how they may be reimbursed if appropriate. This is likely to involve a more granular consideration of the issues in relation to imported materials, labour and the practical responses to covid-19.

04 / The cost of Brexit

As a result of the Brexit transition period now having come to an end, there will be pressures and some enduring uncertainty from new trade frictions, delays caused by customs checks at the port, and changes to free movement of people.

Now that the UK has completely left the EU, the construction industry will no longer have easy access to the transient workforce it has historically used to supplement its domestic workforce. New rules on visas will make it difficult for EU nationals to work in the UK filling large numbers of skilled roles, without pushing up labour rates to meet the new points threshold.

Due to the combined impacts of Brexit and the coronavirus pandemic, in its latest forecast the Construction Industry Training Board suggested that construction employment would fall from 2.7 million in 2019 to 2.4 million in 2021, and would not recover until 2025. Excluding 2020, construction output was expected to have increased in every year of this forecast period, according to the Construction Products Association, increasing demand for a diminishing labour force.

These pressures could threaten the productivity of the construction industry by increasing the cost of construction, as well as by reducing the number of people available to build, design or provide services to the built environment.

The cost of structural faults

An article in the Financial Times in June 2018 referred to the “outsourcing system of the UK constructing model”, commenting on the fact that main contractors make little or nothing for their efforts while contributing just 10% of the workforce on a typical construction site. It remarked on how risks are passed down through many layers of the supply chain, not necessarily in a way that matches them to appropriate rewards, suggesting that these structural faults encourage an opaqueness of responsibilities and a tendency to cut corners.

In 2019 Alinea conducted research and obtained views from a selection of clients, ultimately asking the question: is there a new way to procure construction projects? It uncovered some common reasons for failures in procurement, and some ideas for getting the best out of the process, but firmly came to the conclusion that when problems occur it is usually down to poor behaviours.

Sub-optimal behaviours against a background of fault lines in the way the industry is structured results in poor productivity and wastes money.

05 / Align for success

It is often assumed that everyone on a construction project will understand the fundamental objectives and how to play a part in achieving them. More often than not, however, that assumption is wrong. Everyone will have an appreciation of some elements, but rarely will the whole team have a full and aligned understanding.

An aligned-for-success process is a very simple one: it is about making sure everyone involved has a shared and very clear understanding of the “why?”, “what?” and “how?” of the project:

- Why are we undertaking the project?

- What do we need to achieve and what does success look like?

- How will we work as a team to deliver it?

These simple questions have their genesis in some significant projects that did not achieve the success they deserved because of a lack of understanding and alignment. A National Audit Office briefing for the Committee of Public Accounts in 2016 stated that “a third of government projects due to deliver in the next five years are rated as in doubt or unachievable unless action is taken to improve delivery”. The briefing outlined key issues such as poor early planning and a lack of clear accountability in the leadership of a project – making issues on high-profile projects such as Crossrail all the more understandable.

Such issues are not the exclusive domain of the public sector: the gap between success and failure in private sector projects rests on the same principles.

06 / Intelligent procurement

The UK procurement model’s failure to support collaborative behaviours or ownership from the supply chain, leading to a lack of accountability and often poor quality, is not its only problem.

There are also other issues: the avoidance of BIM, a failure to capture lessons learned, unrealistic programmes, poor design detailing, low-quality tender documentation, and a focus on lowest price.

Some clients want their construction partners engaged from day one, and the only reason they hesitate is because they worry about getting a fair deal.

Fundamentally, there is a need to:

- Set a clear procurement philosophy – not choosing on price alone, being realistic and clear on risks, considering trade contractors’ perspectives and involving them early, and defining a strategy early against agreed objectives.

- Select the right team – the one that is best for the client and for the project, getting them to reinforce the above philosophy and instilling in them a common culture of teamwork.

- Know what “good” looks like – particularly in terms of exemplar design reports.

- Map the supply chain – its layers, complexities and geographical spread, to better understand costing, delivery risks, responsibilities and carbon footprint.

The opportunity lies in putting this all in place and sending the right message to the market: “We have a thoughtful client, an aligned and prepared team; we will truly adopt BIM, work openly to mitigate risks and allocate them fairly, and want a partner to help deliver our vision, for which we will pay a clear and fair price.”

07 / Digitalise the process

Construction was ranked one of the least-digitalised industries in the UK in a recent survey from McKinsey, above only agriculture and hunting. The industry has always been fragmented, with its separation of design and construction, and its complex supply chain layers. No doubt, this contributes to poor performance, low investment and insufficient innovation (and partly explains the poor productivity data).

A considerable number of construction businesses are not fully embedding digitalisation. In July 2020 the RICS surveyed firms across 13 countries and surmised that “digital transformation is a priority for 72% of construction firms worldwide. But 32% of surveyed firms spend less than 3% of total turnover on digital technologies. The very best of intentions are useless without investment.”

Digitalisation in construction can reap real benefits if applied across the whole design, procurement and construction process. Informed clients recognise the investment required in project infrastructure and skills but also understand the benefits to detailed design co-ordination and development.

Alinea has real evidence to support the commercial benefits:

- Quick and clear exchange of information: rapid workflows and the ability to work with models in 3D.

- Harvesting of quantities that produce fast, reliable and accurate measurement.

- Linking measurement to cost plan pricing data and subsequent optioneering of design BIM models for detailed design and procurement, to de-risk design co‑ordination and identify scope gaps or points of risk. Such a robust position can be used as a foundation of contract negotiation to provide confidence to the contractor, which manifests in lower prices.

- Measuring construction progress and intelligent valuations using digital platforms, providing effective and transparent records of site progress.

08 / Smart simplicity in design

In the 1990s leading clients recognised the benefits of integrating supply chain innovation and technical know-how into design and construction processes. The definition of a “completed” design for contract execution has become growingly unclear, exemplified by the blurring of lines between RIBA Plan of Work Stages 4a and 4b, and the perennial debate around the hierarchy of contract design and precedents.

A building is often designed twice and built once – designed for tender and then redesigned by the contractor’s supply chain to facilitate construction. Sometimes what appear to be the most straightforward of package designs, such as drylining or blockwork, are just not suited to the needs of the builder. There can be a lack of technical understanding from the designer, the cost consultant and the main contractor about how best to convert the information into construction detailing. Poor tenders and site problems can result.

Cost can be eliminated from the design and construction process by placing the detailed design under the control of the party best placed to undertake it. Naturally, a design should be co-ordinated at key milestone stages, particularly RIBA Stages 2 and 3, but beyond this, the benefits of engaging with industry to complete detailed design in a more integrated model is critical to remove waste (in process and construction) and improve efficiency, delivering better quality at reduced cost.

A typical example: drylining

A design team will seek to develop a detailed design for drylining based on industry standards that best suit the architectural and performance criteria of the particular building. On a major project this could result in as many as 40-50 different drylining wall types.

Dryling subcontractors will see this as frustrating: technical design of multiple wall types complicates co-ordination with other trades, and procurement of materials, supervision of installation, and creates more waste. The supply chain’s approach will be to reduce the number of wall types to optimise cost and time.

While to an architect and cost consultant, the trade may choose wall types that mathematically could look more expensive, consistent detailing will create efficiencies in construction to optimise time and cost.

Only through earlier trade engagement or perhaps procurement of package design based on performance criteria and broad architectural requirements can these benefits be maximised. There are many more packages that would benefit from such a “design once, build once” approach.

09 / Low carbon, low cost

To put an unsubstantiated allowance against “sustainability enhancements”, or to assume that the creation of a low carbon building must accrue a significant cost, is unhelpful and potentially misleading. There should be enough information and data to provide a menu of costed (and carbon-assessed) options.

A net zero carbon building does not have to attract a significantly higher construction cost (though it can). A wide variety of considerations are key to ensuring that a project is effective, functional, viable and sustainable:

- There is a very strong link between carbon, cost and value, requiring clarity of project brief and objectives at the outset. The hierarchy of possible interventions begins with a concept design that aims to be as materially efficient as possible, removing both carbon and cost from the building.

- Concept decisions driven by low carbon goals need to be made early to have a benefit: halfway through RIBA Stage 2 is too late.

- Traditional office drivers must be challenged and evaluated, as they often compete with low embodied carbon.

- Focus should be placed on where 75% of embodied carbon lies: the structure (floors and columns) and the basement.

- It is not just about carbon; sustainable design covers environmental, social and economic aspects. The consensus will sometimes be a best fit across all these parameters.

- Net zero carbon refers to the whole lifecycle of a building, from upfront carbon used in construction to the carbon used in whatever happens to it at the end of its life (stages A, B, C and D as defined by Whole Life Carbon Network): all of this is important.

10 / Positive lessons from covid-19

Site teams’ responses to the pandemic have resulted in increased levels of teamwork, raising productivity amid challenging restrictions. Streamlined practices include:

- Detailed planning of the works upfront and on a continual basis to properly assess what materials, labour and activity are required at the optimum time.

- Trades working in smaller groups, in a co-ordinated sequence, without the frustrations of lack of materials, congestion and the non-completion of previous trades.

- Cleaner, healthier places to work, with improved health and safety leading to greater care, attention to detail and pride in delivery.

- Streamlined management, decision-making and communication approaches enabling clearer direction on what is required, when and to what standard.

- Increased automation on site, together with implementation of offsite prefabrication to reduce installation time and the number of operatives required on site.

Site teams enabled to deliver projects under these conditions have been better motivated to deliver more effectively, with real gains that were well documented in the Loughborough University report, Covid-19 and Construction: Early Lessons for a New Normal? Alongside five main contractors and a trade contractor, the researchers assessed six projects and concluded there had been rapid and effective responses, with changes in site layouts and working practices resulting in remarkable improvements in worker effectiveness, with a perception of improved health and safety too.

The report includes some powerful statements, not least: “with the productivity and the new ways of thinking we believe we only need 7½ people to do the same job as 10 people”. We need to embed such learnings into future projects.

11 / Conclusions

The waves of covid-19, Brexit and climate change will wash over one another in the coming months and years. The response of real estate will be to look for buildings that are future-proofed and sustainable (indeed, this is already happening), in what many are calling a flight to quality.

In product terms, these are uncertain but exciting times, yet the ability of the industry to help create these future buildings is compromised by some fundamental constraints, and the viability of projects will rely on teams and supply chains being able to find efficient ways of designing, procuring and constructing.

Progress enabled by technology may well bring some productivity gains that are not yet realised, but it may also expose flaws in how we organise our projects. It will be just as, if not more, important to instil the right behaviours: more than anything, teams working together towards the same goal will determine success.

Alinea has distilled the responses to these challenges into a manifesto, with the belief that its implementation could produce savings in out-turn construction costs of up to 10% compared with the status quo.

Five-point manifesto to boost productivity:

1. Set up the project for success

2. Make the use of BIM and digital working the default setting

3. Strive for smart simplicity in design and detailing

4. Place net zero carbon at the top of the agenda

5. Challenge the product to reflect a new world

Acknowledgments

Alinea’s Mark Lacey, Rachel Coleman, Mark Day, Paul Montgomery also contributed to this article.

No comments yet