The question is: how long will conditions allow these results to continue?

Despite the weather it has been another month of positive economic news for the construction industry with the latest figures from the ONS showing that the industry grew by 1.8% month-on-month and 5.8% year-on-year in January.

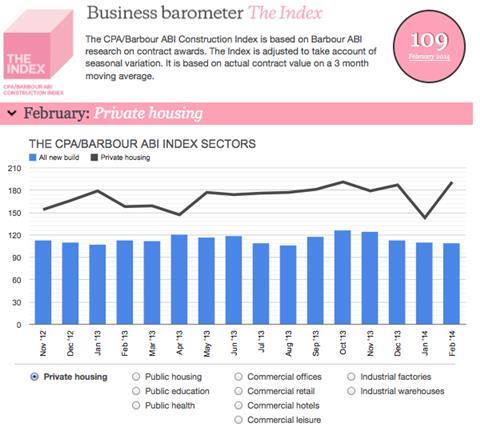

It is the residential sector which has accounted for the majority of this growth over the past 12 months with the CPA / Barbour ABI Index for private housing 191, 21% higher than February 2013.

The strength of the sector was further evident in the results posted by the major housebuilders in the last month. The levels of profit increases were eye watering, with Taylor Wimpey recording a 39% increase, Bovis a 39% rise, Persimmon 49%, and Barratt a staggering 162%.

It is clear that this is no ordinary recovery in the housebuilder market and it was no surprise to see share prices increasing in line with profits.

The housebuilders have acknowledged the role that stimulus packages such as Help to Buy have played in returning these results and while the debate continues over the effectiveness of this scheme the evidence of supernormal profits is clear to see.

The question is how long will conditions allow these results to continue? With the Funding for Lending scheme already withdrawn from the residential market, one may think that the longer term outlook is weaker for the housebuilding industry. However, the equity loan section of the Help to Buy Scheme was extended to 2020 this week and

the underlying fact remains that UK is still building around 100,000 to 150,000 fewer homes than required each year. With the Labour Party already announcing a raft of housing policies ahead of next year’s election, and the other parties sure to follow suit, the focus on this issue will intensify. As long as house prices continue to rise (the latest Halifax figures show they increased by 7.9% in one year) and wider macroeconomic conditions improve, demand will continue to outstrip supply in the market. Even when government stimulus packages are removed, this seemingly perfect storm for house builders looks set to continue.

Click here for the full Barometer data

Michael Dall is lead economist at Barbour ABI

No comments yet