Richard Steer wasn’t surprised to read that the cost of the London Olympics is set to rise – they nearly always do. What counts is what you get for the money

Shock, horror: the London Olympics is going to cost more money than first thought. Those who live in the real world of project and cost management – that’s us – realised the price tag was a little understated when the figures were first touted. Taking into account rising labour costs, ever-changing security considerations and inflationary pressures from heightened energy costs over the next six years, it may be that a predicted £1.5bn overrun is still too conservative.

However, the Olympic Delivery Authority appears to be well in control of the situation and is pressing all the right buttons at this time. I am not sure where the story of possible overruns originated, but it is shrewd news management to start getting it out at this time and to move the agenda from sports to legacy and regeneration.

We will not be making the same mistake as the mayor of Montreal, the host of the 1976 winter Games, who declared that the Olympics “could no more make a deficit than a man could have a baby”. The Canadians will finish paying off their £1.2bn, 30-year debt in 2008. There’s no news yet on the babies.

I’ve had a quick look through the archives to find out how other cities have fared – it makes for revealing reading.

Barcelona budgeted the 1992 Games at about £3bn; they eventually cost £6.2bn. They also rejuvenated a dilapidated waterfront with housing and an impressive marina and unemployment dropped from 18.7% to 6.1% during and after the Olympics.

Atlanta 1996 was not the best organised Games and a lot of the venues were already in place, but it did make more than £500m in profit.

Sydney 2000 had an infrastructure budget of £1bn, set in 1998. By the time the torch was lit in the opening ceremony, this had risen by more than £300m.

I am not sure where the story of possible overruns riginated, but it is shrewd news management to get it out at this time

Athens was a memorable sporting event, but costs spiralled and a the need for increased security after 9/11 helped raise the final account to more than £7bn. The question of legacy was overshadowed by tight timelines and many of the venues are now redundant.

So what can we learn from these experiences? First, we need to manage global and local expectations. The team running the Olympics – Lord Coe, Lord Moynihan, Tessa Jowell and Ken Livingstone – are all politically experienced and media savvy, though they may not all be in position for the next six years. The man in charge of the Olympic Delivery Authority, David Higgins, has a formidable track record of achievement.

The formation is settled, too. Our Olympic line-up is a clear 2:4:1. That’s two years of planning, four of building and one of testing.

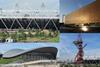

A central plank of the Olympic legacy strategy is that the area of London housing the games, Newham, Tower Hamlets, Waltham Forest and Hackney, are four of the 10 most deprived boroughs in the country.

Legacy costs money in the short term, and 40,000 new homes will cost £1.5bn if you throw in the costs of laying extra power lines, drainage, decontamination work and cleaning rivers. But it will serve as a beacon for the

UK construction industry when we get it all right. You notice that I say when and not if.

The eyes of the world are on this project – this is not a Premiership stadium or a Tube line. This is a chance for the best of British to demonstrate how good we really are. A golden opportunity to realistically manage expectations, move into an early lead and stay in front right up to the finishing line.

Postscript

Richard Steer is senior partner in Gleeds

Get the latest London Olympics news at www.building.co.uk/2012

No comments yet