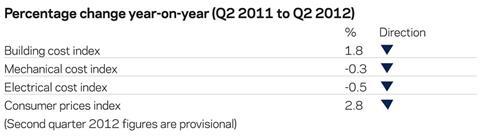

Construction inflation is continuing to fall across the board in the second quarter while many wage agreements remain frozen. Peter Fordham of Davis Langdon, an Aecom company, reports

01 / KEY CHANGES

- All construction inflation measures falling

- Mechanical and electrical costs lower than last year

- Consumer price inflation rates rise unexpectedly

- Manufacturing industries’ input costs on falling trend

- Prices of oil based materials and work categories much higher than last year following the increase in oil prices in early 2011 and again in early 2012

- Metals prices down 25-50% over the last 18 months as uncertainty over the global economy has intensified

- Metal based construction materials substantially lower over the last 12 months

- Most labour wage agreements remain frozen with employers resisting union pay claims

- Construction industry redundancies so far this year up 10% on 2011.

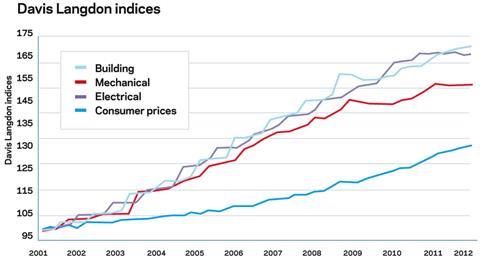

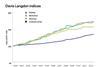

The following chart shows how Davis Langdon’s index series, reflecting cost movements in different sectors of the construction industry, have fared since 2000, with the movement of the Consumer Prices Index for comparison.

Building cost index

Small rise (0.3%) between the first and second quarters of 2012 but year-on-year increase lowest for over two years.

Mechanical cost index

Index static for last three quarters but year-on-year change turns negative for first time since the first quarter 2010.

Electrical cost index

Materials price increases at start of year partially reversed in May and June. Frozen wages and lower materials costs produce negative inflation rate.

Consumer prices index

Annual inflation rate continues to fall towards government target though some head winds may slow progress.

Guide to data

Davis Langdon’s cost indices track movements in the input costs of construction work in various sectors, incorporating national wage agreements and changes in materials prices as measured by government index series. They provide an underlying indication of price changes and differential movements in the various work sectors but do not reflect changes in market conditions affecting profit and overheads provisions, site wage rates, bonuses or materials price discounts/premiums. Market conditions are recorded in Davis Langdon’s quarterly Market Forecast (last published 20 April).

02 / PRICE ADJUSTMENT FORMULAE FOR CONSTRUCTION CONTRACTS

Price Adjustment Formulae indices, compiled by the Building Cost Information Service (previously by the Department for Business Innovation & Skills), are designed for the calculation of increased costs on fluctuating or variation of price contracts. They provide guidance on cost changes in industry trades and sectors and on the differential movement of work sections in Spon’s Price Books.

Over the last 12 months between July 2011 and July 2012, the 60 building work categories recorded an average rise of just 0.6%, down from 2.3% three months ago and continuing the downward trend of recent quarters since peaking at 5.2% last October.

Price movements in most work categories have been benign over the last year but those showing the highest increases have been:

| JULY 2011-JULY 2012 | % CHANGE |

| Pavings: coated macadam and asphalt | 9.0 |

| Finishes: carpets | 5.0 |

| Sanitary appliances | 4.7 |

| Waterproofing: liquid applied coatings | 4.0 |

| Finishes: flexible tiles and sheet coverings | 3.5 |

| Pipes and accessories: plastics | 3.4 |

| Finishes: screeds | 3.3 |

Coated macadam pavings leapt in price at the beginning of the year, mirroring the jump in oil prices in February.

The largest decreases have occurred in:

| Metal: miscellaneous | -2.7 |

| Piling: steel | -3.1 |

| Raised access floors | -3.2 |

| Cladding and covering: lead | -3.3 |

| Cladding and covering: aluminium | -4.2 |

| Cladding and covering: coated steel | -5.4 |

| Metal: decking | -6.8 |

These are largely the same work categories that had started to register price declines three months ago but the level of price reduction has increased, reflecting recent falls in steel and other metals prices.

Materials

Oil prices are on the rise, while lack of international demand is depressing metal prices

03 / EXECUTIVE SUMMARY

- Falling consumer price inflation rate halted as air fares rise

- Manufacturing input costs, except for oil prices, falling

- Industry output prices peaked in April and are now under downward pressure

- Metals prices continue to fall amid pessimistic forecasts for international growth

- Construction materials price inflation at lowest level for 30 months

- Prices for mechanical and electrical services materials lower than this time last year and falling

04 / KEY INDICATORS

The index rose by only 0.1% between June and July but the corresponding period of 2011 was flat, resulting in an increase in the annual rate of inflation. The downward trend is expected to resume next month but rising oil prices may limit the fall.

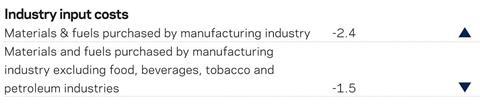

Input costs fell for three consecutive months before a slight recovery in July, as oil prices returned to an upward trend. The annual rate of change remained negative for the second month, a dramatic change from the +18.5% annual change recorded in July 2011.

The narrower measure, for manufacturing industry excluding food, beverages, tobacco and petroleum industries, fell for the fourth consecutive quarter in July. Input costs have now fallen 3% since March. The cost of imported metals fell 8% over that period.

Industry output prices in July held their level of June but the annual rate of increase declined for the fifth consecutive month. The same pattern was recorded by the narrower margin (excluding food, beverages, tobacco and petroleum).

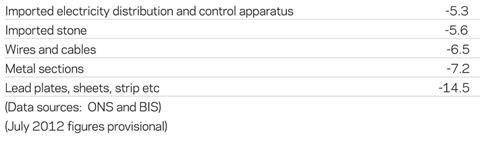

Most metals prices have fallen consistently over the last year by around 20-25% with nickel prices dropping over 30%. Metals prices peaked in February or April 2011 since when prices have generally fallen by a quarter to a third. Nickel prices have fallen almost a half as reduced demand has created over-supply.

Construction industry

Materials price increases for the construction industry over the last year (to June 2012) are detailed below:

Overall, construction materials rose by 1% over the year to June, progressively down from 7.2% last December. Prices fell sharply in June, particularly for non-housing new work, as items such as concrete reinforcing bars fell in price in response to lower worldwide commodity prices.

Prices for materials for mechanical and electrical services installations are now lower than a year ago. This reflects both the fall in metals prices and the higher value of the pound reducing the cost of imported components over the last year.

Some construction materials have still shown significant price increases over the last year:

But may also have fallen:

Labour

Weekly earnings are marginally higher, but many wage negotiations have stalled

05 / LABOUR MARKET STATISTICS

- Over the three months to June 2012, weekly earnings in construction averaged £552, 2.6% higher than the same period the year before

- Average earnings throughout the whole economy rose by 1.6 % over the same period

- In the first quarter of 2012, over 2 million people were employed in construction, a rise of 14000 over the year before but a 12000 reduction on the second half of last year

- 40,000 people were made redundant in the construction industry in the first half of this year, 4,000 more than in the same period of 2011 but compared with 50,000 in 2010 and 95,000 in 2009.

06 / WAGE AGREEMENTS

The parties to the Construction Industry Joint Council (CIJC) have failed to reach agreement on the basic pay rates under the Working Rule Agreement for 2012/13 so the existing rates for 2011/12 remain in place. Fare, travelling and subsistence allowances increased from 2 July in line with the March Retail Prices Index i.e. a rise of 3.6%.

The wage rates agreed by the Building and Allied Trades Joint Industrial Council (BATJIC) last year were intended to apply from 12 September 2011 until 10 June 2012. However negotiations between employers and unions broke down without further agreement.

Plumbers in Scotland and Northern Ireland were also expecting a pay review in June this year but no agreement has been reached and their rates remain as those determined from June 2011.

Heating and ventilating operatives have had no increase in wage rates since October 2010. Unite has submitted an ambitious claim for a minimum 10% increase in hourly rates from the start of October 2012 as well as a reduction in the working week and increased overtime rates. The employers’ side remain silent on the issue.

Electricians’ wage rates have been frozen since January 2010. Unite has called for a 7% wage increase from the start of 2013. Talks have taken place between the union and employers without agreement.

Wage rates for workers in the engineering construction industry, including steel erectors and scaffolders, have been frozen since January 2011. Discussions regarding NAECI 2013 and beyond have been taking place during the summer and are scheduled to continue in early September.

Demolition workers have secured a 2.5% wage increase from 20 July and their agreement provides for a further 2.5% from July next year.

| Operatives | Agreement body | Current basic hourly rate | Effective since | Details in | Date of next review |

| Builders and Civil Engineering operatives | Construction Industry Joint Council | Craft rate: £10.46/hour | 5 September 2011 | Cost update, 26 August 2011 | No further agreement |

| Building and Allied Trades Joint Industrial Council (BATJIC) | S/NVQ3 Advanced craft: £10.73/hour | 12 September 2011 | Spon’s Architects’ and Builders’ Price Book 2012 | Negotiations stalled | |

| Plumbers | The Joint Industry Board for Plumbing Mechanical Engineering Services in England and Wales | Advanced Plumber: £13.50 / hour | 2 January 2012 | Spon’s Architects’ and Builders’ Price Book 2012 | 7 January 2013 |

| Scottish and Northern Ireland Joint IndustryBoard for the Plumbing Industry | Advanced plumber: £12.89/hour | 6 June 2011 | Spon’s Architects’ and Builders’ Price Book 2012 / Cost update, 27 May 2011 | Due 4 June 2012 but no further agreement | |

| H&V operatives | Joint Conciliation Committee of the Heating, Ventilating and Domestic Engineering Industry | Craftsman: £11.38 / hour | 4 October 2010 | Spon’s Mechanical and Electrical Services Price Book 2012 / Cost update, 26 November 2010 | Wage rates remain frozen at 2010 levels |

| Electricians | The Joint Industry Board for the Electrical Contracting Industry / Scottish Joint Industry Board for the Electrical Contracting Industry | Approved electrician: £14.35/hour (own transport) | 4 January 2010 | Spon’s Mechanical and Electrical Services Price Book 2012 / Cost update, 26 February 2010 | Wages rates remain frozen at 2010 levels |

No comments yet