In the second of our series on recent changes at major contractors, we look at Balfour Beatty

Recent changes:

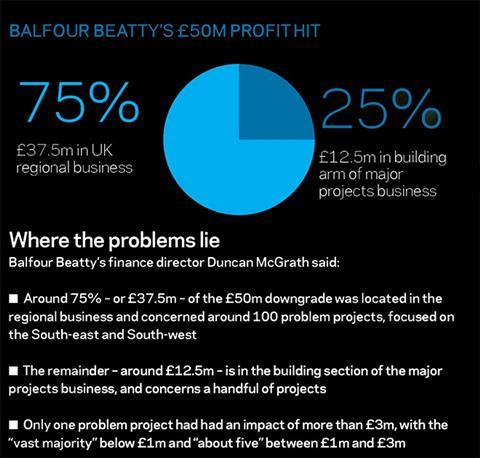

In April, industry giant Balfour Beatty warned that profit at its £3.2bn-turnover UK construction business would be £50m less than expectations following a review of the business.

The announcement also saw Balfour Beatty Group chief executive Andrew McNaughton seize control of the UK construction business, with former chief executive Mike Peasland stepping to the role of managing director of the regional business, where around 75% of the £50m hit to profits was located.

Steve Waite, managing director of the regional business left the firm, with immediate effect, and was followed out the door by his right-hand man Rob Walker, executive director of the regional business.

Mike Peasland will leave the business at the end of the year - and Balfour Beatty has not ruled out further departures.

The firm has said the problems stemmed from a combination of difficult trading conditions, which had led the firm to take additional risk through the bidding process, as well as operational issues, including strain on suppliers and subcontractors, tighter delivery schedules and delays on some projects.

But McNaughton has also conceded that the wide-ranging restructure the business has been being implementing since last year, which saw six operating companies reduced to one and regional offices cut from 75 to 37, had had an impact on operational delivery within the regional business. He said new management teams had failed to get to grips with their project portfolios and failed to impose the required bidding controls.

McNaughton now plans to impose rigorous bidding controls across the business, with the firm focused on bidding at margins of 2% and upwards, which is likely to see it withdrawing from the straight building market for the foreseeable future - a move that McNaughton describes as conjecture, but has not denied.

Latest results:

The UK construction business reported revenue of £3.18bn in the year to 31 December 2012 - a drop of 6% on 2011 - with a loss of £37m, due largely to one-off restructuring costs.

The firm expects revenue for its UK construction business to fall 20% in 2013, leaving it with revenue of around £2.55bn, down 35% on the £3.89bn the firm posted in 2009.

In a trading update this month Balfour Beatty’s UK construction arm reported a 23% fall in revenue in the first four months of 2013 - with the group’s overall construction revenue down 11%.

The firm said the UK market continued “to be adversely impacted by the shortage of major public projects and fierce competition in the regional markets”.

What the company says:

In truth, the UK construction business is now a declining part of Balfour Beatty’s global operations, bringing in turnover of £3.18bn last year - less than a third of the group’s £11bn turnover. That is set to fall further this year, down to around £2.55bn.

Balfour Beatty therefore naturally highlights the success of its wider operations, where it is pressing to become a global economic infrastructure giant, rather than dwelling on the difficulties experienced in the UK construction business.

However, McNaughton has admitted that, having taken control of the group after Ian Tyler’s departure in March, his move to also take control of the UK construction business will see the firm reining back on its push to become a global economic infrastructure giant, at least in the short term.

He says the impact will be mitigated by moves to free up senior management capability in other parts of the business, particularly in the US and emerging markets, but adds: “I’m certainly not giving up the role that I have in terms of the [Balfour Beatty] Group, but you will understand that some of the things that I would have wanted to push on I’m going to have to rein back a little on.”

The firm says the problems in the UK construction business are contained, with the business expected to broadly break even this year.

Chief financial officer Duncan McGrath says the £50m hit to profit will be confined to this year, as the 100 or so regional projects affected were shorter-term in nature, but concedes there could be a further impact on next year: “Saying how much of the £50m will repeat next year is a very difficult question, clearly not all of it and hopefully not a substantial part of it, [but] there could be an element that carries on,” he says.

He says the regional business still had around 70% of its 2014 order book to fill, which would now be subject to the greater rigour and strict controls the firm was imposing.

1 Readers' comment