Little evidence of election uncertainty according to latest indices with growth in contract awards across sectors

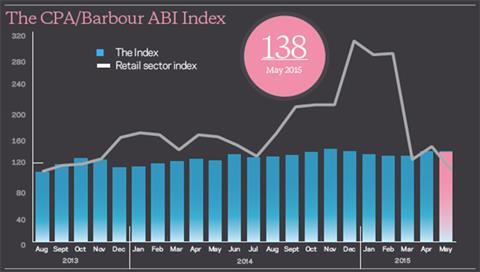

The good thing about the election being out of the way is that it means everyone can stop talking about it and focus on business. If the uncertainty around it was going to have a significant impact on the industry, we would have expected it to be picked up in new contract awards over the past few months. But, that wasn’t the case judging by the CPA/Barbour ABI index, which was 138 in May, the same figure as April and 12% higher than one year ago. This is because, in general, private sector construction is determined more by the state of the UK economy than anything else, regardless of elections. Across the indices, growth in contract awards was seen in May in the private housing, health, hotels, factories and warehouses sectors, which should continue to boost activity on the ground throughout 2015 and into 2016. However, it wasn’t all good news. May saw a fall in contract awards in education, offices, retail and leisure projects.

Click here for all the latest Barometer data

Retail sector index

Shifting sands

The retail sector is currently in a state of flux. The long term is very much about how retailers adjust to the increasing movement towards internet shopping, which shifts construction away from traditional retail and towards warehouses distribution centres. However, the short-term fortunes of the retail sector surround when we will see a return to shopping centre growth, which has broadly been flat over the past year, and the movement away from new build retail towards the refurb of existing properties on high streets in main cities. This is especially the case for the major supermarket chains, which had previously been the key driver of retail construction but are increasingly finding themselves under pressure from low-price chains such as Aldi, Lidl and Netto. As a result, the major supermarkets are in a period of consolidation; closing larger stores while focusing on opening small shops with higher margins, but at a slower rate than previously. So, it is little surprise to see the CPA/Barbour ABI retail index in May fall to just 109 compared with 145 last month and 160 one year ago, suggesting a challenging period ahead in 2015.

Noble Francis is economics director at the Construction Products Association

No comments yet