I’m not often optimistic, but 2015 looks set to be a happy new year for construction

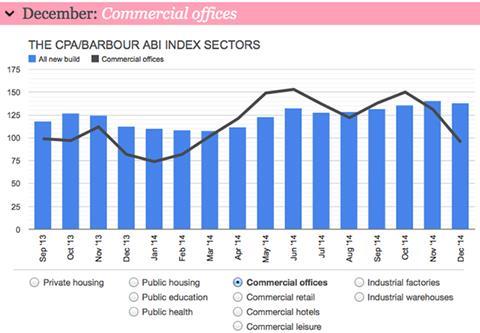

The CPA/Barbour ABI overall index for construction contract awards was at 138 in December, 2% lower than November’s high, but 23% higher than a year earlier. Output rose 5% in 2014 and the index indicates similar growth this year. Increases occurred in almost all sector indices, which bodes well for the recovery’s sustainability. In 2014, private housing was the key driver, but to have the whole industry driven primarily by one sector heightens the recovery’s risks. But, with increases in awards for education, health, commercial and industrial, we should see both private construction growth and a welcome return to public sector construction this year. As for the risks, on the positive side the fall in oil prices should cut costs significantly. However, key concerns regard labour availability and election uncertainty, which may hinder public sector contract awards this year and impact on activity next year.

Click here for all the latest Barometer data

Commercial offices sector index

Looking beyond London

The commercial offices sector is traditionally dominated by London, which accounts for around 40% of UK office construction. It was hit hard by the financial crisis to the extent that office construction in 2012 was 53% lower than at pre-recession peak, in 2007. 2013 and 2014 saw double-digit growth, albeit from historic lows, as work on major towers in the West End and City drove activity. The last of the recent major towers, 20 Fenchurch Street has now been completed, with new construction activity in London likely to slow. The largest new offices projects in London are the White Collar Factory on Old Street and 60-70 St Mary’s Axe (aka Can of Ham). The CPA/Barbour ABI commercial offices index in December was 15% higher than a year earlier and points towards further growth in activity in 2015 and 2016. As growth in London is likely to slow, it is likely to be offset by a return to growth in cities outside of the capital. Three of the five largest projects in the pipeline at the moment are in Birmingham and Leeds, which will come as a welcome boost to contractors outside the M25.

Noble Francis is economics director at the Construction Products Association

No comments yet